Productos, soluciones and servicios para los negocios

The financial industry serves as a foundational pillar of modern society, relying heavily on advanced technology, vast amounts of data, and cutting-edge intelligence. At a national level, the resilience of financial systems is the backbone of economic strength. Within individual banks, resilient IT systems are critical not only for seamless banking services but also for safeguarding their reputation. Today, the financial sector stands at a pivotal moment of transformation, driven by advancements in distributed technologies and the integration of AI into business models. In this context, addressing the insufficiencies of existing systems and transitioning to new distributed architectures has become a top priority from both business and technological perspectives.

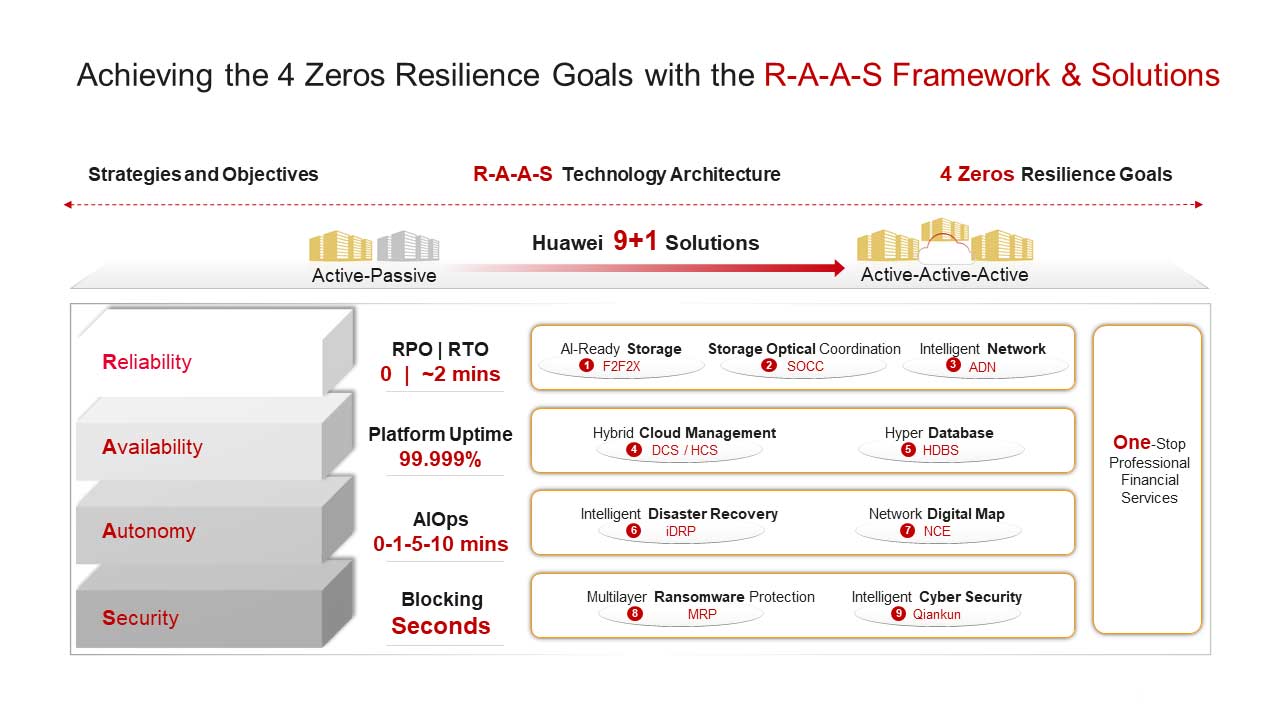

Huawei proposed the 4 Zeros Financial Resilience Goals in 2024 — Zero Downtime, Zero Wait, Zero Trust, and Zero Touch. Drawing on decades of experience in the financial sector, Huawei further unveiled its AI-Powered R-A-A-S (Reliability, Availability, Autonomy, Security) Framework during the MWC Barcelona 2025 in March. This framework is designed to empower financial institutions in building highly resilient digital and intelligent infrastructure. To be specific:

• Reliability ensures zero data loss. This involves multiple copies of data, real-time synchronization, and the cross-domain coordination of storage, computing, and networks.

• Availability minimizes service interruptions with cell-based databases, microservice clusters, and multi-active cloud services, ensuring 99.999% system availability.

• Autonomy achieves zero human errors, 1-minute fault identification, 5-minute fault location, and 10-minute fault rectification. In increasingly complex IT environments, our digital twin and AI technologies enable intelligent simulation, location, and rectification, forming an AIOps system that caters to multiple vendors and domains including cloud, network, and security. Huawei also provides intelligent data center disaster recovery solutions via the iDRP platform, enabling fast fault detection, assisted decision-making, and agile switchover.

• Security involves an in-depth defense system powered by AI, through terminal-edge-cloud collaboration, cloud-storage-network collaboration, and unified security policy management. This system can rapidly identify and block cyber attacks within seconds to ensure data security.

AI-driven business models, mobile finance, and stringent regulatory frameworks are steering the direction of traditional financial systems, and how they are to evolve. Such technological advancements are highly taxing on more conventional, fully centralized architectures. Distributed architectures effectively address key limitations in legacy systems, including low resource utilization, security vulnerabilities under high-concurrency workloads, and restricted scalability — both horizontally (scale-out) and vertically (scale-up).

Transitioning from legacy systems to distributed architectures, however, is a huge endeavor that involves many domains. Reliability is challenged during collaboration across optical, storage, network, and computing product domains. Banks must still ensure high availability in the applications of cloud-based databases, big data platforms, and virtualization technologies. Resilience in disaster recovery must be maintained across data centers in distributed cloud architectures integrating cloud and network operations. Not to mention, banks must ensure data security in their open architectures.

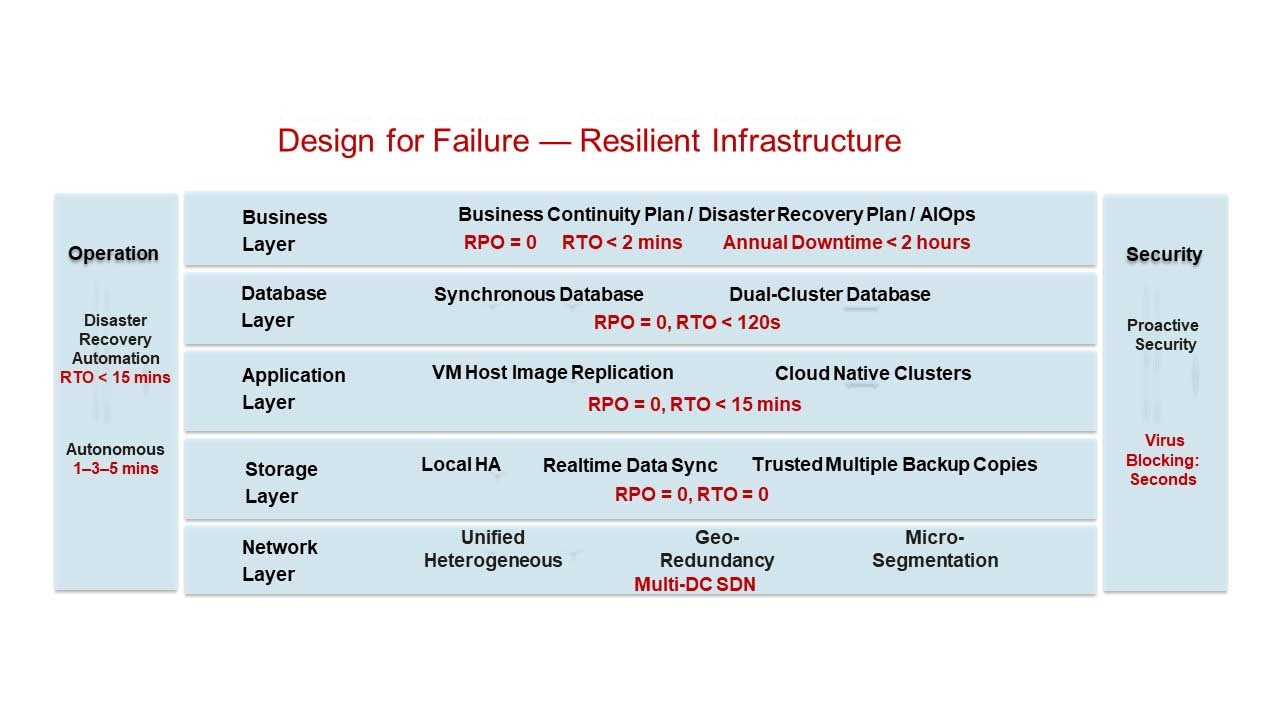

To tackle these challenges, Huawei's R-A-A-S Resilience Framework emphasizes architectural planning, layered decoupling, and system integration as a guiding strategy.

Financial institutions, navigating a time where centralized and distributed architectures coexist, need top-level ICT architecture planning to support future growth. This involves future-proof technological roadmaps, standardized solutions, and adaptable technologies — laying the groundwork for resilient financial infrastructure.

Layered decoupling becomes critical as distributed architectures grow in complexity. This approach entails defining standards for different layers, aligning resilient infrastructure designs with specific objectives, and exploring project milestones for different layers based on engineering practices.

Huawei offers nine major solutions along with one-stop professional services for its customers: All-Flash Storage, Storage-Optical Connection Coordination (SOCC), and Xinghe Intelligent Data Center Network (DCN) for high-reliability infrastructure; GaussDB, Cloud, and Virtualization for high-availability services; NCE (simulation environment, 1 minute for discovery, 3 minutes for demarcation, and 5 minutes for recovery) and Disaster Recovery based on the iDRP platform; and security solutions, such as MRP and Qiankun, protecting customer data across terminals, edges, and clouds.

Huawei also provides comprehensive professional services to enhance financial resilience across the entire customer lifecycle — from resilient data center design to integration, disaster recovery migration, and operation solutions. By aligning with customers' business strategies, Huawei focuses on top-level architectural designs that deliver high data center reliability, high service availability, seamless end-to-end operations, and robust ICT security. Huawei collaborates with partners to define milestones, determine the engineering scope, and assist customers in consolidating, modernizing, or building data centers tailored to their unique needs.

Enhancing the overall resilience of financial data centers is much more than a one-time endeavor. It typically involves several interconnected projects and requires holistic evaluation and unified management. A combination of top-down planning and bottom-up implementation significantly enhances financial institutions' disaster recovery drills and boosts the resilience of their data centers.

The growing importance of resilience was brought into the spotlight on February 27, 2025, when the European Central Bank experienced a significant clearing system failure. The incident revealed a host of issues, including ineffective fault location and demarcation, a lack of system reliability design, inadequate disaster recovery drill capabilities, as well as the absence of a simulation test environment. Such issues are commonplace in large financial institutions across the globe.

Huawei's R-A-A-S Resilience Framework is a practical approach to helping financial customers address resilience challenges arising from AI-driven business models and the transition to distributed architectures. By building resilient infrastructure that features high reliability, availability, autonomy, and security, Huawei aims to empower the financial sector in achieving the 4 Zeros.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy, position, products, and technologies of Huawei Technologies Co., Ltd. If you need to learn more about the products and technologies of Huawei Technologies Co., Ltd., please visit our website at e.huawei.com or contact us.