This site uses cookies. By continuing to browse the site you are agreeing to our use of cookies. Read our privacy policy>

![]()

This site uses cookies. By continuing to browse the site you are agreeing to our use of cookies. Read our privacy policy>

![]()

Enterprise products, solutions & services

North America and China came out as clear winners when it comes to the implementation of intelligent banking initiatives, according to IDC's and Huawei's Global Intelligent Banking Evaluation Model.

The model looks at six key dimensions to understand whether banks have been successful in bringing intelligence into their operations. It then scores the maturity of intelligent banking in different regions.

Our scores point to higher maturity in both North America and China, even if for different reasons.

North America has made significant investments to improve customer channels and personalize user experience. Cloudification, strong leadership, and a strong data-driven culture have also played a key role.

In China, we see faster implementation than in other regions thanks in part to a strong culture of innovation and reinvention and in part due to powerful top-down leadership. The country has built a robust digital finance ecosystem, which collaborates in the transformation of customer journeys. Plus, China is able to rapidly scale underlying tech infrastructure toward intelligent, digital banking systems.

Growth is more tepid in other regions. Enterprises are starting to establish and roll out enterprise-wide strategies in advanced European economies, but elsewhere success remains largely elusive. Approaches in these regions are ad-hoc and siloed, reflected in the lower intelligent banking scores.

The world is changing. In large part, the changes are driven by expansive digitalization across a wide range of industries and sectors. Finance has been one of the first industries to truly embrace digitalization, forced to do so by the pandemic but also driven by customer demand for more convenience.

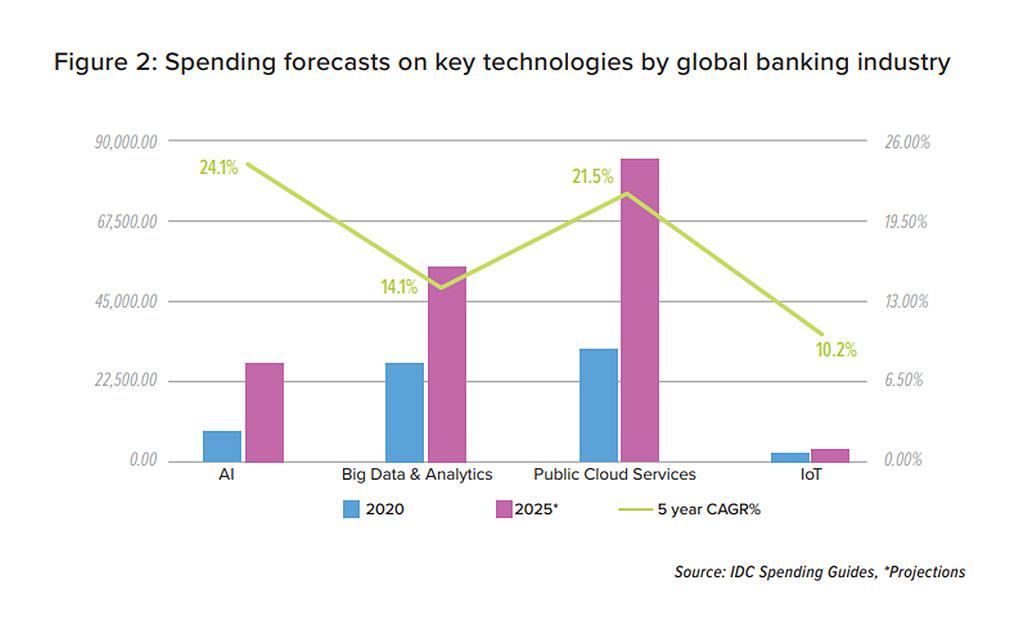

Our forecasts show exponential growth in spending on technology coming from the banking sector. In this, AI, big data and analytics, and cloud will see the largest investment as banks automate, digitalize, and become more data-driven and intelligent. Additionally, banks are investing in upgraded video conferencing, replacing legacy systems, enabling big data analytics, risk and finance integration, blockchain, IoT, and 5G.

We are seeing new ways of banking, which require these technologies for success. First of all, we've already seen an exponential surge in digital payments. In some countries and for some banks, most transactions are now taking place online, requiring robust underlying digital infrastructure, including cloud.

This newfound convenience is raising customer expectations beyond traditional banking. Users want emotive experiences and personalization, which can only be delivered through a certain level of automation and interconnection. Both of these require AI and IoT for enablement.

Further, customers no longer wish to depend on physical branches for their banking services. While brick-and-mortar banks won't be replaced quite yet, we expect that banking will becoming increasingly phygital. Transactions will start online and be finalized in person when needed, so digital user journeys will need to seamlessly integrate with physical ones.

Risk has re-emerged as a key area of focus for banks. On the one hand, there is lending excellence and risk analysis. Banks are looking at new data sources to evaluate the customer's ability to pay back loans. This involves making lending risk evaluation smarter and more data-driven.

Banks are also concerned with climate and sustainability. Realizing their key role in decarbonizing portfolios, banks are looking toward technology as a key enabler for greener finance.

Externally, digital currencies are starting to signal important tech changes for banks, as central banks begin to explore and even pilot digital currency projects. Internally, banks are faced with new ways of working. Telecommuting signals challenges in compliance and security, requiring extremely robust cloud technologies designed for banks.

all this intelligence is crucial. Banks are investing in AI for everything from service chatbots for customer onboarding and servicing to high-impact processes like policy administration, underwriting, and AML. Intelligence is equally crucial for automation in data-driven processes, data analysis, targeted marketing, and of course user journey customization.

Intelligent banks are the future, this much we know. But, how are different regions faring in this transformation journey? IDC collaborated with Huawei to develop the Global Intelligent Banking Evaluation Model.

We strongly believe that intelligence needs to be in everything that banks do in order to succeed and stay competitive. By this, we mean three concrete aspects:

• Ability to synthesize information (the process of converting data into information and subsequently into knowledge with AI)

• Capacity to learn (using AI to understand the relationships among various pieces of information and its application to a particular problem)

• Capability to deliver insights at scale (leveraging AI for decision support and decision automation requirements for everyone in the enterprise).

That’s why the Model evaluates six distinct dimensions, which are: Resilient Leadership & Strategy, Innovative Business Model, Revamped Tech Infrastructure, Strong Data-driven Culture, Reengineered Processes, and Optimized Hybrid Workforce.

Let's take a closer look at these dimensions.

Resilient Leadership & Strategy

In today's volatile economy, resilience is absolutely crucial. Banks need a global strategy that is backed by strong management and implemented top down. We have found that banks with such a strategy tend to exhibit higher digitalization and intelligence levels than their counterparts. At the same time, this dimension evaluates the bank's culture of innovation and whether innovation is prized and promoted within the bank and region.

Innovative Business Model

Leaders in this dimension excel in three ways — they transform their customer journeys, optimize their operations through intelligence, and forge a strong ecosystem of partnerships. As lockdowns swept across the world, banks were forced to bulk up their digital presence and provide mobile services.

Those that have really stood out went a step further, creating user journeys that are seamless, streamlined, and connected. They also took a stab at optimizing internal operations, adding flexibility and adaptability to their systems in anticipation of future volatility. And finally, banks that are ahead of the competition are developing new business models with other industry players, be it fintechs, robo-advisor providers for wealth management, or other industry stakeholders.

Strong Data-driven Culture

IDC expects that 25% of tier-1 global banks will have deployed there data warehouses and analytics operations on the cloud by 2025. In Asia Pacific, 93% of banks will be operating on hybrid and multi-cloud environments as early as next year.

This dimension looks at how data-ready banks are — their ability to discover, acquire, and prepare data; whether they can use the data they acquire — including utilization, insights, and sharing; and of course, regulatory compliance with local data protection and privacy laws.

Revamp Tech Infrastructure

To succeed in this dimension, banks need to have built an intelligent core for their underlying technologies that drive their digital transformation. This core must give the bank universal access to intelligent applications and data analytics. Here, we also look at the banks' technical architectures, their level of centralization, scalability, and agility. And finally, we evaluate innovation from a technology perspective — the deployment of cutting-edge solutions like 5G, blockchain, AI, IoT, and cloud.Reengineer Processes

Beyond simply injecting technologies, banks need to create efficient processes that can actually support automation and intelligent banking. This means ongoing optimization that isn't just focused on a single change, but continuous modernization that is agile and adapts to the evolution of banking processes and digitalization takes hold. In addition, high scorers in this dimension must adopt flexible, yet robust security and governance policies for intelligence-based initiatives.

Optimize Hybrid Workforce

One of the big challenges in the transition to digital and intelligent is the talent and skills gap. Banks that succeed in this dimension are investing in reskilling and upskilling, diversifying their talent pool, and creating a culture of collaboration and change management. They are also automating repetitive tasks and manual processes. Plus, they are looking at more hybrid working models by investing in infrastructure that supports telecommuting, like VPN connections and security tokens.

As mentioned earlier, we are seeing the fastest deployment of intelligent banking in North America and China and some progress in advanced European economies. In other regions, the implementation is lagging. But when we take a closer look at the weighted scores per dimension, we see some interesting details emerge.

Leadership is definitely one of the highlights for North America as it tends to be more empowered than in the rest of the world, driving enterprise-wide strategies that aim toward intelligent banking. China similarly stands out, largely due to its top-down organizational approaches, which result in quick implementation.

While it's true that North America, China, and Europe have stood out in terms of resiliency and leadership, we are seeing Asia Pacific performing very well in dimensions like business model innovation and revamping tech infrastructure.

Of course, it comes as no surprise that China outpaces other regions in terms of business model innovation and upgraded tech infrastructure. The country is unrivaled when it comes to cashless payments and digital transactions, where giants like Alipay and WeChat collaborate with local banks to enable a virtually cashless society. On a national policy level, China is also heavily investing in a range of cutting-edge technologies, prioritizing ones like 5G, AI, blockchain, and big data.

Once again, North America and China are the two to watch when it comes to data-driven cultures. Both are focusing on mining the value of data rather than simply collecting data that's available. And it's paying off. For example, North America-based Great Western Bank experienced 300% growth between 2008 and 2014, which it largely attributes to its effective use of data and insights.

In contrast, Europe is grappling with regulatory pressures in the way it can use and monetize its data. While banks do realize the importance of data-driven intelligence, their hands are often tied when it comes to actually operationalizing data in meaningful ways.

How about process modernization? North America is leading but Europe and China are close behind. All three regions are quickly optimizing and digitizing processes and workflows to increase scalability and deliver better services to end users.

Of course, we are seeing modernization among the top banks in Asia Pacific as well, but the rest of the market players are still relatively slow to respond. In Latin America and Middle East and Africa, banks still lack end-to-end processes, struggling to apply the right technologies to the right use cases.

Finally, North America is the only one truly embracing a hybrid workforce. The rest of the regions are far behind. Banks in North America are actively investing in reskilling and upskilling, trying to close the talent gap. In addition, they have deployed a digital workforce that collaborates with human employees.

It's important to remember that even weighted averages give us the big picture, but the devil is still in the details. In each regions, there are leading banks that are deploying incredibly innovative models, led by strong management backing, and as a result, delivering intelligent services to their end users.

Also, these dimensions do not exist in a vacuum. Instead, each transformation journey may focus more or less on some of these dimensions. Each bank's unique needs will also be reflected in how they approach becoming, digital, intelligent, and ultimately more sustainable.

I encourage you to take a closer look at the Huawei and IDC White Paper: Making New Realities Possible with Intelligent Banking. We not only dive deeper into the concepts behind the intelligent banking evaluation model, but also share some of the best practices from intelligent banks around the world. You can download the paper here.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy, position, products, and technologies of Huawei Technologies Co., Ltd. If you need to learn more about the products and technologies of Huawei Technologies Co., Ltd., please visit our website at e.huawei.com or contact us.