This site uses cookies. By continuing to browse the site you are agreeing to our use of cookies. Read our privacy policy>

![]()

This site uses cookies. By continuing to browse the site you are agreeing to our use of cookies. Read our privacy policy>

![]()

Enterprise products, solutions & services

A few days ago the classic debate over who is the world's capital of Fintech again hit the Twitterverse as it does periodically. Two of my friends got into it in a jovial manner, but it belies a continued debate that has been going on for the better part of a decade now. Even PM Boris Johnson got into the debate back in 2014-2015 saying London had become a true "world centre of Fintech". London has given birth to some very impressive Fintech's and the Mayor of London's unfailing support (both in the guise of Johnson and Sadiq Khan) has been instrumental in the city's strong Fintech culture. But how might we measure that innovation, that success in order to benchmark the world's #1 Fintech city?

In terms of metrics, while the term Fintech predates the heady 2010-2020 decade of fintech, I'm going to limit this debate to the last decade, mainly on the basis of the incredible growth in household fintech names, venture investment and impact on the economy at large. Now, I recognize that I'm not the first to embark on this endeavour. Indeed, Crunchbase published their own ranking of fintech ecosystems in December 2019, as the first of it's kind identifying what they thought were the most innovative Fintech cities and unsurprisingly they had SFO beating out London and New York.

"The report, which evaluates 230+ cities and 65 countries, is designed to highlight opportunities and drive transparency across the ecosystem. The San Francisco Bay Area, London, New York, Singapore City, and Sao Paulo round out the top 5."

Introducing the World’s First Global Ranking of Fintech Ecosystems

Crunchbase, December 4 2019

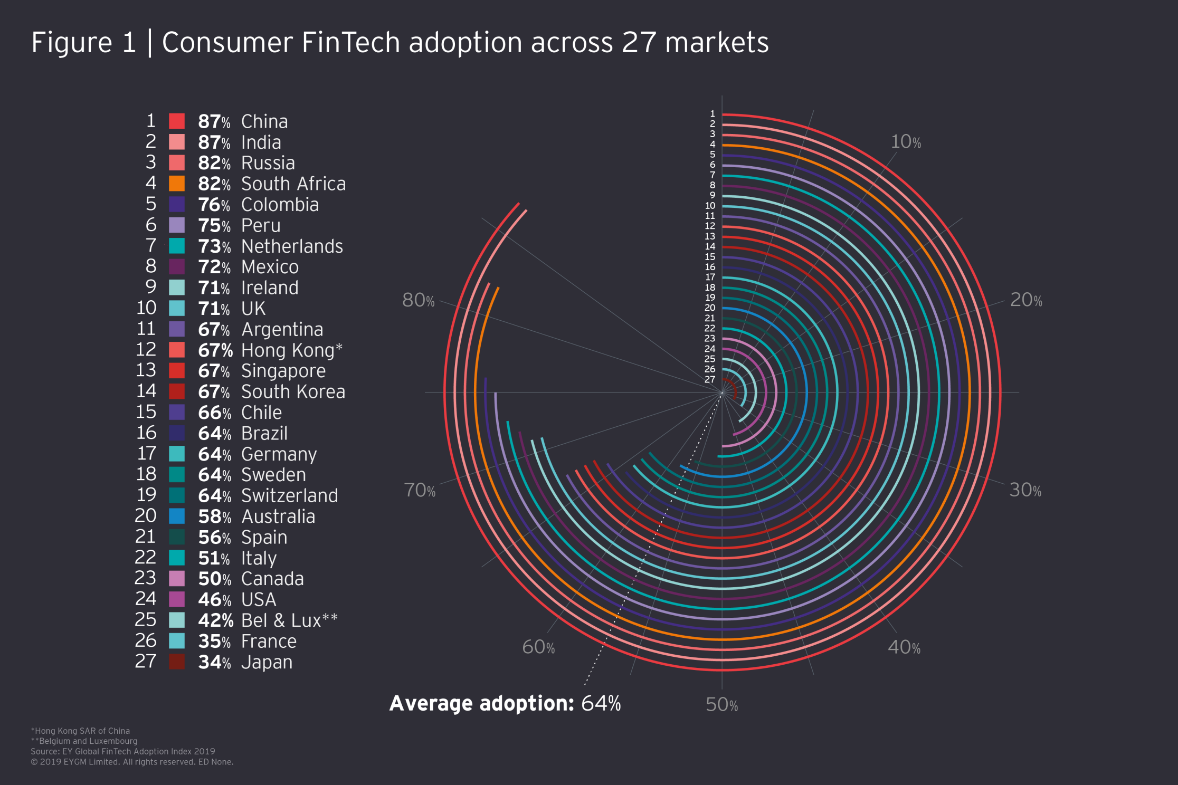

Immediately what stood out to me was that this was a very Westernized view of Fintech. In China, according to research by both EY and Statista, fintech adoption rates peaked at 87 percent of the population in 2019 and were as high as 92 percent for certain segments of the market. Whereas, the UK trailed at 71 percent of the population and the USA didn't even reach the 50 percent mark. While consumer fintech adoption is just one measure, it's very clear that fintech has affected far more citizens day-to-day in China and India than it has in the United States or the broader UK outside of London. Lack of regulatory flexibility and incumbent lobbying of government administration has worked effectively in the US at slowing down consumer-level adoption in respect to fintech modality and brands. In the US it is a fight to disrupt, in China the disruption is embraced.

Research conducted by Cambridge University, Zhejiang University (Academy of Internet Finance), and Sinai Labs came to a very different conclusion to the CrunchBase ranking where 4 of the top 7 Fintech cities in the world are in China!

While jobs created or VC dollars invested are great metrics, we could argue that the best fintech cities in the world must generate adoption of fintech across the broader population, and as a result, create demand for fintech services resulting in the growth of fintech companies, possibly unicorns. Thus, while I'm tempted to do a top 100 cities in Fintech, let's cover off the top 17 using the following metrics as a meld of previous rankings and available data:

1.Country-level consumer adoption - how can you call yourself a fintech city if your citizens aren't adopting fintech in their daily lives?

2.Venture capital investment over the last five years - investors need to see the city as attractive also, and continued investment sees an argument that both growth and ROI exists (we could have also measured successful exits I guess)

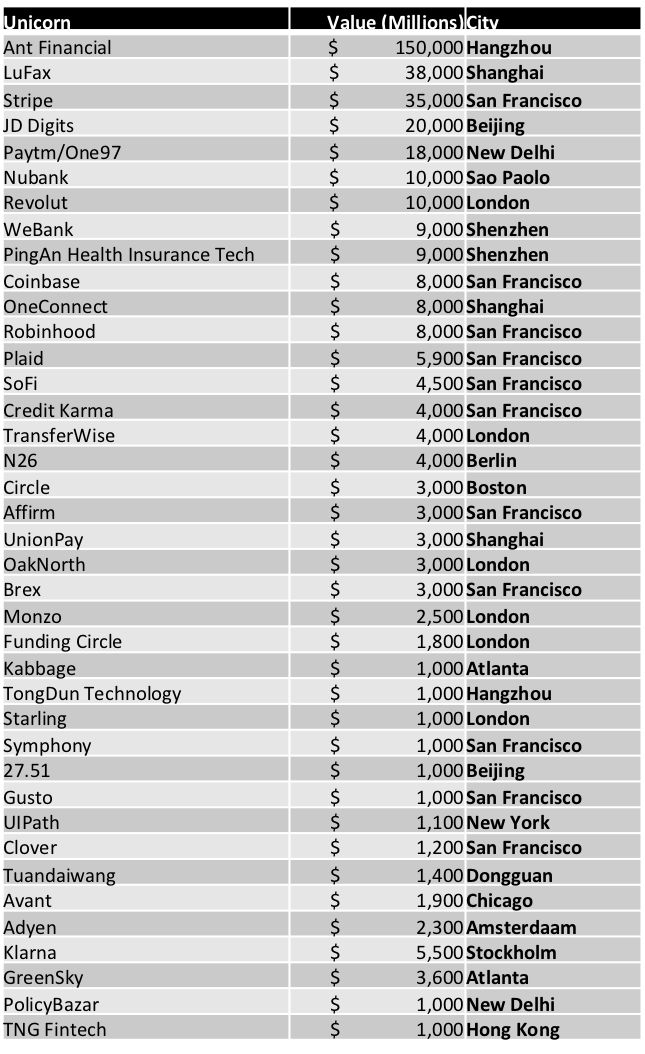

3.Unicorns born from the city, and value of - number of unicorns and aggregate valuations (at last round). A full list can be found here

For level setting, the largest privately owned company in the world is Ant Financial worth $150 Billion at the last valuation, and of the top 10 privately owned unicorns globally, 5 live in the US and 5 in China (based on 2018/2019 figures).

By comparing citizen adoption, the number of unicorns produced and their aggregate value, along with overall fintech funding by VCs we get a very different picture of both the US (Crunchbase) and China (Cambridge) studies, as you'd expect. Interestingly enough, New York, Hong Kong and Singapore all fare rather poorly, in fact, Atlanta beats out NYC in pure Unicorn producing power. I'm sure that this will create some lively debate, but these are simple rankings based on an aggregate of primary factors. We certainly could add more data points, such as the number of people employed by city in Fintech, if we could get those data points.

This is as an exhaustive list as I'll think you'll find. If I've missed any please let me know, and if you want the spreadsheet/raw data PM me.

As it stands, it's pretty clear that neither London nor NYC or San Francisco have a claim on being the centre of fintech globally. In fact, the number of cities that don't align with traditional financial centres says a great deal about Fintech disruption itself - it's clear that old skills in finance have not translated into centres of fintech competency writ large.

Ranked number 6 globally and #4 in China is the city that lies on the border between Mainland China and Hong Kong (SAR). With a population of just over 12 million, Shenzhen is ranked as the third most valuable economy in China (by GDP contribution) and first in terms of GDP per capita. Recently Jim Marous and I had the pleasure of visiting Shenzhen at the invitation of one of the most innovative companies in the world, Huawei. Today Shenzhen produces over half of the international patent applications coming out of China.

Already, Shenzhen is home to some of the most innovative companies in the world including Huawei, Tencent, DJI and others. It's a young city. Just 35 years ago it was basically a fishing village with a population of around 30,000, but when Deng Xiopeng designated it as the country's first Special Economic Zone, the city boomed.

Today 90% of consumer electronics are built or have components shipped from Shenzhen. If Silicon Valley is the heart of the world's software industry, Shenzhen is it's hardware-based cousin. More than half of all international patents filled out of China are born in Shenzhen.

The Huawei R&D campus is modelled after European cities and is split into two areas, research and manufacturing. The research city is modelled after 7 different European cities covering almost 4 square miles of land. In the distance, hi-rise apartments are available also built by Huawei and provided to more than a quarter of the workers as prestigious local housing. All the perks of a SV startup are here with a range of services on campus, free food, free transportation and there's even a KFC and Starbucks on the campus.

The production line is a modern engineering marvel. The day Jim Marous and I visited Huawei was running production for the P30 Pro smartphone, and every 28.5 seconds one of these top-spec phones were rolling off the production line, more than 2600 smartphones a day. On the wall were faces of employees that had improved the production line process by 1 second here, 3 seconds there. A few years ago more than 60 people were required to run one production line in the factory here, but today it's typically 12 or 13. But rather than fear innovation as a mechanism for disruption, the entire company and indeed the entire city, seems to be energized by the possibilities of the future.

I first visited Shenzhen in 2001. The city has more than doubled in size since that time, but what is more inspirational is the innovation at the heart of Shenzhen's success. It's easy to see why much of the west is wary of companies like Huawei and Tencent. Their ability to innovate is powered by a culture that the West hasn't see broadly in more than 50 years. It's also why cities like Shenzhen and Hangzhou is where the Fintech Unicorn's of this decade are being born.

In the Huaqiangbei electronics market area of Shenzhen (local Westerners call it HQB), you see first hand the affluence, innovation and integrated nature of technology in this city. Every store you go to accepts facial recognition payments, robots greet potential shoppers and store clerks have hand-held translation units to help you out immediately despite language gaps. If you want to see first hand a real city of the future, this is where you should look for inspiration. Not London or San Francisco. This is a smart city where every citizen is living the future!