This site uses cookies. By continuing to browse the site you are agreeing to our use of cookies. Read our privacy policy>

![]()

This site uses cookies. By continuing to browse the site you are agreeing to our use of cookies. Read our privacy policy>

![]()

Enterprise products, solutions & services

When banks and other financial institutions are advancing their digital transformation journey, banks are also transforming their IT architecture.

There are several important reasons. For one thing, the entire legacy IT architecture needs reconstruction (application architecture, data architecture, and technology architecture). These layers have used closed technologies (IBM mainframe and midrange computers, IBM DB2, Oracle database, etc.) for a long time, resulting in high costs (investment and O&M costs). For another, application development or business operation is time-consuming and previous technological development restricts the transformation of the entire architecture. Open technologies, such as virtualization, open-source databases, and middleware, are advancing rapidly in the recent decade, which makes technological replacement possible.

Different countries and regions have varied approaches. The most common one is a bi-modal architecture.

The traditional IT architecture formed in banks over the years, involving IOE, middleware, database, and development environment, cannot be abandoned or reconstructed overnight. However, banks need a new architecture to support various open or Internet-based applications. For instance, online banking, micro-finance, e-commerce, and other cloud native applications can be easily and quickly deployed on the new architecture.

A new architecture generally follows an open, distributed, or cloud-based architecture. In the recent decade, China's financial institutions have taken one step ahead because they are facing a fierce competition with China's Internet companies and China's healthy economic growth, including the banking industry, firmly drives IT development. China's online shopping festivals generate a large number of Internet transactions, exerting huge pressure on traditional and innovative banks to process these transactions. This pushes banks to reconstruct their technology architecture which supports quick, elastic resource deployment and rapid application iteration, adapting to the fast-changing market.

With the change of user habits, traditional banks need to roll out applications as fast as possible, such as marketing applications (flash sales) and non-traditional financial services (life and e-commerce applications). This allows banks to acquire customers or attract the millennials to enhance competitiveness. Therefore, traditional banks need to quickly build a digital core while maintaining a stable traditional core. The digital core, powered by open, distributed technologies, support the fast development of next-generation applications, better customer acquisition, ultimate customer experience, and lower IT O&M cost per account. In addition, this new core helps to build a next-generation data platform, so that banks can quickly reconstruct data planes (big data, data lakes, and data factories), enabling the rapid development and deployment of innovative banking services.

When talking about the transformation direction of the banking IT architecture, we usually put open and distributed architectures together. A distributed one can scale out quickly to support non-linear/huge transaction volume, which is closely related to the architecture design. The traditional banking architecture (IOE architecture) is centralized and difficult to scale out. The architecture powered by x86 servers and open, distributed technologies (e.g. MySQL database and Hadoop) is easy to scale out, such as the XML architecture introduced by WeBank. The industry has solved many problems and piloted open and distributed architectures on a large scale. WeBank is a case in point. China Minsheng Bank, MYbank, and other banks have also deployed their new banking system architecture or open banking system architecture by leveraging open, distributed technologies.

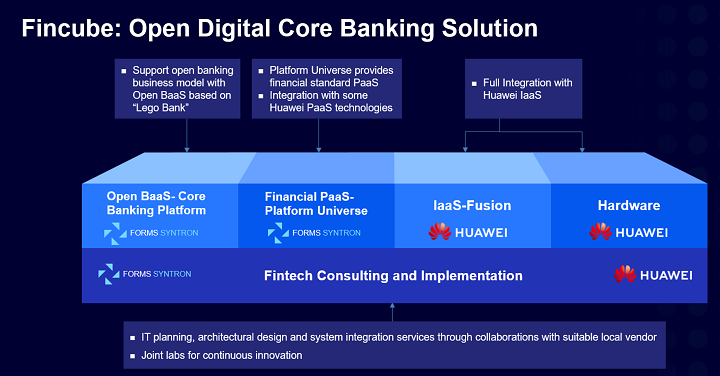

Banks outside China move a bit slower. However, they never give up or stop migrating services from RISC servers to x86 servers and shifting from the traditional core to the new one. They have keeping moving forward slowly. So the new architecture becomes an irreversible trend despite the fact that the traditional one will survive for a long time. Since last year, Huawei Financial Services Business Dept has cooperated with a leading Chinese banking service provider to develop a solution called Fincube. This solution helps to form a modular core system for open banking using distributed, open technologies at the IaaS, PaaS, and SaaS layers. Huawei provides IaaS infrastructure and distributed storage technology (FusionCube) while the partner offers fully distributed PaaS technologies and a modular digital banking service system that can flexibly adapt to various service development and O&M scenarios.

This solution has gained wide customer recognition since its release. By communicating with international bank customers at Huawei summits, we got to know that they speak highly of Chinese banks' IT architecture transformation experience in the past five to ten years. This occurs not because technological development provides the feasibility of applying an open, distributed architecture to banks. The banking industry is conservative. Without large-scale long-term application, banks hold a wait-and-see attitude. Large Chinese banks are developing rapidly and have performed well in establishing new architectures and transforming legacy ones. From these banks, international banks have seen bright prospects and gained confidence in transformation. This is the architecture transformation trend that we have observed. The best practices and solutions represent Huawei's long-term partnership and efforts. They also embody Huawei's value: Huawei, as a global enterprise, shares Chinese banking industry's solutions and best practices to international banks to help them achieve digital transformation.