Yapı Kredi Makes Life Easier for Its Customers with Huawei Storage

This site uses cookies. By continuing to browse the site you are agreeing to our use of cookies. Read our privacy policy>

![]()

Enterprise products, solutions & services

The very first bank in the Republic of Türkiye to offer customers credit card services, Yapı Kredi is the country's third largest private bank, with 16,426 employees operating nationwide across 804 branch sites. Yapı Kredi continues to be a pioneer in card payment systems, adopting a leading position in the sector, with over 12.9 million credit cards issued, as of year-end 2021. Its payment solutions not only include traditional Point of Sale (PoS) services and online applications, but also support Quick Response (QR) code and contactless payments over mobile devices, as well as innovative payments from inside the car . As such, Yapı Kredi is very much in the vanguard, innovating the world's credit card sector.

At the beginning of 2022, Yapı Kredi set clear goals for its card payment systems. It wanted to increase the use rate of card and PoS customers over digital channels as well as enhance the overall customer experience. At the same time, with its customer-base growing, the bank faced the additional challenge of increased demand for contactless payments. During service peak hours, workloads were soaring, with more and more users logging in to the bank's app, causing legacy Information and Communications (ICT) infrastructure to strain, unable to scale effectively to meet demand. It was clear. Yapi Kredi needed a new storage system that could meet diverse workloads, in order to carry out day-to-day business tasks.

In particular, the bank was looking for a secondary storage node to boost the resiliency, availability, and overall performance of its payment systems. In short, new hot-standby storage was required, with availability deemed the most important feature: the new solution needed to be immune to the risk of downtime. Of course, downtime is a huge threat to a range of banking services, inevitably leading to a fall in service quality, spiraling numbers of unsatisfied customers, and the very real danger of significant reputational damage.

After evaluating a range of different IT infrastructure solutions, Yapı Kredi invited Huawei to present a remote Proof of Concept (PoC) using OceanStor Dorado all-flash storage, a solution that is characterized by the high performance and availability of its storage support. Conducted under strict conditions, the solution proved its ability to meet the bank's needs and Yapı Kredi's Information Technology (IT) team came to understand the design and operations of OceanStor Dorado in detail. As a result, this Huawei storage solution was selected by the bank, as an integral part of its strategic initiative to modernize IT infrastructure.

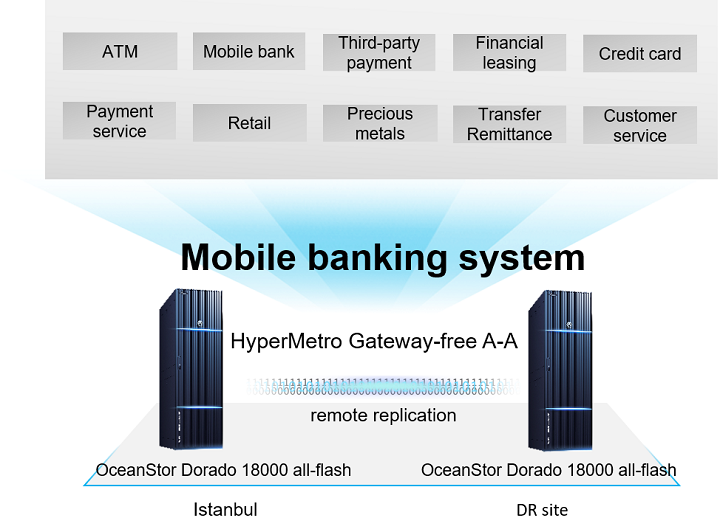

The specific Huawei OceanStor Dorado solution chosen is a high-end all-flash storage system that delivers industry-leading performance of up to 21,000,000 Input/Output Operations Per Second (IOPS) and 99.9999% reliability: six nines . This system features intelligent acceleration, designed to meet the demands of core enterprise services. It also sets unprecedented standards for industry reliability, tolerating the failure of seven out of eight controllers. After passing committed performance levels during acceptance tests, the bank chose two identical storage systems, featuring eight controllers each, one installed in the city of Istanbul and the other at a geographically separate Disaster Recovery (DR) site.The specific Huawei OceanStor Dorado solution chosen is a high-end all-flash storage system that delivers industry-leading performance of up to 21,000,000 Input/Output Operations Per Second (IOPS) and 99.9999% reliability: six nines . This system features intelligent acceleration, designed to meet the demands of core enterprise services. It also sets unprecedented standards for industry reliability, tolerating the failure of seven out of eight controllers. After passing committed performance levels during acceptance tests, the bank chose two identical storage systems, featuring eight controllers each, one installed in the city of Istanbul and the other at a geographically separate Disaster Recovery (DR) site.

The end-to-end solution of Dorado 18000 ensures Yapı Kredi’s significant gains in performance. Compared the traditional storage system, Yapı Kredi ensured 2.6x more performance. By forming symmetric architecture of Dorado high-end storage, the availability of the solution improved from 99.999% to 99.99999 %, means the sum of service interrupt time of a year is 3.1s. The Huawei storage systems provide the high performance and availability required to keep pace with the bank's growth. It’s easy-to-scale ability can prepare for any business shift in the future. Additionally, Huawei OceanStor Dorado high-end all-flash storage systems enabled data reduction capabilities which ensured =~1:3 DRR improved the TCO by 40% compared the traditional storage.

It's a simple equation, really: all digital banking services must be directly supported by highly reliable IT infrastructure. "With Huawei, we've found the perfect mix that has allowed us to optimize our internal workflow and accelerate the customer experience," said Mustafa Çetin, Infrastructure Planning and Platform Director for Yapı Kredi. And with its storage upgrade in place, the bank is continuing to add more and more options to its innovative digital payment solutions portfolio, delivering an ever faster, increasingly easier payment experience to its customers. At the end of the day, that's what really counts.