ผลิตภัณฑ์ โซลูชั่น และบริการสำหรับองค์กรธุรกิจ

The impact of digital service outages is greater than ever. Particularly in China’s case, cash now comes second to digital forms of payment. In a world built around constant connectivity where online payment is king, service interruptions that last even seconds can result in an extraordinary margin of business loss. Since 2020, this margin has spiked exponentially; the financial sector estimates a total of nearly USD 2.5 billion in direct losses due to compromised network connections.

It is clear that the more we rely on digital services, the more availability and resilience our financial infrastructure will demand. The security and processing speeds of transactions even at peak volumes is essential to the longevity of digital services, particularly when it comes to major retail events like Single’s Day or Black Friday. Limited-time events like these force transaction systems into serious bottlenecks, challenging their performance and often exceeding 10,000 transactions per second.

Banks have already taken great strides in digital transformation, enabling the move to cashless transactions and supporting mobility for their services. Most banks have upgraded their application architecture from closed to open; and while an enormously positive and transformative change, it comes with its own unique pressures on operations and management.

So how can we ensure systems run smoothly, 24 hours a day?

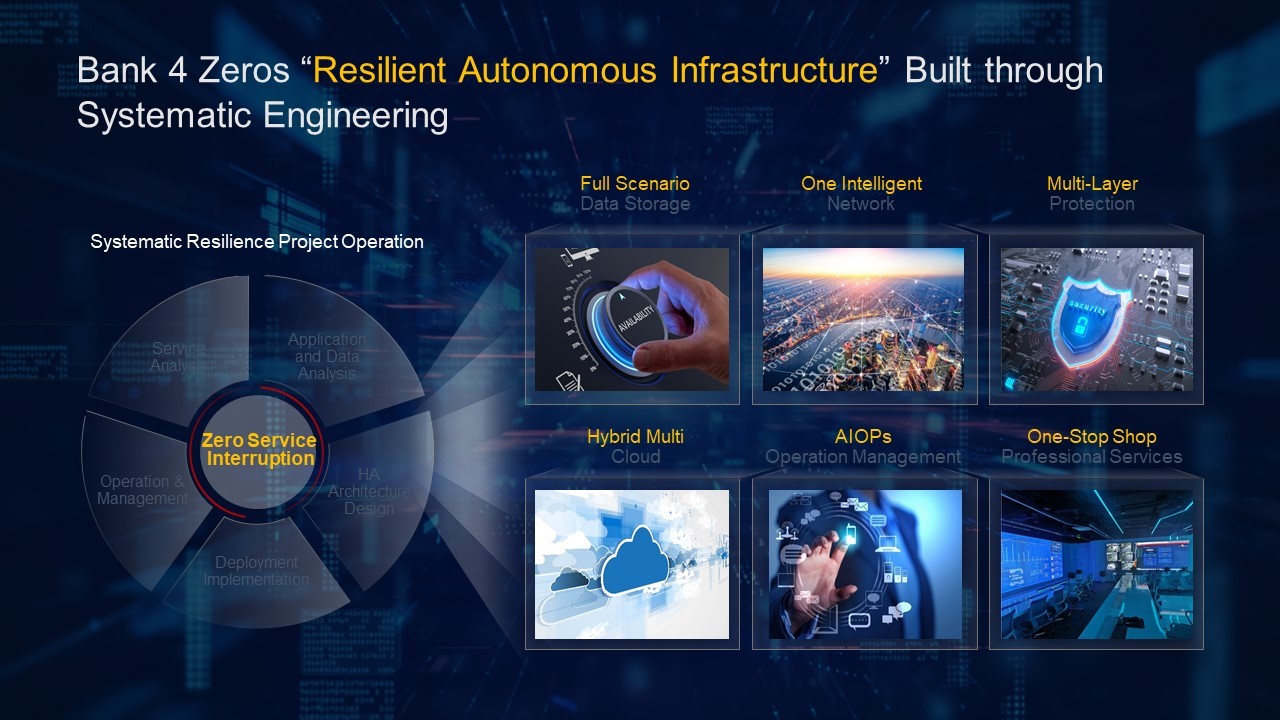

This is where the Four Zeros come in: zero trust, zero wait, zero downtime, and zero touch.

Zero trust refers to making sure every transaction is secure and reliable. It is a framework that requires every user and interaction be authenticated and authorized continuously, which keeps a tight lock-down on applications and data to prevent ransomware and other forms of cyber-attack from breaching security.

Zero wait is rather self-explanatory: it promises a seamless payment experience for users, whether in peak hours or not.

Zero downtime demands that services remain online at all times, no matter what. This is often a question of whether the bank’s digital architecture is equipped to handle emergencies and system failures. We at Huawei believe that applications and architectures should be designed with failure in mind, and they should be able to self-heal with capabilities honed for quick recovery. The aim is to mitigate potential service interruption through various fail-safes.

Zero touch is where AI becomes instrumental. With the support of AI in operations, we can achieve automation in a plethora of areas and harness data to make predictions and reduce the likelihood of incidents occurring.

Now, to achieve the Four Zeros in finance, banks need to take certain systematic steps as an ongoing project. They must consider service analysis, data and application analysis, design, deployment, and operation. Huawei has boiled this down to six essentials:

Active-active architecture is commonly used in enterprise storage systems to provide high availability and load balancing. Ensuring that a clean and secure copy of data is kept safe is extremely important. With this method of data storage, when an emergency occurs, business can continue uninterrupted and disaster recovery is significantly easier.

With one network from the edge to the DC and Cloud, users can enjoy a superb service experience. With a solid 10 Gbps connection and zero roaming interruption, intelligent networks provide resilient, adaptive and secure connectivity.

Through the use of a proactive network, as well as a storage and security isolation system, passive response can be turned into proactive defense from cyber-attacks across several layers. By protecting data at every angle, tampering can be entirely eliminated, and backup recovery speeds increased by four times.

Most banks want to branch out in their cloud strategies, with some wanting to move to public cloud for a model that most benefits their OPEX, and others wanting to build local private clouds for data security and regulatory reasons. The hybrid multi cloud model combines multiple public and private clouds to enjoy the best of both worlds under a single infrastructure.

Through the use of large models, the digital map can support live visualization, simulations, troubleshooting and more while removing the element of human error. Decision-making in O&M becomes informed by data and AI-powered analysis.

A strong, professional service team is essential. This is true not only for implementation, but throughout lifecycle management. The professionals on your team must not only understand the tech they’re working with, but the business models the tech is designed for. Using insight tools and consulting services is a wise choice.

Huawei naturally has compiled solutions to match all six points. Our resilient and autonomous framework for a bank’s Four Zeros combines a digital core, multi hybrid cloud data platform, mobile money and AI contact center, AI-Ops, and consulting services as a complete, neatly-wrapped package.

Now, such a project may seem vast. A great place to read more is our latest white papers: Financial Data Storage Top-Level Architecture, and Huawei Xinghe Intelligent Target Financial Network. The Four Zeros are set to redefine resilience and financial infrastructure. We hope to work with you to advance the future of financial services.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy, position, products, and technologies of Huawei Technologies Co., Ltd. If you need to learn more about the products and technologies of Huawei Technologies Co., Ltd., please visit our product pages or contact us.