Enterprise products, solutions & services

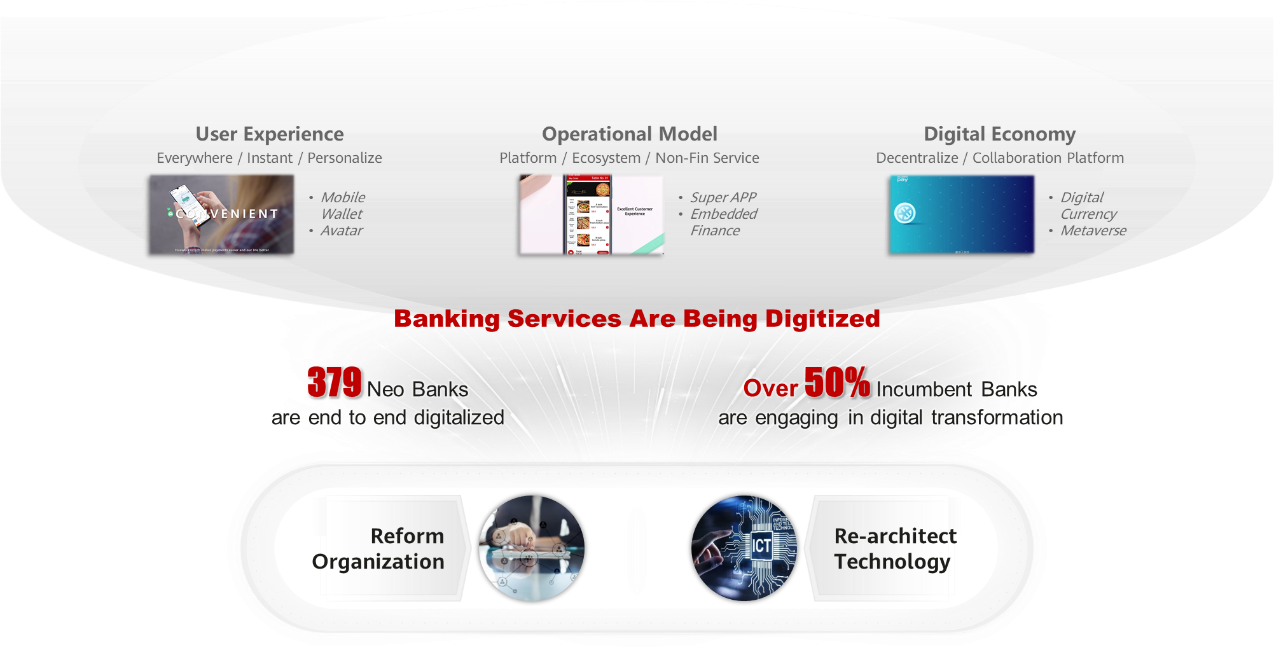

We see that digitalization is happening in all industries and everywhere, and is significantly making people's work and life more convenient and efficient. The digitalization in banking is ahead of most other industries, and acting deep and delicate in diversified areas.

In fact, if our sights span the past and the next decade, digitalization is continuously evolving the user service journey, reshaping organizational operations and creating the economic model of the future. In such a rapidly changing environment, using technology to reach and serve customers from multiple dimensions, improving business processes, product design and experience, is becoming a focus for every bank.

Banks are trying to expand payment services through more open e-wallets to avoid being hidden from third-party payments and Fintech competitors. At the same time, leaders are considering embedding financial services into digital scenarios and introducing non-financial services from partners to please and engage customers. The upcoming decentralized and collaborative economy opens up a new imaginable space for growth, encouraging industries to find new mechanisms to break through current operational bottlenecks. Banks eager to find the right way to digitalize their services, hoping to reach all corners of the digital economy, provide ubiquitous services, and form financial models that are harmoniously integrated with digital scenarios.

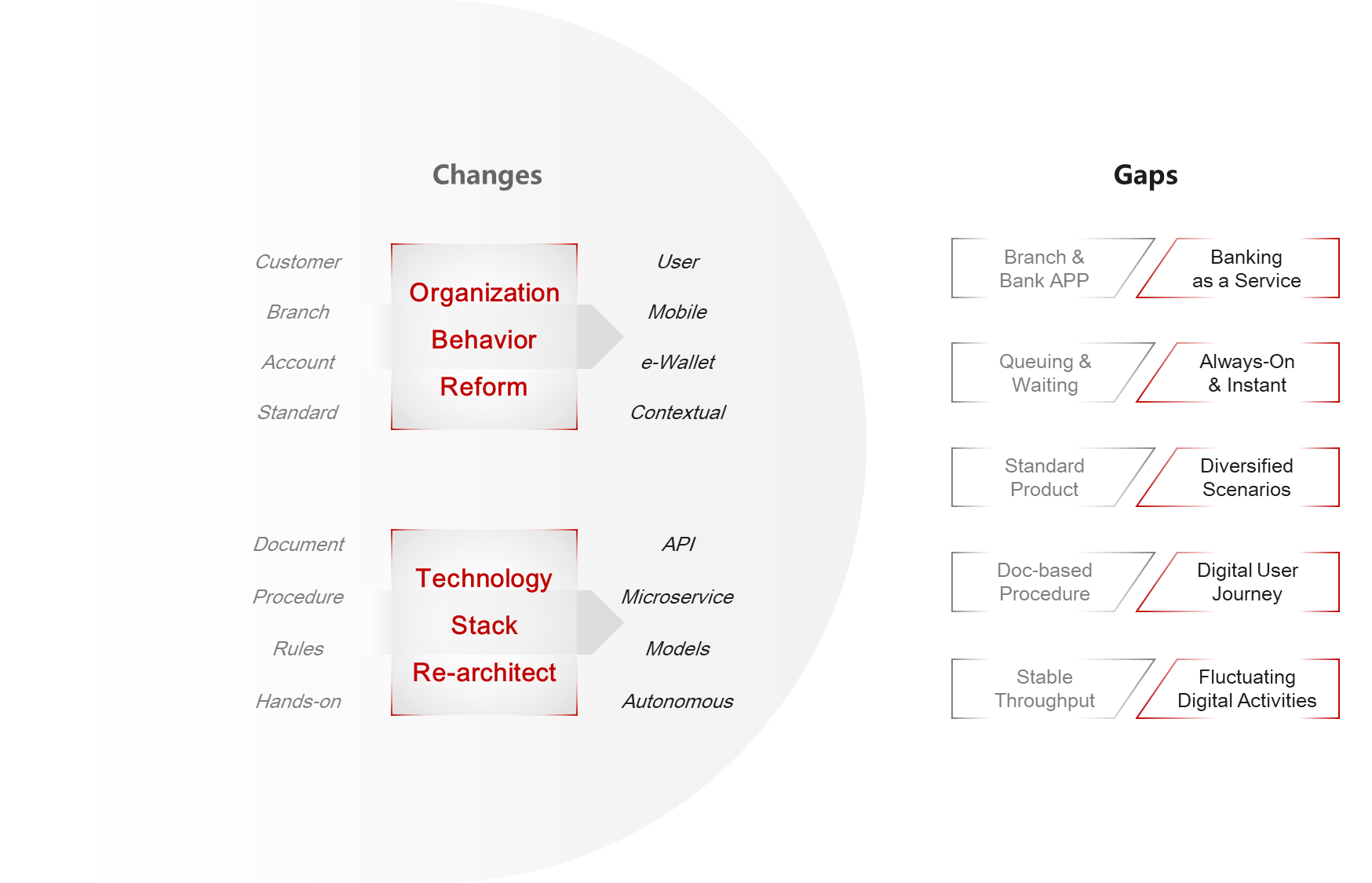

Through extensive communication with leaders of all types of banks around the world, we have found that digital transformation of banks needs to be driven by two wheels: reforming organization and behavior, and re-architecting technology.

Bank customers now behave more like mobile users, wanting to use digital payments anytime, anywhere and access socially interactive financing or investment services, not limited by physical facilities or necessity of face-to-face services. These require banks to have completely different technical capabilities and tools from existing ones, such as product microservices, big data decision-making, and automated processes.

While look into the changes of organization behavior and technology, we find some highlight gaps in existing services:

• Branch, internet banking and traditional bank APP are not able to support banking as a service.

• Customer expectations of always-on and instant service challenge current time-consuming and manual processes.

• Standard products sold on self-owned networks cannot meet scenario oriented featured services.

• Decision-making process in digital journey cannot replicate the existing mode based on expert & document.

• Stable infrastructure and throughput are unable to cope with dramatic fluctuations in digital user activity.

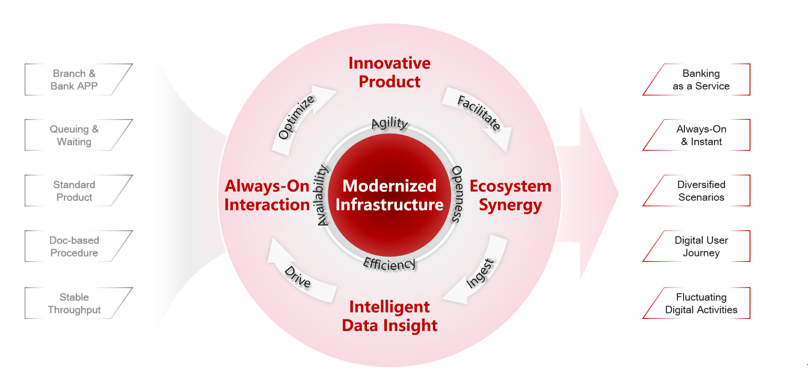

We believe that banks’ different digital capabilities are mainly reflected in five areas: product design, ecosystem cooperation, data intelligence, interactive experience, and infrastructure. By rethinking strategies in these five areas and building matching capabilities, banks will be able to bridge the digital service gaps.

By obtaining feedback from customer interactions, banks are able to optimize product design. At the same time, product design integrated with ecosystem services will help banks achieve harmonious scenario-based finance and win-win cooperation.

Through synergy with ecosystem and context, the multi-dimensional and rich data obtained not only helps banks better understand customers, but also gain deeper insight into digital scenarios, thereby driving better customer interaction experience.

A modern infrastructure that is agile, open, efficient, and highly available is a solid technological foundation that drives digital services. IT-as-a-service infrastructure frees bank talents from heavy IT maintenance and focuses on higher-value business innovation.

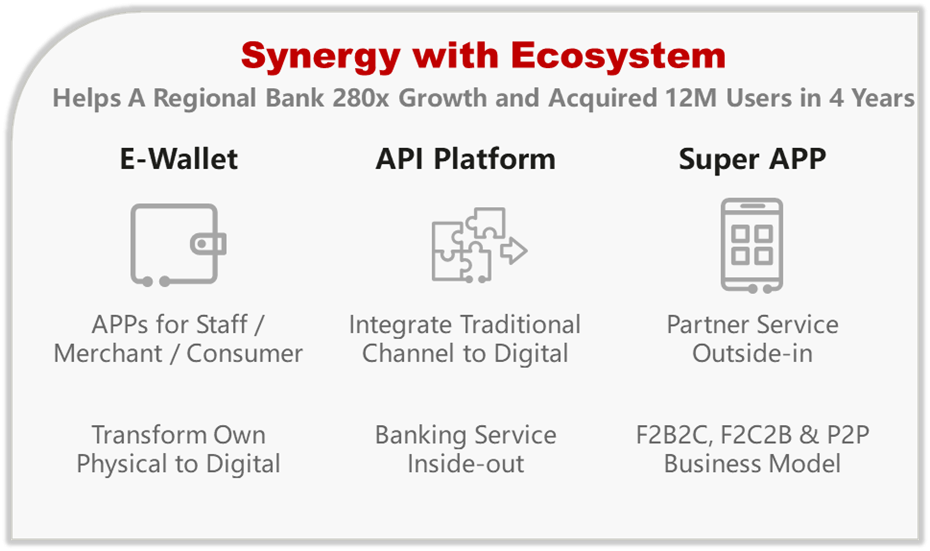

The ecosystem is the most important element of bank digitalization. This will be a ticket for banks to enter the digital economy and take a place.

Third-party digital payment companies are growing rapidly in the digital payment market with flexible operation. While enter the area, banks must have comparable or even more advanced service models, and provide tools for business development teams. The e-wallet platform should not only be consumer-oriented, but also help merchants access business in real time and help banking teams operation.

Using the APIs Platform to embed banking services into the digital platforms of large partners is another strategy for banking services beyond own touch points. The initiative enables banks to understand the digital behavior of users and the business of partners, not just payments.

A more ambitious model is SuperAPP, which transforms the bank into a platform operating model, opening up users and data services to partners. Customers could enjoy the quality partners' services in the bank APP. Operational transformation helps banks seize financial service opportunities from the digital needs of individuals and enterprises and form a solid and dominant business ecosystem.

A leading regional bank achieved an incredible journey of 12 million customer growth and 280x transaction growth in 4 years by developing a synergistic ecosystem.

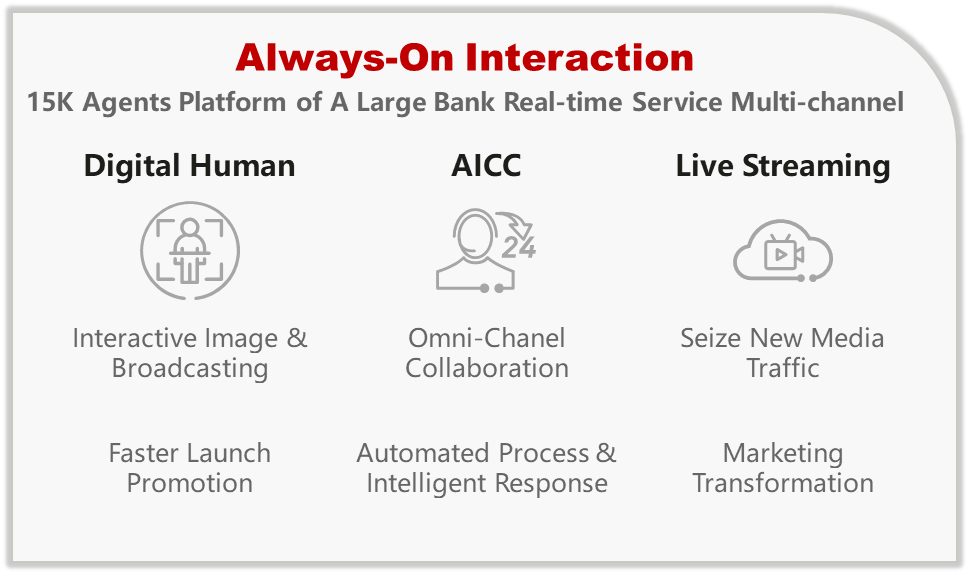

Another important element of digitalization is user experience of interactive service.

Banks used invest heavily in one way or reactive service like portal advertising, offline marketing and manual call center, which would no longer highly efficient in new digital competition. It’s necessary to leveraged interactive service to seize digital user's interesting.

The growth of online business has led to an exponential increase in customer interaction. How to deal with customer service has become a quality & cost-effective issue that must be addressed. Only intelligent customer contact centers based on AI, robots, and multimedia convergence can help banks respond to customer 27 by 7 no wait service with high quality. And through rapid analysis of customer real-time feedback, timely optimization of service quality, product design.

As a key part of comprehensive digital plan, a large Brazil bank built new customer service center, which transform bank from branch-dependent services to remote omni-channel services to support all-day interactive customer contact.

Marketing with digital human & live streaming would help banks improve execution efficiency and friendliness. Now, with 1-2 days of AI modeling, banks can release digital human based online-offline consistent and high-quality advertising & marketing to branch and online channels, reducing the amount of resources for campaign preparation and training. The leading banks have started to build live streaming capability to enable new style digital marketing activities. A China’s leading retail bank held more than 2,000 live streaming events in 2021, attracting more than 3 million customers in a single event.

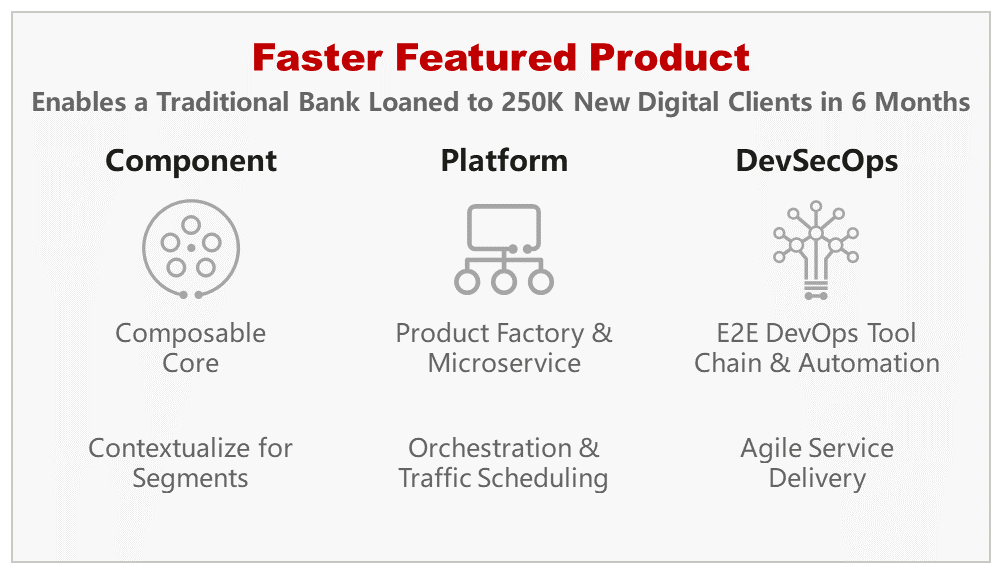

Recently, there is a market leading Thailand bank that have launch their business loan initiatives in digital market. The bank took just 6 months from build a entire new digital lending system to acquire 250,000 new customers.

Compared with traditional business competition that relies on the scale of branches, innovation and iteration speed will determine the competitiveness of banking products in the digital economy. To achieve speed of “faster to market, faster user feedback, faster product optimization”, banking product innovative models need to start from three aspects: component, platform and process.

In traditional method, business products are developed based on complicate centralized core banking system and architecture of high coupling processes and data. The dedicated multiple front-end to back-end business resources & technical teams are required put into project, and follow a complex collaboration and development process to ensure product delivery quality. This model usually leads to a more than half year cycle from product development to launch, and iteration cycle takes weeks to months.

To accelerate business go-live, the new-generation digital product model needs to be based on the component design concept of composable & hierarchical decoupling. Leading banks are using the model to greatly improve business product development speed, shorten contextual featured product launch cycle to weeks and iteration cycles to days. From technology aspect, the new product should be more easily embedded into not only bank owned channel, but also partners' ecosystem. Thus, the technology platform of micorservice and transaction orchestration would be necessary capability to enable open, scalable and flexible services.

To achieve agile operation and product iteration of production services, many bank ITs are trying to build CICD procedure with mixture tools and some banks are extending the process to DevOps to empower collaboration between technology and business teams. In fact, mixture tools DevOps occupied high resource on construction & maintenance, but still left many break points in the procedure, which brought extra workloads and potential risks. The better solution is to apply a maturity end-to-end platform with security embedded, we call it "DevSecOps", to both simplify bank IT maintenance, strengthen technology security and save investment.

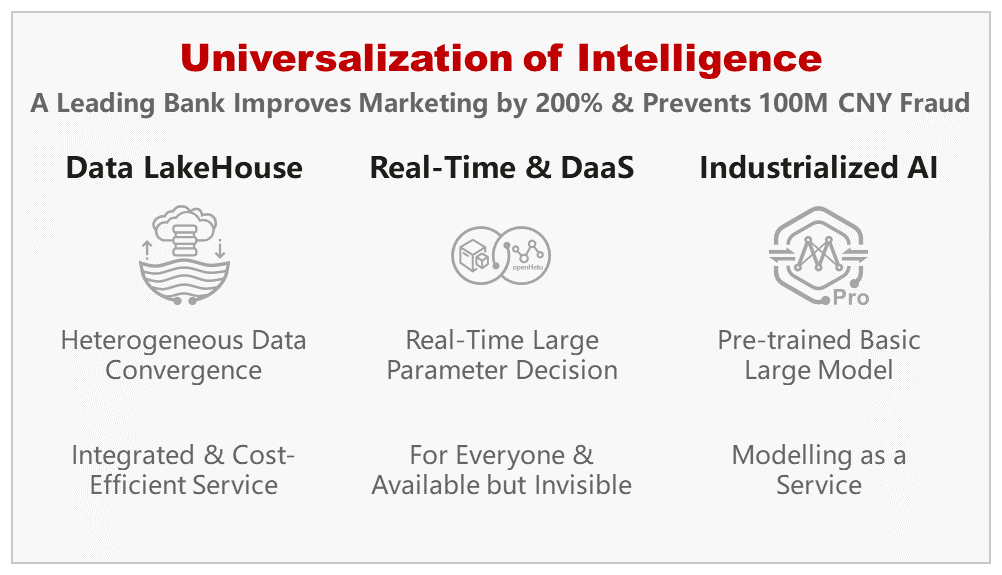

Emerging Fintechs are developing their distinctive services and market opportunities rapidly by leveraging alternative data for decision-making. All existing banks' offline and online activities have accumulated a huge amount and variety data that is now widely considered as the most valuable asset of the future, but has not been centrally and effectively explored.

Once upon a time, bank data was fragmented and scattered in various data systems, mainly serving financial, management, risk, and compliance reports. New data services emphasize data-based decision-making and enable business development, operation, and product innovation. This requires banks to build a new data service platform. The integration of data warehouse and data lake, AKA data lakehouse, is seen as a way to build advanced digital enterprise data platform. The platform centrally manages heterogeneous data, including structured transaction data, semi-structured, unstructured engagement data and efficiently support more comprehensive data insight. Meanwhile, from architecture aspect, the platform would balance in technical cost and service efficiency for handling huge volume data. Through data service development tools and real-time decision engine of new platform, bank would universalize and provide high efficient data services among business departments and users to improve operational competitiveness and drive sale growth.

By completely replaced traditional data warehouse with the new integrated data lakehouse platform, a global top 20 bank improves marketing efficiency by 200%, prevents tens of millions of dollars of fraud losses every year, and provides instant data intelligence services for thousands of market development and operation staffs.

With the rise and maturity of AI, banking, as a rigorous service industry, has been paying close attention and using them cautiously. Industrial AI production lines and pre-installed generative AI models combined with data supplement of data lakehouse can meet bank' s enterprise-level needs, and easily develop controllable AI for business process and contextual service.

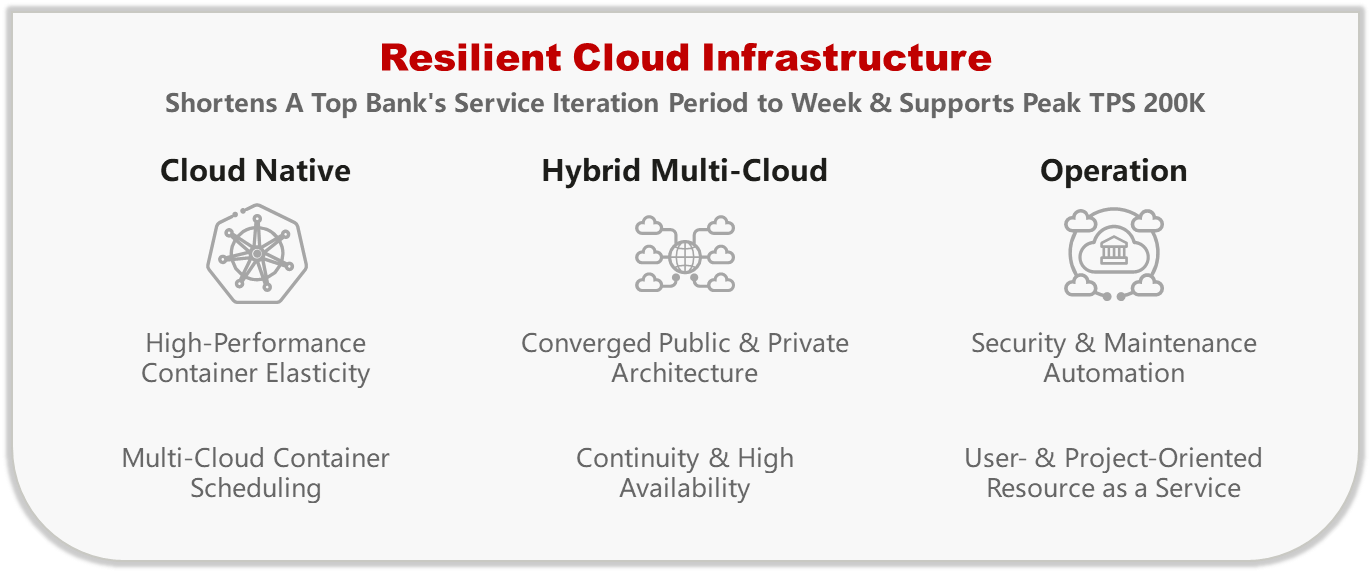

Only a resilient, open cloud infrastructure can drive and unleash the performance of all of these digital productivity tools. Digitalization is to use advanced technologies to fuse into digitalized economy & create business competitiveness. Cloud-based technical architecture and operation model are the basic platform for all these advanced technologies.

Technologies such as cloud native provide flexible and cost-effective IT resources for businesses, and help banks shift IT investment from CAPEX to OPEX, which is oriented to business results, so that they can directly benefit from the business value brought by technologies.

Based on our conversations with banks and regulators around the world, we believe that hybrid cloud is a better modern infrastructure for banking. Through the collaboration of public and private clouds, hybrid cloud enables banks to operate more confidently and in compliance with regulations, improves own technical capabilities to reduce external technology binding, maximizes external resources and investment efficiency, and ensures business continuity and high availability. Meanwhile, to maximize IT talent development and productivity, banks need to transfer manpower on infra O&M to innovation. The security, autonomy, and self-service cloud resource services will unleash the greatest technical productivity and talent value.

Digital competition is changing fast. In the digital economy era, different digital strategies and driving forces will widen the gap between banks.

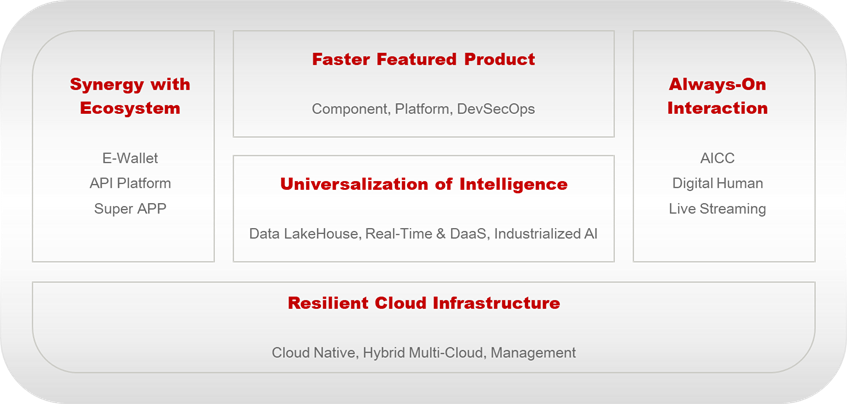

Banks in different regions and characteristics are accelerating their business strategies and trying to seize opportunities in rapidly changing markets. "Synergy with Ecosystem", "Always-On Interaction", "Faster Featured Product", "Universalization of Intelligence", and "Resilient Cloud Infrastructure" are the five core competencies that banks must focus on when shaping digital services. Moreover, their complementarity can maximize the value of technology and promote the effectiveness of digitalization.

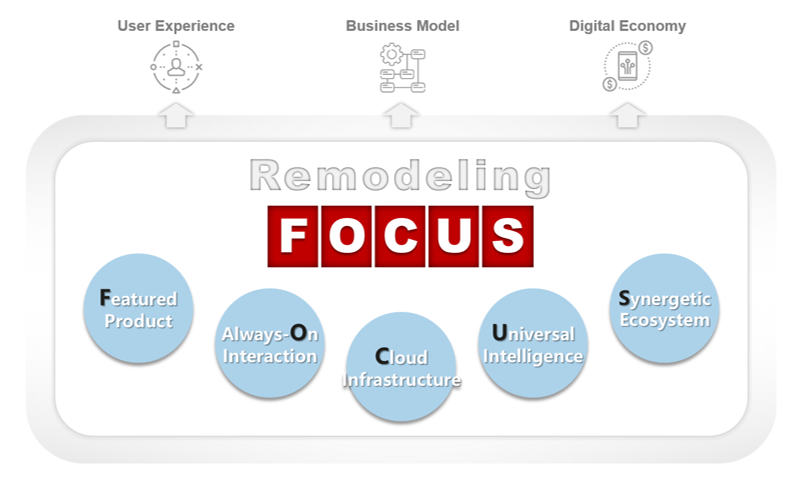

The "FOCUS" model aims to remodel 5 competencies to define competition strategy, target architecture, transformation process and key technology, helps the banking industry digitize and integrate into the accelerating digital economy to form ubiquitous and harmonious services.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy, position, products, and technologies of Huawei Technologies Co., Ltd. If you need to learn more about the products and technologies of Huawei Technologies Co., Ltd., please visit our website at e.huawei.com or contact us.