New Converged Data Platform Helps ICBC Execute ECOS Strategy

ผลิตภัณฑ์ โซลูชั่น และบริการสำหรับองค์กรธุรกิจ

Huawei and ICBC have cooperated over the past five years to build and operate a massive cloud data lake. During that period, Huawei has helped ICBC build a solid and efficient data foundation to execute its “ECOS” strategy. Because of this successful cooperation, hundreds of data applications now run efficiently and accurately on a big data service cloud platform.

Established in 1984, the Industrial and Commercial Bank of China (ICBC) is a large, state-owned bank directly managed by China’s Ministry of Finance. In 2018, ICBC ranked first in the Top 1000 World Banks list, compiled by the global financial intelligence publication The Banker. In 2019, ICBC ranked at No. 26 on the Fortune Global 500 list — the highest position occupied by any bank. As China’s largest commercial bank, ICBC prioritizes the development of Financial Technology (FinTech) and, given its focus on the domain, FinTech is now regarded as ICBC’s core competitive strength and a key driver of its reform and innovation.

In November 2019, ICBC announced its “ECOS” smart bank ecosystem strategy, aiming to use cutting-edge FinTech to drive service transformation and development and build a smart bank for the digital era.

“E” refers to “Enterprise-level” : ICBC aims to create a new system for product integration, information-sharing, process linkage, and channel collaboration from a corporate point of view, to deliver a consistently high-quality “One ICBC” experience to customers.

“C” refers to “Customer-centered,” embodying ICBC’s “customer first” service principle and its goal of “becoming a bank at customers’ fingertips as well as in their hearts.”

The “O” stands for “Open,” representing both “openness and convergence”: ICBC is embracing new life- and scenario-based financial service development trends. With its own e-banking, e-connection, and e-shopping platforms as the cornerstones, ICBC aims to build an open and cooperative financial ecosystem that benefits all parties based on Application Programming Interfaces (APIs) and financial ecosystem cloud platforms.

Finally, “S” means “Smart,” indicating that ICBC is making comprehensive deployments in cutting-edge technologies such as Artificial Intelligence (AI), blockchain, cloud computing, big data, and Internet of Things (IoT) — referred to as “ABCDI” — and has developed a series of core technology platforms to provide the strongest “brains” for banks in terms of customer service, precision marketing, risk control, and decision-making management, ultimately empowering the bank’s transformation and innovation.

Based on its ECOS strategy, ICBC built an open and converged cross-industry ecosystem. The strategy has helped ICBC become China’s largest comprehensive financial service provider, allowing seamless integration of financial products and services — including payment, financing, wealth management, and investment — into customers’ daily lives and everyday consumption habits as well as into enterprise scenarios such as education, healthcare, mobility, and government services. Because of these developments, ICBC’s financial services are now as convenient and accessible as water and electricity.

The bank also developed an “intelligence+” innovation model by strengthening digital and intelligent applications to make services, products, risk control, and operations smart, meeting the new expectations and requirements people have for financial services.

To support flash sales scenarios — a prime example of increased expectations for financial services — ICBC developed high adaptability and flexible capabilities. Its support for high-frequency and complex services has been enhanced through IT architecture transformation and application of new FinTech. These capabilities were proven when ICBC supported a transaction rate that increased five-fold during the peak hours of the “Double 11” shopping frenzy on November 11, 2018. And in 2019, when China released commemorative coins to mark the 70th anniversary of the founding of the People’s Republic of China, within five minutes of the launch, ICBC apps were able to support more than 30 million reservations.

ICBC owes such successes to the dual-core IT architecture it built, becoming the first bank in the industry to develop core banking service processing capabilities based on a distributed cloud platform. More than 90 percent of system functions run on the open platform, greatly improving system transaction performance and ensuring fast and stable system operations.

The bank also built a range of industry-leading enterprise-level FinTech platforms, covering AI, IoT services, and blockchain technologies, to promote the integration of new technologies and services. ICBC has developed leading enterprise-level technical and service application capabilities, and the platforms have empowered financial services by improving both service quality and efficiency.

With component-based innovation capabilities featuring flexible combinations and rapid Research and Development (R&D), ICBC is highly agile and can quickly respond to new market and customer requirements.

Smart banks require a solid, intelligent, efficient, and open data foundation. In 2015, ICBC and Huawei established a joint innovation team to create a converged data platform. Initially, the team chose an Electronic Data Interchange (EDI) application on the existing appliance platform, running the simplest 100 operations on Huawei’s GaussDB Online Analytical Processing (OLAP) for test purposes. After running these operations successfully, the team then repeated the process — this time choosing the most demanding and complex operations to more fully test OLAP’s capabilities and improve its performance. Step by step, the team completed EDI full program migration, as well as the migration of all subsets of the data warehouse, and the subsequent migration of data warehouse appliance products. In the process, ICBC and Huawei developed an industry-leading open and converged data platform.

• First Appliance Data Warehouse Platform Migration in China

On June 30, 2019, ICBC’s enterprise-class data warehouse based on an appliance platform was replaced with a big data service cloud, based on Huawei’s converged data platform. This successful running of converged data products indicated that ICBC was taking the lead in building the digital world (a world in which ICBC will play a leading role, serving the real economy, and providing more inclusive financial services). At the same time, the success demonstrated that Huawei’s converged data warehouse platform, with FusionInsight and GaussDB at its core, has become a world-class leading data platform.

ICBC’s big data service cloud is built on top of Huawei’s open, distributed infrastructure. With thousands of clusters and a storage capacity of nearly 100 Petabytes (PB), the cloud supports over 100,000 Transactions Per Second (TPS), and integrates and manages structured and unstructured data. It provides real-time, quasi-real-time, minute-level, and hour-level computing capabilities, and is a new generation of open big data ecosystems, jointly built by Huawei and ICBC’s big data team for the Internet of Everything (IoE) era. It is also a converged data platform with the largest scale, most complete data, strongest capabilities, and most comprehensive functions in the financial industry. ICBC has 125 applications, 26 branches, and more than 1,000 scenarios that provide cloud-based services.

• Cloud-Based Data Lake Enables More Efficient Services

In the past five years, ICBC and Huawei have cooperated to process more than 50,000 operations, 80 data marts, 100,000 data models, and petabytes of data, as well as completing the construction, migration, and operation of a massive cloud data lake. Hundreds of data applications — including customer management, marketing, risk management, real-time risk control, performance management, and self-service data analysis — now run effectively and efficiently on the big data service cloud platform. This is an impressive feat because, for this to happen, each line of code must run correctly, each piece of data must be accurate, each system must be connected, and each operation requires excellent performance.

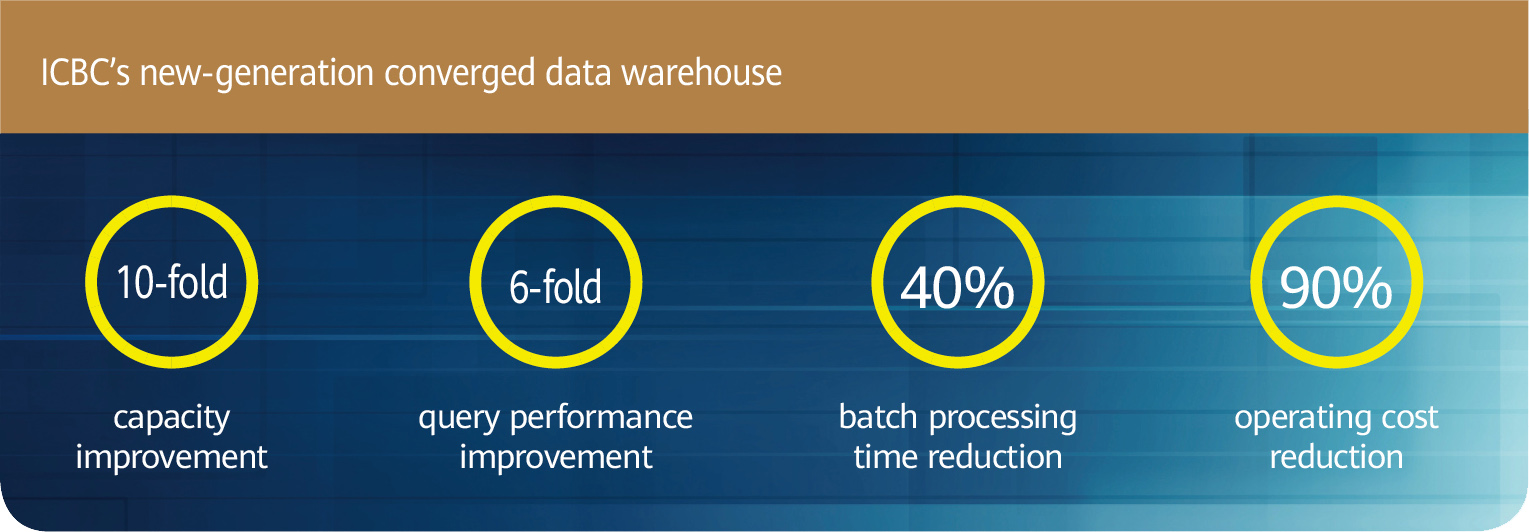

The next generation converged data warehouse eliminates the disadvantages of the original data warehouse appliance, such as a closed architecture, insufficient data processing capabilities, high costs, long periods of downtime during capacity expansion, low batch-processing efficiency, and the inability to support cross-generation product upgrades. The converged data warehouse integrates unstructured and stream data and offers high scalability. And the practical benefits of the solution are clear. For example, after completely replacing Vendor T’s data warehouse appliance, the capacity capability increased ten-fold, query performance improved six-fold, batch-processing time was reduced by 40 percent, and operating costs were slashed by approximately 90 percent. The solution is relatively future-proofed, too, as it supports smooth evolution on the cloud.

As digitization has spread rapidly across industries in the era of big data, it has become increasingly difficult for traditional data warehouses to keep up, given the explosive growth of data volumes. To cope with the trend, enterprises are now actively seeking out supplementary or alternative solutions for data warehouses.

Huawei’s converged intelligent data platforms can meet the requirements of multi-source, heterogeneous, and diverse data analysis in the digital era. They include key components — such as intelligent data connections, intelligent data storage, intelligent data processing, and intelligent data enablement pl a t forms — that implement full-lifecycle data management and processing. The logical data warehouse solution based on Huawei’s converged data platform provides unified storage, a unified directory, and data virtualization capabilities for multi-source, remote, and heterogeneous data, implementing cross-source, cross-domain, and cross-cloud data management and analysis, and connecting data silos and streamlining the global data supply chain. The solution enhances the ability of data warehouses to adapt to emerging new services, helping enterprises build leading data infrastructure, embrace industry digitization, and maximize data value.

Looking to the future, ICBC is determined to enhance the application of its innovative financial technologies, and Huawei will continue to support ICBC’s data platform innovations in Enterprise Intelligence (EI), AI, and the data middle platform, as well as improve full-stack cloud-based service capabilities based on the HUAWEI CLOUD Stack (HCS) 8.0. The two companies will continue to collaborate, as they aim to transform digital finance.

Founded on January 1, 1984, ICBC is a large state-owned bank directly managed by China’s Ministry of Finance. In 2018, ICBC ranked No. 1 on the Top 1000 World Banks list compiled by global financial intelligence publication The Banker. In 2019, ICBC ranked No. 26 on the Fortune Global 500 list — the highest position of any bank.