Enterprise products, solutions & services

In pursuit of national productivity and economic strength, governments have long focused on bolstering the competitiveness of the manufacturing sector: a well-functioning manufacturing sector can provide mass employment, attract substantial foreign direct investment, and capture significant export revenues. Manufacturing accounts for 42% of the collective GDP of Middle East and North Africa (MENA) countries — notably higher than the global national average of 25%. Given such influence, the sector features prominently in the national visions and development plans of MENA governments. This is particularly apparent in Saudi Arabia’s National Industrial Development and Logistics Program (NIDLP), the UAE’s strategy for the fourth industrial revolution, and Oman’s Industrial Strategy 2040.

The overarching objective of these plans is to make each country’s manufacturing, mining, energy, and logistics sectors strong and agile enough to flourish in an increasingly competitive world economy. To successfully compete, companies must be able to respond effectively to power shifts among global industry leaders, changing commodity demands, the increasing adoption of new energy sources, and the ascendancy of digital economies. The NIDLP, for example, calls for Saudi Arabia’s industrial sector to grow by 9% in the 2020s, up from the 6% growth figure recorded in the 2010s. It also calls for the country to rise from 23rd to 15th in the global industrial sector rankings (based on GDP).

Action plans in the Middle East aimed at boosting the manufacturing sector usually feature three key objectives:

• Diversification: Governments are pushing their manufacturing sectors to move away from reliance on hydrocarbons and chemicals, to become more involved in fields such as defense, aerospace, renewable energy, life sciences, and electronics.

• Localization: Governments see the benefits to be gained if organizations procure materials from within its country or region. Localization ensures a value addition to materials (as opposed to merely re-exporting) and promotes “made in” national branding.

• Digitalization: The goal is to modernize factories and boost productivity through the widespread application of digital technologies.

Like other sectors in the economy, manufacturing is also going through Digital Transformation (DX). Identified by terms such as “Industry 4.0” and the “fourth industrial revolution”, this transformation is characterized by Cyber-Physical Systems (CPS). The first industrial revolution was characterized by mechanization using steam power; the second, by mass production using electricity and assembly lines; and the third, by automation through electronics and computers. And while the third industrial revolution embedded computing elements into standalone machines, CPSs go further still, and a network of such machines, processing inputs and outputs in a seamless manner controlled by computer-based algorithms, takes automation to the next level.

Technologies such as the Internet of Things (IoT), robotics, Artificial Intelligence (AI), 3D printing, Augmented Reality (AR), Virtual Reality (VR), and 5G lie at the heart of this transformation toward automation. These technologies, in turn, build on the foundation provided by the “third platform”: cloud, big data analytics, social media, and mobility. Transformation will affect the entire manufacturing value chain, from design and production to delivery and customer service. Indeed, through Industry 4.0 programs, the industrial heavyweights of the world — USA, Germany, Japan, and China — are set to increase the level of automation in the manufacturing sector from less than 10% in 2018, to above 40% by 2030. International IT market research firm IDC predicts that nearly a quarter of all DX spending in the MEA region will be made by manufacturers, with the total exceeding US$6 billion in 2020.

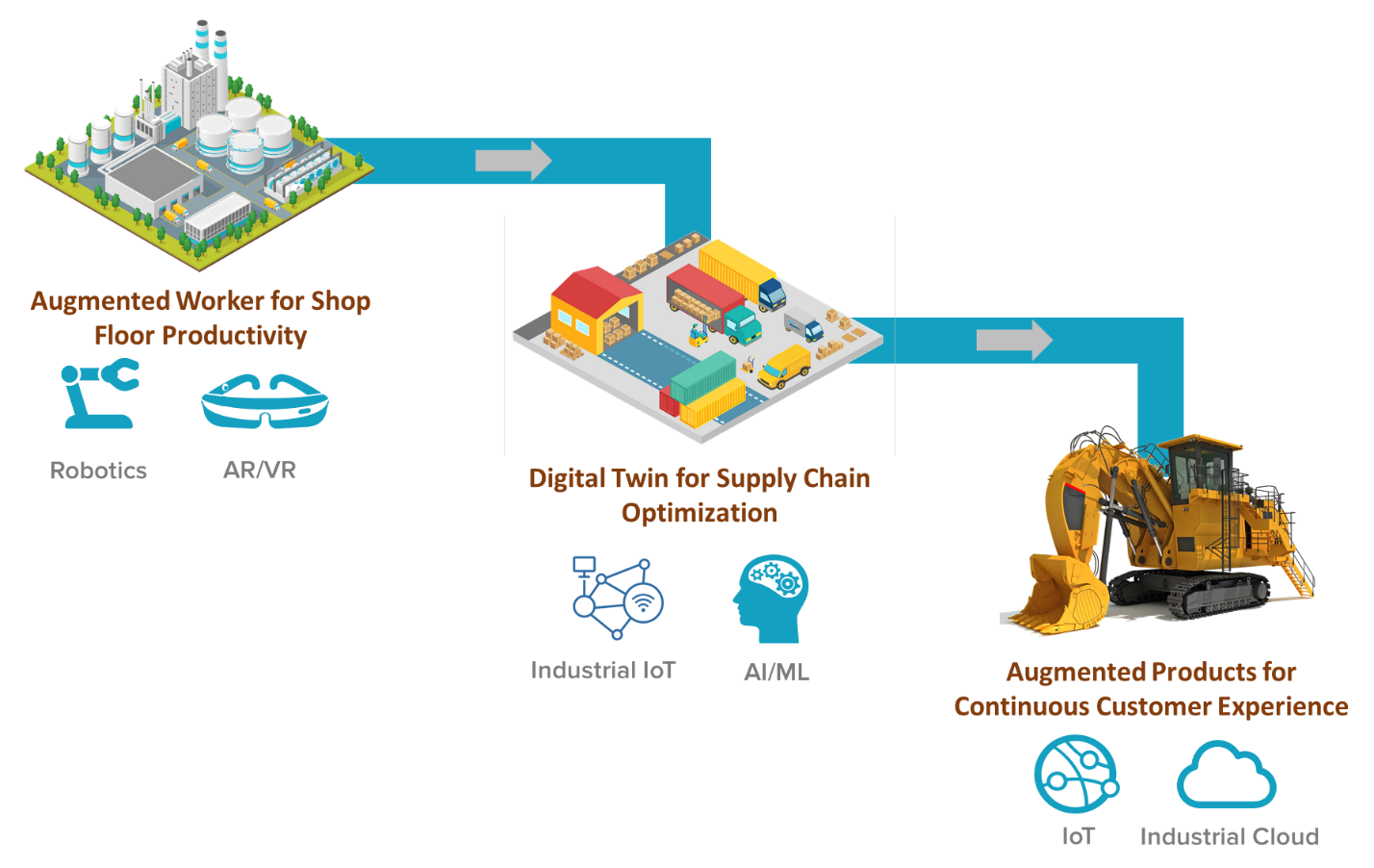

Many national digital transformation plans focus on future-proofing the manufacturing sector by modernizing factories using fourth industrial revolution technologies. So, what does a future factory look like? The answer lies in examining how digital technologies are transforming the manufacturing sector’s three core functional areas.

Manufacturers have traditionally sought to increase the productivity of the shop floor by empowering workers with better tools. Similarly, in the factory of the future, the shop floor will feature “augmented workers” equipped with the latest digital tools. Huawei’s Global Industry Vision for 2025 (GIV@2025) predicts that there will be 103 robots for every 10,000 manufacturing employees by 2025, meaning that it will be common place for industrial robots and people to work side-by-side in the factory environment. In turn, this will also transform the nature of skills required on the shop floor: people who are comfortable making data-driven decisions will prosper.

Supply chain optimization — from raw materials and parts to the delivery of final products to end users — remains a priority for manufacturers. A key challenge that manufacturers face is bringing agility into operations in accordance with fluctuations in customer demand, ranging from ensuring the availability of the right amount of raw materials and end products at the right time, reducing wastage, to avoiding disruptions by using predictive asset maintenance. With the proliferation of sensors into almost every ‘thing’ and the advent of industrial IoT, manufacturers can create a digital twin of the manufacturing value chain.

The success of the digital twin depends on an extensive network of cloud based IoT elements connected through a high-speed, low latency communication network that’s supported by technologies such as 5G and Wi-Fi6. The digital twin collects data from the elements and provides a real-time view of assets and the value chain. However, the true potential of a digital twin is only realized when this data is processed by AI/Machine Learning (ML ) platforms, to predict events in the value chain. Using these insights, manufacturers can benefit from smart procurement, logistics automation, and extended planning — optimizing their value chains. Leading analyst firm IDC predicts that, by 2024, more than 60% of G2000 manufacturing organizations will rely on AI platforms to drive digital transformation across the supply chain, leading to productivity gains of more than 20%.

Manufacturers have traditionally focused on perfecting their products rather than building long-term relationships with customers. However, in today’s competitive environment, spurred by a growing digital economy, it is imperative that organizations think beyond product quality and focus on ongoing customer engagement across a product’s lifecycle. Industrial machinery manufacturers, for example, are embedding technology that helps them to continuously monitor equipment health and perform predictive maintenance. Elsewhere, automotive players are providing value-added digital services (for example, monetized over-the-air software updates). 5G, industry cloud, industrial IoT, and AI work together to enable these use cases.

5G is expected to proliferate rapidly. It took ten years for full 3G rollout, and five years for 4G: 5G is predicted to take just three. Huawei’s GIV@2025 predicts that, by 2025, 6.5 million 5G base stations will provide access to 58% of the world’s population. The industrial sector stands to benefit tremendously from the new capabilities and opportunities enabled by 5G use cases, such as the remote-control operation of industrial machinery. For example, the next generation of intelligent mines will feature remote-controlled excavators to perform drilling, shoveling, truck loading, and shipping work. The operator, sitting at a remote operations console, will have access to multiple perspectives of all operations. The key to this is the high speed and low latency connectivity provided by 5G, and Huawei is already working with its customers on such solutions.

The industrial sector — mining, manufacturing, logistics, and construction — continues to be the biggest revenue generator and employer in the Middle East. To increase exports and attract investment in a highly globalized environment, it is critical for organizations to embrace the data-fueled innovations of the fourth industrial revolution. With digital technologies increasingly embedded in the manufacturing value chain, organizations are being presented with opportunities to address challenges related to demand volatility, skills, and productivity.

Governments in the Middle East should focus on supporting the transformation of manufacturers into digital enterprises by building the necessary digital infrastructure. This will accelerate the creation of intelligent digital twins, empower workers on the shop floor with technology, embrace automation, and continuously improve customer experience. This will drive the competitiveness of the sector and help fulfill the national vision of individual nation states.