This site uses cookies. By continuing to browse the site you are agreeing to our use of cookies. Read our privacy policy>

![]()

This site uses cookies. By continuing to browse the site you are agreeing to our use of cookies. Read our privacy policy>

![]()

Enterprise products, solutions & services

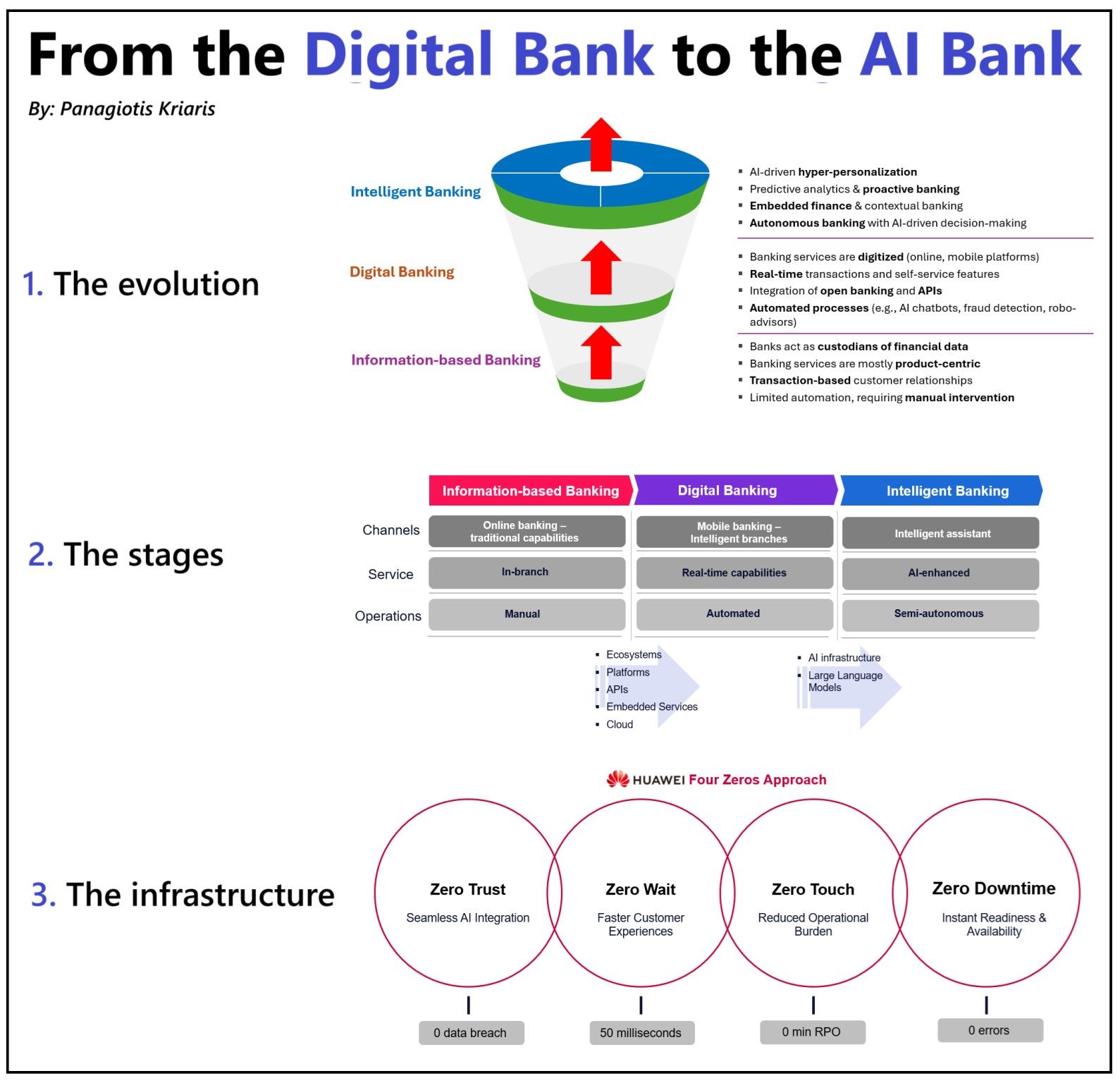

The digital bank is an outdated concept, fast being replaced by the intelligent bank. The only question is how soon banks can manage the transition. Let's take a look.

I have broken down the main elements that make up the transition to the intelligent bank:

1. From transactional to predictive banking: Digital banking enabled 24/7 self-service, but intelligent banking takes it further by predicting customer needs. AI-driven models analyse real-time data to offer personalised financial insights, proactive credit offerings, and automated investment recommendations.

2. AI-powered risk & fraud management: Traditional risk assessment relied heavily on historical data. Intelligent banks use AI and machine learning to detect fraud in real time, identify suspicious patterns, and prevent threats before they occur.

3. Hyper-personalisation: Instead of generic offers, intelligent banks use AI to tailor financial products to individual customers (mass personalisation).

4. Seamless omni-channel experience: Customers no longer interact with banks through a single channel. Intelligent banking ensures that a user can start a transaction on a mobile app, continue it via a chatbot, and complete it with a human advisor, all while maintaining a seamless, connected experience.

5. Autonomous banking operations: Intelligent banks optimise back-office processes using cloud and AI automation, reducing human errors and significantly improving efficiency. Functions such as loan approvals, compliance checks, and reconciliation are increasingly self-regulated by AI-driven workflows.

Banks are in a time race. They not only need to move from digital to intelligent but also do it fast.

In doing so, technology is the biggest dependency. One of the most interesting approaches I have seen on how to best support banks in this transition is Huawei's 4 Zeros model, which is based on four main pillars:

1. Zero Downtime → Instant Readiness

AI-powered predictive maintenance and cloud resilience ensure 24/7 availability, allowing banks to deploy and scale AI solutions without service disruptions.

2. Zero Wait → Faster Customer Experiences

AI-driven real-time processing eliminates delays in transactions, approvals, and customer interactions, making banking services ultra-responsive.

3. Zero Touch → Reduced Operational Burden

End-to-end automation using AI and machine learning removes manual intervention in processes like KYC, loan approvals, and compliance, freeing up resources for AI innovation.

4. Zero Trust → Seamless AI Integration

AI-driven security frameworks continuously validate access, ensuring trust and compliance while enabling banks to integrate AI-powered services without increasing risk.

The era of intelligent banking isn't a distant future – it's happening now. Banks will not be able to transform in months but getting a head start can make a difference.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy, position, products, and technologies of Huawei Technologies Co., Ltd. If you need to learn more about the products and technologies of Huawei Technologies Co., Ltd., please visit our website at e.huawei.com or contact us.