Produkte, Lösungen und Services für Unternehmen

Smartphones, PCs & Tablets, Wearables, mobiles Breitband und mehr

Über Huawei, Nachrichten, Veranstaltungen, Brancheneinblicke und mehr

Digital transformation, which all industries are trying to achieve, is one of the major trends of the era. Those that manage to keep up will reap major benefits, while those that don't will surely be left behind.

Huawei has continually had exchanges about digital transformation with clients of the financial industry from all over the world. We have organized over 300 online meetings with nearly 100 clients from over 60 countries and regions, and more than 80% of them were decision-makers. In these exchanges, we have not only shared with clients' specific cases that highlight our practical experience with the digital transformation of the financial industry, but have also listened to the challenges and needs our clients have in this field.

We observed that there is an increasing amount of internal and external factors influencing the trend of digital transformation, from the continuous evolution of mainstream technologies such as cloud computing, 5G, big data and AI, to the unforeseen and uncertain pandemic last year, to the transfer of traffic to mobile devices by the constant change of consumer behavior, and to new business models emerging as the digital economy accelerates.

Based on these preceding factors and our understanding and practical experience of the global financial industry, we came to the conclusion that there are six financial industry trends.

First, the development direction of mainstream technology is very clear. The financial industry no longer hesitates to incorporate technology into day-to-day operations and has no choice but to continuously increase the investment into new technologies to keep up with the times. Mobile technology brings innovative user experience, cloud-native technology promotes the development of microservices and APIs, cloud computing meets the demands of AI and big data in terms of computing and storage, 5G is available for more types of devices to help support the popularity of video meetings, short videos and the live streaming market. In the global financial industry, public cloud services are increasingly used to improve user experience by promoting mobilization, 5G technology is utilized to develop innovative scenarios, and old equipment and systems are rapidly being phased out. The key points we need to consider now are how to properly collect, process and use data, as well as how to widely apply AI technology.

Second, digital payments are gradually replacing the use of cash. With the widespread popularity of mobile apps, the evolution of real-time risk control technologies, the improvement of the user experience, and the development of fintech platforms, digital payments are developing rapidly in more regions of the world, while credit cards and cash are fading into the background. Slowly but surely, we are heading towards a cashless society. Digital payments are carried out on mobile phones to innovate user experience through mobile wallets, breaking away from the tedious payment system based on traditional bank cards. Fintech companies are leading the digital payment business and have easily entered more financial service fields, such as wealth management and consumer loans, by leveraging large amounts of payment and scenario data. According to a Statista report, global digital payment users have reached 3.8 billion in 2021, with total payments amounting to approximately US$6.68 trillion, accounting for more than 50% of the payments market.

Third, we need to speed up digital transformation. The frequently changing situation leads to many problems, such as global supply chains being halted, the economy facing short-term inflation due to loose monetary policies, and investors and consumers lacking confidence when facing the uncertainties of the future. In the financial industry, we have to cope with operational challenges while bearing the cost pressure brought by digital transformation, along with problems like insufficient investment in science and technology and slow progress in cloud transformation. Speeding up digital transformation is urgently needed to respond to these challenges.

Fourth, the financial industry is shifting the way to interact with customers. As physical networks, ATMs, online banking and other traditional media are decreasingly used, social networks, mobile apps, video meetings, AI robots and other emerging media are becoming primary means in the financial industry to improving user experience and satisfaction by providing customized services. According to FinancesOnline, more than 50% of customer traffic of banks was via mobile apps in 2019, and the figure will exceed 80% in 2025.

Fifth, cryptocurrency is gradually integrating into the financial system. Followed by more adherents, it has expanded to a US$2 trillion market cap: fintech companies are using cryptocurrencies as payment tools, financial institutions are starting to add cryptocurrencies to their portfolios, multiple countries and regions accept cryptocurrencies as financial assets, and El Salvador has even adopted cryptocurrencies as legal tender. According to a report by the Bank for International Settlements, more than 36 central banks around the world successively issued central bank digital currencies to try to digitize fiat money.

Sixth, regulators begin to implement anti-monopoly laws and regulations on the payments market. In China, where internet giants occupy a monopoly position in the payments market, regulators have brought out rules to restrict the excessive development of internet giants, avoid potential systemic risks, and encourage a multi-platform payment market in order to provide fair opportunities for banks to compete with internet giants. Other countries are also following the same trend. Regulators of various countries have already put forward more specific regulatory requirements for Amazon, Apple, Google and other internet giants in anti-monopoly, charging mechanisms, customer privacy and other aspects, and restricted them through digital taxes, fines and other means. This trend enhances the complexity of digital transformation in the financial industry.

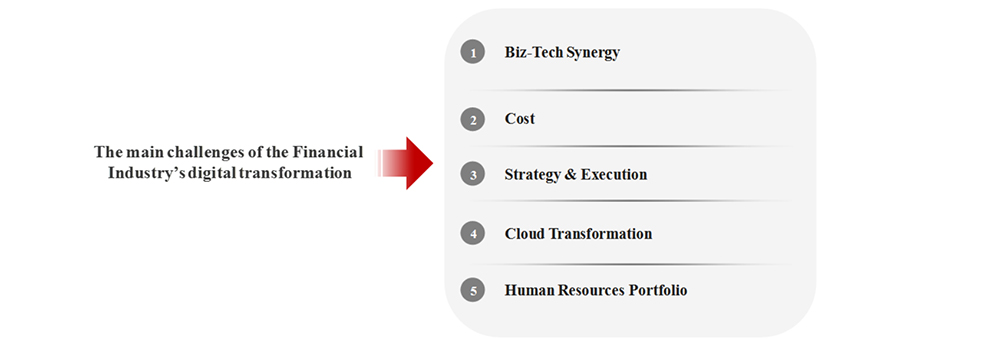

With such a clear development trend, we can find an easy path to achieve digital transformation. The financial industry needs to further accelerate digital transformation to adapt to the changing customer needs and emerging business models. In the process, the financial industry needs to think about strategies for the following five major challenges:

Five Major Challenges for Digital Transformation in the Financial Industry

Biz-Tech Synergy: In developing, connecting and operating, the financial industry needs to break the traditional organizational boundaries to make business teams and technology teams highly coordinated and integrated to ensure the efficiency of digital operations.

Cost: During the transformation, the financial industry needs to ensure the production and operation of traditional systems, while promoting digital transformation. The cost will be high, which is why the key is to find efficient ways for the transformation and the iteration of old and new systems to control costs.

Strategy and Execution: Management teams need to develop clear and feasible strategies, and have the determination and ability to execute firmly. Strategic ambiguity and indecision are often the main reasons for the failure to achieve digital transformation.

Cloud Transformation: This transformation focuses on creating customer-centered products and services, innovative user experience and inventive business models. The success of cloud transformation is determined by the way microservices remold scenario services, the way big data platforms and AI are used, and the way data security and regulatory compliance are ensured, which are the key to realizing business agility.

Human Resource Portfolio: The portfolio indeed needs to be built through employee recruitment and training. For digital transformation, a majority of employees should be capable of digital design, operation and tools, including cloud computing, mobilization, big data, AI technology and user experience (UX) design. One of the main challenges is incorporating technology talents into business teams.

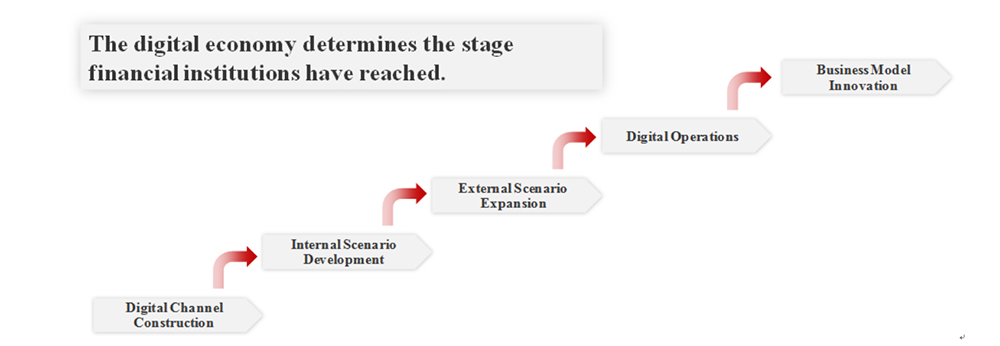

In addition to the challenges mentioned above, financial institutions also need to think about the stage of digital transformation in order to decide on specific actions accordingly. We believe that the development degree of the digital economy determines the stage of digital transformation in the financial industry. There are mainly five stages:

Digital Channel Construction: This stage is the center of digital transformation in the financial industry in the early stage of the digital economy. Accounting and transactions are centered in major traditional application systems for rapid response, stability and reliability. The interaction with customers mainly focuses on inquiry business.

Internal Scenario Development: As the digital economy is in the primary stage of its development, the application in the financial industry is turning to a user-based structure. While digital transformation in the industry begins redesigning user experience, internal digital scenarios are becoming the target. At this stage, the main actions include: using automation tools to enhance the efficiency of internal service processes, using microservices to transform application so as to rebuild customer interface and embed risk and compliance operations in the middle and back ends, using big data to continuously optimize user experience, using diverse services to attract customers and drive traffic, such as discussion communities, lower charge rates and games, and using cloud computing and other emerging technologies.

External Scenario Expansion: As mobile payment becomes popular, the digital economy has developed to the next level, and mobile devices become the first point of contact with customers; the financial industry begins to enter this stage. Through super apps, one-stop services become a reality. At this stage, the main actions include: expanding contextualized life services based on mobile payment to introduce more merchants to these apps, actively interact with third-party service platforms in order to expand service coverage and get more customer traffic, reforming application interfaces to build a RESTful API platform. [Note: A RESTful API, also known as REST API, is an application programming interface (API or web API) that conforms to the constraints of REST architectural style.]

Digital Operations: In market areas with a fast growing digital economy, as customer behavior changes thoroughly and business models are constantly updating, the financial industry begins to enter this stage. The main actions include: using digital means such as live streaming and AI voice to gain customer channels, activate potential ones, guide and maintain them; extensively using big data platforms and AI algorithms; building a customer-centered digital operation platform to empower the customer group management department of the head office, regional centers of branches, all other branches, and even every customer manager; and building an organization centered on digital operation to set up an end-to-end scenario development team and operation team in order to form an all-digital business model connecting online and offline outlets.

Business Model Innovation: Along with the rapid development of the digital economy, there is great competition for customer traffic among internet giants, payment platforms and e-commerce platforms. In order to avoid being marginalized in the competition, the financial industry needs to play their own advantages, and explore new business models on the premise of regulatory compliance. At this stage, the transformation will be further diversified, including: embedding financial services into scenarios to build and connect businesses and customers based on mobile devices to break the traditional financial service platforms that have department boundaries; continuing to look for new ways based on digital operation to realize sales volume, such as 5G, industrial finance, Internet of Things and digital currency; and taking advantage of platforms to develop wealth management business, asset-light operation and reduce the impact of the economic cycle.

The above are some of our thoughts on digital transformation in the financial industry, including the main trends, challenges and development stages. In the future, we will continue to have in-depth exchanges with financial clients on digital transformation, discuss our experience and practice of digital transformation, and share our latest observations.

Huawei's vision is to bring digital to every person, home and organization for a fully connected, intelligent world. Based on our expertise in the field of ICT, our technology innovation in 5G, big data, cloud, mobilization, AI and other aspects, our practical experience of digital transformation in the financial industry and our feedback summary during communication with global financial clients, Huawei, as a reliable partner, is willing to help everyone successfully realize their own digital transformation.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy, position, products, and technologies of Huawei Technologies Co., Ltd. If you need to learn more about the products and technologies of Huawei Technologies Co., Ltd., please visit our website at e.huawei.com or contact us.