Produkte, Lösungen und Services für Unternehmen

Smartphones, PCs & Tablets, Wearables, mobiles Breitband und mehr

Über Huawei, Nachrichten, Veranstaltungen, Brancheneinblicke und mehr

In Money Changes Everything: How Finance Made Civilization Possible, first published in 2016, leading financial historian William N. Goetzmann argues that finance is what has driven progress, not the other way around.

In today's uncertain world, then, finance is slated to play a pivotal role in driving economic recovery. However, in order for this to happen, the Financial Services Industry (FSI) needs technological upgrades, and it needs them fast. Only then can it support other industries to recover, unleash new value, and transform.

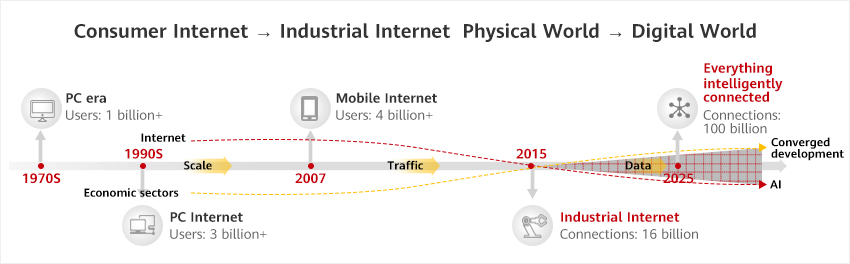

In the past few decades, we've seen mainstream technologies transition from Personal Computers (PCs) to the Internet, the mobile Internet, and now the industrial Internet. As the Internet of Things (IoT) develops, connections expand beyond people to things, exponentially increasing the total number of connections. In 2015, there were 16 billion. By 2025, that number is slated to grow to 100 billion.

In this process, the Internet has evolved from the consumer Internet to the industrial Internet. The consumer Internet has enriched our communications and our lives. But the industrial Internet goes a step further, connecting Business to Business (B2B) and Business to Consumer (B2C) supply chains as well as internal and external business activities and data. This is reshaping the business value chain for traditional industries. The result is a world where everything — people, things, and even Intelligent Twins — is intelligently connected.

The economy is also changing. When we primarily used PCs, large-scale monetization came from hardware and software sales. With the consumer Internet, Over The Top (OTT) vendors monetized Internet portals for traffic. Today, with the industrial Internet, enterprises will need to improve efficiency and service flows, along with drawing on massive amounts of data, to truly monetize technologies. This illustrates the evolution from a traditional economy to a digital economy, spurred on by technology.

In this rapidly developing digital economy, a variety of new services — for example, online trading, digital logistics, mobile payments, and remote communications — have emerged and are gaining prominence in the wider national economy as well as in people's daily lives. In fact, by 2025, the global digital economy is expected to account for 58.2% of global Gross Domestic Product (GDP).

China is one of the leaders in the development of the digital economy. Indeed, in 2020, the country's digital economy grew at an astonishing 9.7%, over three times the nominal growth of GDP in the same period. Total scale reached CNY39.2 trillion (approximately US$6 trillion), contributing 38.6% toward GDP, clearly positioning the digital economy as the key to economic recovery and stable economic growth in the country.

These changes have not occurred spontaneously. They reflect a slew of Information and Communications Technology (ICT) upgrades, which have had a profound impact across industries, including FSI.

For finance, such upgrades have brought about a number of important changes.

Always on: New ICT has enabled real-time interaction and behavior interconnection. Mobile devices are the optimal platform to deliver innovative customer experiences while also facilitating internal enterprise collaboration. This has given rise to brand-new service models.

Super intelligence: 5G enables intelligence on devices, edges, and clouds, supporting distributed all-scenario Artificial Intelligence (AI) and smart contacts anywhere. Ubiquitous intelligence powers intelligent and real-time decision-making models.

Everything intelligently connected: In the digital world, where everything is intelligently connected, more than 100 billion IoT devices will stimulate new business scenarios. Unlike traditional banking that only served people, the Bank of Things (BoT) will also support services for smart things, driving the rapid development of industrial finance.

Distributed collaboration: We are now seeing multi-platform, multi-node, and distributed collaboration. This bottom-up model, which engages a variety of stakeholders, will unleash business potential.

New market scenarios are emerging constantly. From autonomous driving to intelligent coal mines and warehousing, the finance sector will need to be ready to support new business models, while also being the driver for innovation.

In this process, three capabilities are critical.

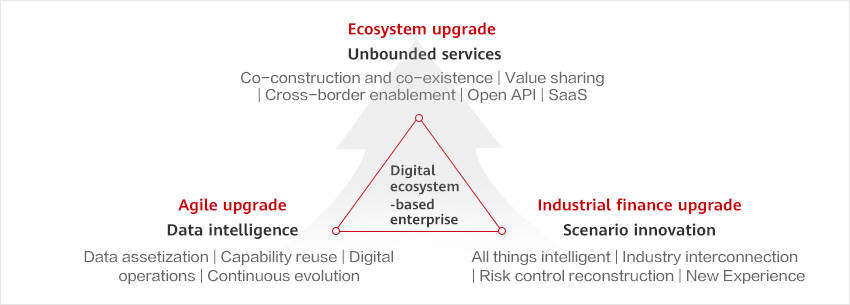

Agility is at the core. How can financial institutions achieve technological, business, and organizational agility through digital transformation? How can they perceive and respond to changes faster?

The sector needs new risk control concepts and models. When everything is intelligently connected with real-time interaction, risk control needs to be data-based, real-time, and intelligent.

Fast sector development will also require a robust ecosystem. Distributed collaboration is creating new scenarios. Therefore, a single financial institution cannot handle all diverse scenarios. Instead, each entity should collaborate with other companies to build an open and integrated cross-industry ecosystem.

Cloud technologies will be one of the key solutions to all of these needs, and they have moved from resource-centric cloud 1.0 to application-centric cloud-native 2.0. This helps the financial services industry meet a variety of new challenges. Cloud technologies will be able to support agile innovation and data intelligence. They are essential for connecting everything and for cross-scenario innovation. And, last but not least, clouds will help connect industry ecosystems and provide untethered services.

To support the necessary upgrades in the finance industry, Huawei will focus on three strategic initiatives.

Agility: Embrace cloud-native technology, build optimal infrastructure through technological innovation, accelerate the integration of data and intelligence, and build agile digital platforms. These changes will help financial institutions achieve technological, business, and organizational agility. They will be able to perceive and respond to changes faster, while also accelerating intelligent data processing and trusted transfers. By doing so, financial institutions will upgrade their business cycles, from scenarios to data, opportunities, services, and finally revenue.

Ecosystem: Aggregate Software as a Service (SaaS) services to build an open ecosystem for all scenarios. We will work with capable partners who wish to cooperate with Huawei in FSI. These partnerships will draw on Huawei's and partners' experience and technical innovation in the digital transformation of the finance industry. Together, we will develop industry-leading solutions and build an open, converged, and cross-industry ecosystem.

Industrial finance: We will engage with real industry scenarios, focus on the industrial Internet, use technologies to go digital, speed up trusted data transfers, unleash the value of data, build new service scenarios and models, and connect scenarios across industries. This will create a business supply chain across traditional sectors, further integrating financial services with other activities.

The opportunities emerging from the development of the industrial Internet are endless. In the financial services industry, "subject credit" is shifting to "subject credit + transaction credit." As industries go digital, they need to obtain objective and reliable transaction data whenever they need it and in real-time. Only if base data assets can be transferred securely can industries build new models and unlock the value of digitalization.

To this end, Huawei offers full-stack cloud, device, and edge capabilities and we have played an active role in the digitalization of various industries. Huawei looks forward to supporting financial institutions by drawing on these capabilities and our experience. On its platforms, Huawei can aggregate more SaaS services, strengthen the ecosystem, and work with financial institutions to build new financial services in all scenarios, creating new value together.

Huawei entered FSI 10 years ago and has since made substantial progress. We have served more than 2000 financial customers in more than 60 countries and regions, including 47 of the world's top 100 banks.

With a decade of experience, Huawei has become an important digital transformation partner for FSI worldwide. In China, Huawei ranks first in both financial cloud infrastructure and data infrastructure markets. HUAWEI CLOUD has served more than 300 financial institutions, including all of China's top 10 banks. At the same time, Huawei's data infrastructure has been deployed by all of its top 20 financial customers. We have also built Asia's largest cloud data warehouse platform for China Merchants Bank (CMB).

Outside China, Huawei received the Most Valued Technology Partner of the Year 2020 award from Singapore's DBS Bank. Indeed, we were the only technology partner out of 64 to receive an award for helping DBS Bank achieve agile innovation, enhance reliability, and improve operational efficiency and services.

Our highly reliable and scalable storage solutions have supported the stable operations of core transactions and business expansion for various institutions, such as the largest bank in Latin America, Itaú Unibanco, Swiss insurer Sympany, Piraeus Bank, the largest bank in Greece, and FTLife, one of Hong Kong's most well-established life insurance companies. In addition, Huawei's mobile money solution has helped Ghana Commercial Bank (GCB) develop mobile payment and inclusive financial services, achieving a 10-fold increase in mobile services.

Working with partners, Huawei has also deployed a new digital service core system for NCBA, a commercial bank with the largest user base in East Africa. This has helped the bank provide inclusive financial services for over 18 million users in Kenya and other countries in East Africa. Activities such as this help banks support the real economy as well as promote sustainable social development for all.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy, position, products, and technologies of Huawei Technologies Co., Ltd. If you need to learn more about the products and technologies of Huawei Technologies Co., Ltd., please visit our website at e.huawei.com or contact us.

How GenAI Sparks Growth and Innovation in Leading Banks

4 Zeros Resilience Underpins the Path to AI Banking

Boost Resilience, Reshaping Smarter Finance Together

Non-Stop Banking, Resilience Boosts Intelligence

Navigate Change, Shaping Smarter Finance Together

Accelerate Change, Shaping Smarter Greener Finance Together

3 Ways Huawei Is Unleashing the Value of Digital for Finance