ผลิตภัณฑ์ โซลูชั่น และบริการสำหรับองค์กรธุรกิจ

The rapid digitalization of financial services has prompted many banks, insurers, and securities to quickly adopt the cloud. But financial cloud migration is not so simple. Companies must assure regulatory compliance while also maintaining enough elasticity to support future financial services. How can we, as a technology company, help the finance sector go digital with cloud?

While many finance companies plan to adopt cloud to boost their business, they are facing an enormous challenge when it comes to security and compliance. Legacy IT architecture houses tons of corporate and personal data that needs to be migrated from closed on-premises systems to relatively more open clouds.

At the same time, existing systems were designed to support a stable flow of services. Now, we are seeing occasional explosive traffic growth as finance services move online, so resource scheduling needs to more automated and elastic.

Plus, adaptability becomes an issue as users expect financial enterprises to respond to their needs immediately and deliver value faster. This is hindered by siloed applications and data, which slow down innovation.

Further complicating cloud migration and adoption, different companies use different paths to adopt cloud. Some try to build home-grown cloud, while others opt for commercial solutions. Yet others choose a hybrid multi-cloud strategy, combining the deployment of public and private clouds. A few still haven't given much thought to cloud transformation and continue to run their services on traditional IT architecture.

There is also a lot of diversity on the application side. We see the sector developing cloud-native applications and innovative services, using big data and AI platforms for large-scale resource scheduling and elastic scaling. While this is a positive shift, it's not always systematic. So, the finance industry needs to reach a consensus on how to systematize cloud migration in a way that benefits both enterprises and users, and enables ongoing innovation.

Drawing on over decade of experience and our expertise in ICT infrastructure, Huawei has built a secure, stable, and efficient financial cloud platform, which serves as the underlying infrastructure for all processes related to cloud.

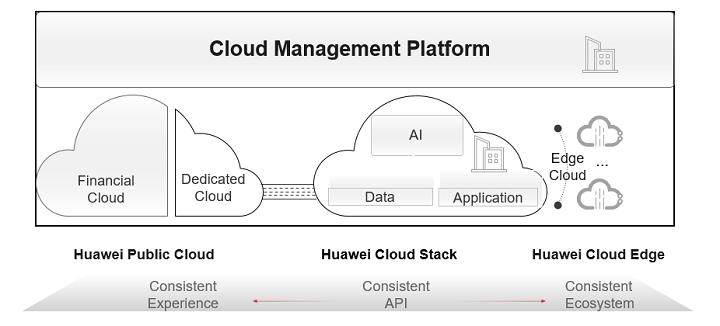

The platform can be deployed on a private enterprise cloud, Huawei dedicated cloud (DeC), or financial cloud and supports edge cloud scenarios such as intelligent branches. Customers choose the deployment model most suitable to their user operations and needs.

Huawei's financial cloud platform features multi-architecture computing, multi-cloud interoperability, multi-domain disaster recovery, and multi-level cloud management. It supports consistency across multiple clouds. Users can fully rely on the elasticity and security of the cloud platform, even if they are unaware of the deployment model. Financial enterprises can use the cloud service components to accelerate innovation and develop new business models.

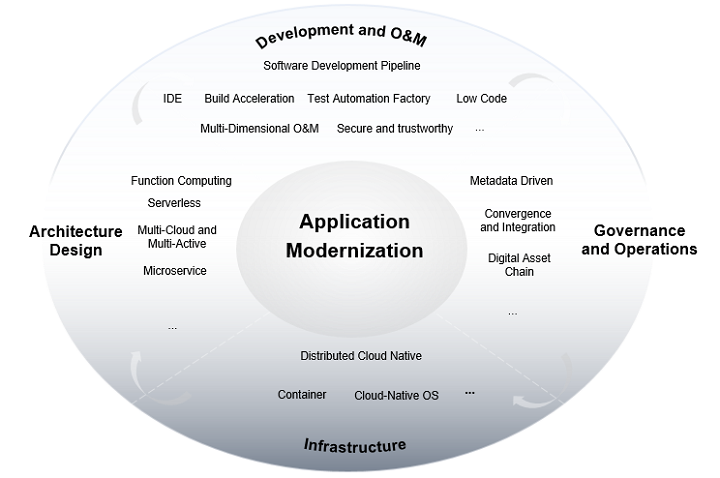

Once a business has the right cloud infrastructure, it can migrate its existing applications to the cloud, and build new cloud-native services.

Companies can also use the elastic resources and abundant technical components on the cloud infrastructure to achieve more agility, efficiency in service iteration, a higher level of automation, and secure O&M. If some applications aren't yet ready for cloud migration, they can still interconnect with those already on the cloud.

Huawei Cloud supports multi-site, multi-center, and multi-active disaster recovery, assuring financial applications. Plus, developers can use components such as distributed databases and transaction middleware to quickly build applications that deliver financial transaction consistency.

ROMA, a platform developed based on Huawei's 30 years of experience in software development, provides full lifecycle management of applications. It connects with cloud and existing services through APIs and message middleware, supporting fast and stable service migration to the cloud.

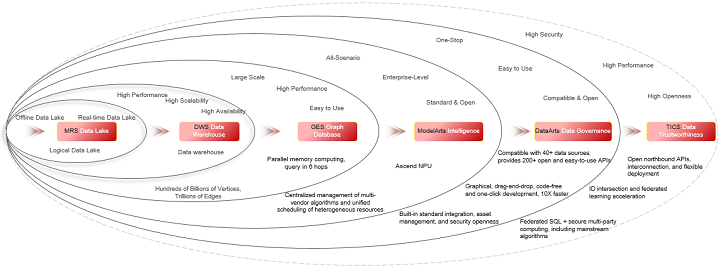

In the past, companies used data primarily for corporate governance. Today, it helps with intelligent decision-making and ecosystem innovation.

Huawei uses cloud data and AI to provide financial enterprises with various services including data ingestion, governance, analysis, AI modeling, and inference. This improves both data supply and consumption, enabling digital operations.

Different data technologies bring different benefits.

• Data lakes can help financial enterprises implement real-time marketing, transaction anti-fraud, and operational analysis.

• Data warehouses speed up regulatory reporting.

• Graph computing enables in-depth insights into customer relationships and analysis of intercompany transactions.

• Data lakehouses improve the production efficiency of enterprises.

• Data-AI integration and Ascend NPU accelerate AI modeling from hours to minutes and facilitate AI development and ModelOps.

All these technologies provide strong support for intelligent risk control and marketing.

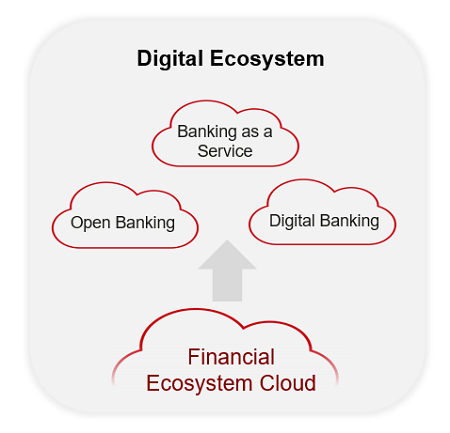

As the sector goes digital, the competition among financial service providers will depend on the robustness of their platforms and ecosystems. Once they have moved to the cloud, companies will need innovation, driven by cutting-edge technologies like big data, AI, blockchain, and IoT. They are also gradually shifting focus from products to scenarios.

What's more, some leading financial companies have also established fintech subsidiaries to deliver their specialized technical capabilities and drive the technological development of the entire industry.

Within this context, Huawei offers the Super App Solution, which helps financial enterprises quickly build mobile banking and mini apps to improve user experience. We also provide open APIs to enable external platform development and infuse financial services into all other industries.

Ultimately, going digital is inevitable in the finance sector. The question is when, how, and alongside whom will companies work to win over their competition. Huawei offers financial cloud solutions to help financial enterprises strengthen their technical foundation and create new value for the industry.