This site uses cookies. By continuing to browse the site you are agreeing to our use of cookies. Read our privacy policy>

![]()

This site uses cookies. By continuing to browse the site you are agreeing to our use of cookies. Read our privacy policy>

![]()

Produits, solutions et services pour les entreprises

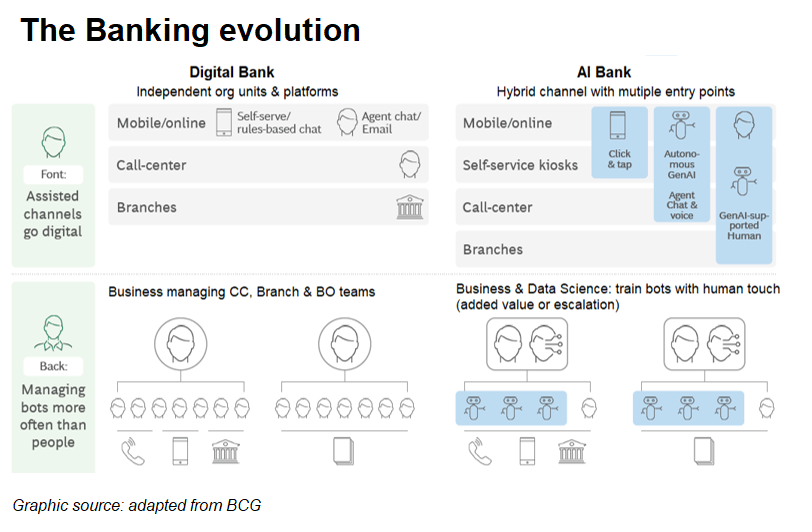

Over the past years, technology has radically transformed banking and financial services, shifting from traditional brick-and-mortar models to highly digitalized ecosystems. The rise of online banking, mobile apps, and fintech innovations has marked a series of transitions as banking has adjusted from supporting the agricultural and the industrial economy to powering the digital economy.

The rise of AI brings now this transformational journey to its next phase, yet in a much more powerful way than anything we have seen before. The reason is that AI is changing banks both from a front-end and from a bank-end perspective, leading to what we call intelligent finance.

To grasp the size of the impact, the revenue boost from AI in the banking sector is estimated to reach $1 trillion by 2030, making it one of the biggest across industries.

For banks and other FS players this abrupt disruption means two key things:

1. The imperative to integrate AI not only in their strategy but also in their daily operations, as a key enabler to compete.

2. The fact that digital capabilities become now a much-needed pre-condition for a successful AI transformation.

For financial organizations that have spent the best part of the last decade going through digital transformation projects this has one major implication: they need trusted partners with capabilities not only on the digital side, but also on the AI side. Seamless, instantaneous, secure, data-driven personalized experiences powered by AI is the next big thing, however not everyone can deliver.

One of those who can is Huawei. In their recent participation at the GITEX GLOBAL 2024 event (October 13 – 17), they have shared enlightening insights as to how they support banks in bridging digital transformation with AI adoption.

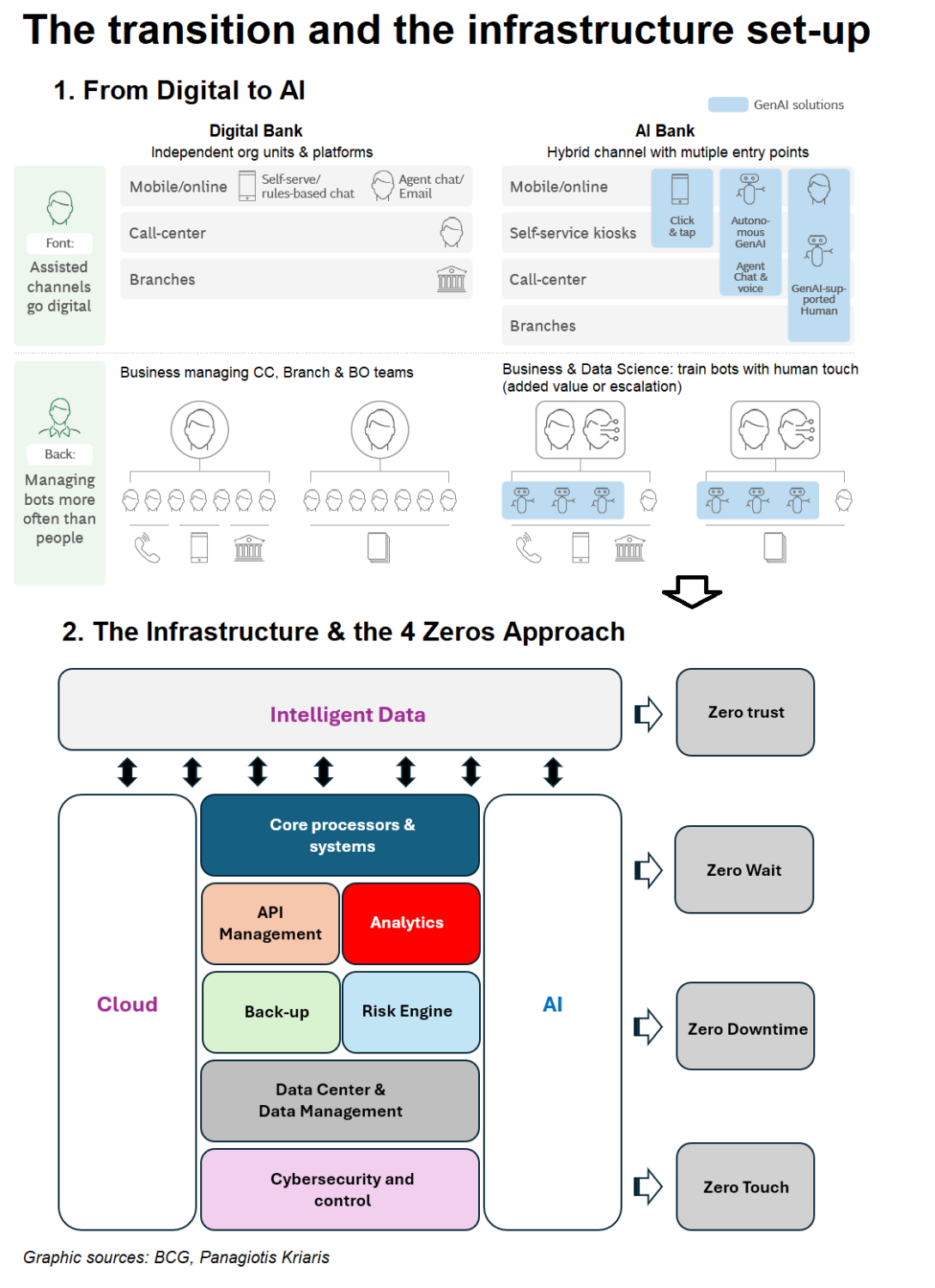

Huawei follows a framework approach - called the 4 Zeros - focusing on delivering a holistic, end-to-end infrastructure set-up that seamlessly brings cloud, network, storage, and computing elements under one roof.

It translates as follows:

• Zero Trust refers to making sure every transaction is secure and reliable. It is a framework that requires every user and interaction be authenticated and authorized continuously, which keeps a tight lock-down on applications and data to prevent ransomware and other forms of cyber-attack from breaching security.

• Zero Wait focuses on optimizing user experience through minimal latency whether in peak hours or not. It’s very connected to the need for real-time data and decisions that has taken FS by storm.

• Zero Downtime means that services always remain online, no matter what. This is often a question of whether the bank’s digital architecture is equipped to handle emergencies and system failures. The aim is to mitigate potential service interruption through various fail-safes.

• Zero Touch is where AI becomes instrumental. It emphasizes the importance of automation in reducing human error and increasing operational efficiency.

What’s crucial to highlight here is that success needs much more than technical support. To address this the 4 Zeros’ approach goes in the direction of effectively creating a blueprint that includes a strategy of connecting data and seamless automation with enhanced security and improved user experience.

Let’s take an example:

Thailand is one of Asia’s most dynamic markets. But changing demographics and consumer preferences as well as technology adoption mean that banks face the challenge of declining customer loyalty. Superior digital experience has become a key factor for customer growth and retention, especially among the young generation.

In this context Siam Commercial Bank (SCB), Thailand’s second largest commercial bank has become a benchmark for digital transformation in the country with the help of Huawei.

After the pandemic the bank decided to up their game by transforming into an AI-first bank.

They call their strategy “Digital Bank with Human Touch” and to do so they wanted to create a new digital finance ecosystem driven by diverse beyond-banking services such as food & beverage and healthcare with an ambition to grow to 200 million digital users by 2026.

Huawei, with over 20 years of experience in the Thai market, managed to deploy this ambitious transformation by:

— providing the underlying cloud native infrastructure

— deploying in just seven months a new digital lending platform that attracted 45,000 new customers in the first three months only

In the new AI era, banks’ ability to integrate AI functionality will be much more critical than their ability to offer it in the first place. The partnership between SCB and Huawei is a good reminder of the power of implementation and of how much choosing the right partner can make a difference.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy, position, products, and technologies of Huawei Technologies Co., Ltd. If you need to learn more about the products and technologies of Huawei Technologies Co., Ltd., please visit our website at e.huawei.com or contact us.