CCB Builds the First '5G+ Intelligent Bank' Offering New Marketing Services

This site uses cookies. By continuing to browse the site you are agreeing to our use of cookies. Read our privacy policy>

![]()

Produits, solutions et services pour les entreprises

When was the last time you visited your bank? When was the last time you carried out a transaction at the bank counter? Internet finance is now at work in every aspect of our lives. Gone are the days of always needing to physically visit a bank branch, where you’d have to queue up to be served at a bank counter. Now, more and more people use mobile banking to handle their transactions, including money transfers, loan, wealth management, tax payments, and automobile financial services. And this can all be done with just a few simple clicks. In this changing environment, traditional bank branches face unprecedented challenges in their operating mode, and are at risk of becoming obsolete.

What direction should traditional bank branches go in as they look to evolve? This a key decision for industry players to consider.

“When stepping into this branch, I’m really impressed by how high-tech every corner of it is. Flashy robots, personalized customer journey display, remote expert service over the STM, eye-catching Financial Capsule, and fantastic automobile financial services experience...You name it. It is totally different from a traditional over-the-counter branch.”

“Once entering the Financial Capsule, I’m immersed in a future financial service space. The clever robot recommends the latest wealth management products and intuitively presents the revenue. I really love it.”

These are a few observations about the “5G+ intelligent.” Beijing’s Qinhuayuan branch of China Construction Bank (CCB). Driven by its need for next-generation system and financial technology strategy, CCB applies innovative technologies such as financial cloud, 5G, Internet of Things (IoT), and Artificial Intelligence (AI) to accelerate the transformation from traditional over-the-counter branches that focus on transaction settlement to smart branches that center on marketing and services, as well as launching the first-of-its-kind future-proof 5G+ intelligent bank.

CCB’s 5G+ intelligent bank innovatively launches application scenarios such as Financial Capsule, Smart Teller Machine (STM), robot, and home bank, and provides 327 functions for common financial services, reshaping the service process from the perspective of the entire customer journey. This intelligent bank integrates online and offline mobile banking services, WeChat banking, and branches, and offers multiple fun interactive games. The end result is significantly improved transaction handling efficiency, minimized queuing time, and more fun and interesting financial services transactions. These make 5G+ intelligent bank an ideal marketing and service center.

But none of this is possible without the WAN infrastructure. While the 5G+ intelligent bank continuously optimizes the financial services experience, it also drives the exponential growth in traffic. As such, bank branches require ever-demanding real-time data transmission performance and high bandwidth. MSTP private lines commonly used by traditional branches are seemingly mature and stable, but offer rates of only 2 to 4 Mbit/s bandwidth. This falls far short of the ultra-large bandwidth required by the wide range of smart applications in the 5G+ intelligent bank. Compounding this problem, to cope with ever-changing business environments, branches have more stringent requirements on mobility and provisioning speed. With more than 10,000 branches across the globe, CCB urgently needs to find a new way to improve the Operations and Maintenance (O&M) and management efficiency on such a large number of complex WANs.

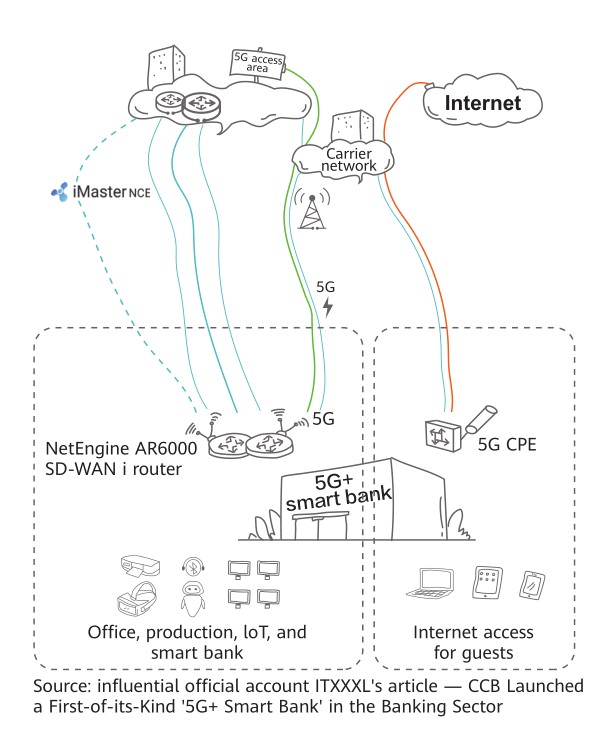

CCB is a pioneer in financial technology innovation, proactively exploring disruptive connection technologies, so CCB was eager to introduce Huawei’s SD-WAN and 5G technologies into WAN construction for 5G+ intelligent banks. The 5G network functions as the underlay network, providing the network infrastructure with ultra-high bandwidth and ultra-low latency for intelligent banks. On top of this 5G network and the legacy MSTP private lines, SD-WAN is used to build an overlay network. In this way, high-speed interconnection channels can be quickly built between CCB’s branches and the financial cloud. The cloud-based iMaster NCE, a network management and control system, implements automated configuration for complex branches. The combination of 5G and SD-WAN leads the development of WANs in the banking sector, and quickly extends the range of CCB’s inclusive financial services while enabling fast rollout of 5G+ intelligent banks.

Cloud and 5G: 100x Bandwidth, Millisecond-Level Latency, and Plug-and-Play

5G features high bandwidth and low latency, as well as being cabling-free. Such characteristics make the 5G network ideal for the banking sector. By deploying Huawei’s NetEngine AR enterprise routers, CCB builds dual service channels (5G and MSTP private lines), achieving 100-fold bandwidth increase for smart branches. Specifically, the tested rate of 5G+ intelligent banks can reach up to the Gbps level, fully supporting the exponential growth of data traffic at intelligent banks. 5G+ intelligent banks can provide full-journey, immersive, and personalized financial services experience.

Other features of 5G are fast deployment and high mobility. This means that intelligent banks can be quickly rolled out without waiting for carriers to install or deploy private lines. It also facilitates quick provisioning of smart branches and setup of demonstrative mobility services; for example, connecting community banks and call centers through 5G/LTE and Internet, or deploying temporary financial service branches at large event venues to provide onsite financial service assurance.

Application-Based Intelligent Traffic Steering, Ensuring Optimal Financial Services Experience

SD-WAN builds an end-to-end overlay network to logically combine intermediate network nodes, and 5G implements one-hop access to the cloud for intelligent banks, greatly simplifying the network topology. Smart banks often have dozens of applications. These applications can be monitored and identified in real time using SD-WAN, which enables access to the cloud through 5G and MSTP private lines. SD-WAN also transmits traffic of key financial applications over the optimal path selected by means of key application identification, dynamic path optimization, traffic steering based on the Service Level Agreement (SLA), application priority, and bandwidth usage. This ensures the optimal experience for key applications.

Intelligent O&M and Unified Cloud Management

SD-WAN orchestrates and schedules network-wide link and bandwidth resources based on applications. It also leverages intelligent application identification to identify a broad range of applications such as key financial applications, IoT applications, and Internet applications in real time, and presents the real-time key indicators including the status and bandwidth usage of applications, links, sites, and devices. This facilitates capacity expansion, link optimization, and site adjustment, and optimizes network investment and planning. What’s more, SD-WAN provides the centralized network O&M and management tools, as well as comprehensive network policy configuration tools to implement unified management of LANs, WANs, and security networks. It also automates the entire process ranging from network provisioning, service deployment, and fault locating, all the way down to routine inspection. In addition, the Geographic Information System (GIS)-based network topology information and multi-dimensional visualized reports based on links, applications, users, sites, and devices help quickly locate network faults while optimizing network policies, enabling financial services to be carried on a simple and reliable network.

CCB has a unified intelligent O&M platform that features strong technical support and easy integration capabilities. Huawei’s SD-WAN Solution can easily integrate with this platform by using open northbound RESTful APIs provided by iMaster NCE. This integration facilitates E2E resource association and full-process automation. To be more specific, based on CCB’s distinctive financial services, the intelligent O&M platform provides a unified self-service User Interface (UI), which provides complete user-oriented service directory, resource application, process approval, and other functions. Furthermore, the intelligent O&M platform delivers SD-WAN network configuration and policies to NetEngine AR routers, achieving association between underlying network resources and financial services requirements. This helps build efficient and flexible WANs that suit financial services and drive the transformation of financial technologies (FinTech). High Controllability and Security, Ensuring Financial Services Security

Network security is crucial to the development of FinTech. Based on Huawei’s brand-new NetEngine AR routers and iMaster NCE, CCB can implement all-round security protection from the device, link, and policy perspectives. On the 5G-powered wireless virtual private network of CCB, Huawei SD-WAN Solution orchestrates security service chains based on security policies to implement end-to-end encrypted transmission of service data, guaranteeing the security of each transaction.

Driven by the pursuit of better financial services experience and quality, CCB has never ceased in its FinTech innovation. As 5G+ intelligent banks are sweeping across China, the combination of 5G and SD-WAN will offer more diversified flexible access options for intelligent banks, and better meet security and flexibility requirements of financial services. Because of these advantages, 5G+ intelligent banks will extend the scope of inclusive financial services and transform into all-scenario financial services experience centers that offer customers an improved banking experience.