Продукти, рішення, послуги для організацій

Currently, it’s clear that global financial institutions need to deepen their digitalization in the face of uncertainties in the operating environment on top of interest margin changes. The data-intensive financial sector is a pioneer in digital and intelligent transformation, and requires high reliability and security. Increasingly open services expose financial institutions to many changes and challenges, including in service continuity, efficient operations, cyber security, and customer behaviors:

• Service scenarios are diversifying. Commercial banks are adopting open systems to build a more comprehensive ecosystem together with customers across industries as well as upstream and downstream industry chain partners. This will enable them to provide faster financial service support for a wider range of user groups like small and medium sized enterprises, township enterprises, and agricultural businesses.

• The behavior changes of emerging customers, such as post-95 digital natives, have permanently changed financial interaction models. ChatGPT, which skyrocketed in popularity almost in no time after being rolled out, is driving financial interaction models to move faster from digital connectivity to intelligent interaction.

• Financial institutions are applying AI across branch services, customer service support, marketing recommendation, credit evaluation, investment research, and consultancy, with aims to improve service experiences through technological innovation. Additionally, global banks have deployed intelligent risk management and security defense systems to cope with increasingly frequent transaction fraud and ransomware attacks to protect funds.

• Global central banks are deploying unified real-time digital payment systems and promoting the application of digital currencies to cope with future massive encrypted transactions.

• To respond to ever-changing requirements, financial products need to be highly agile from design, development, release, to operation if they are to support the quick rollout of new services. Transforming bank production systems from closed to open architecture has become immensely popular. How to ensure high performance and availability of core services in extreme environments is the primary technical challenge that must be overcome.

In the new intelligent era, financial institutions must have robust and resilient digital infrastructure, agile and elastic data platforms to quickly adjust financial product types and provide secure, reliable, and continuous services to cope with rapid changes in user requirements.

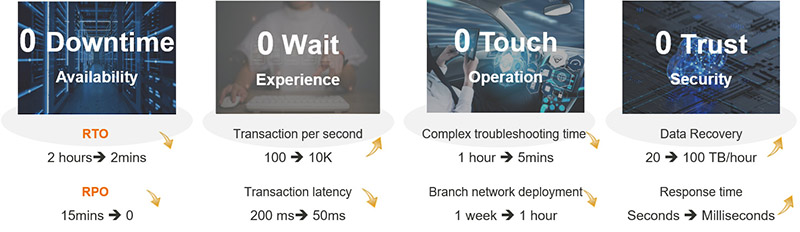

Huawei has proposed to build resilient financial infrastructure with 4 Zeros: Zero Downtime, Zero Wait, Zero Touch, and Zero Trust.

The 4 Zeros are not separated capabilities but require in-depth collaboration across financial clouds, data centers, wide area networks (WANs), and branch networks. To achieve this, we need to coordinate cloud, network, storage, and computing infrastructure to develop an end-to-end resilient system. Specifically, we need to:

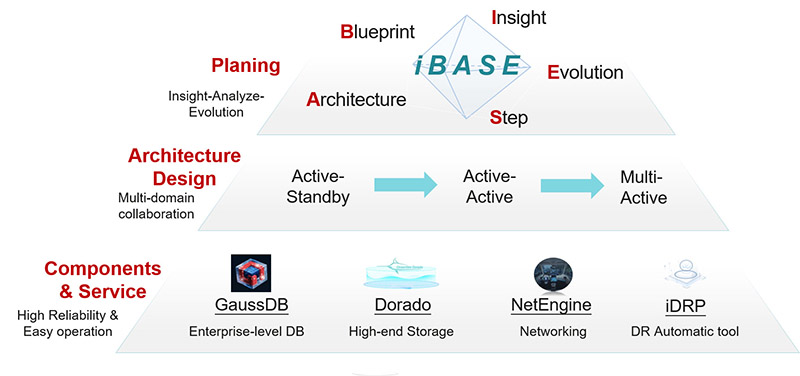

• Enhance the top-level planning and design of new financial data centers. This includes gaining insight into services, investment returns, data sovereignty, and technical constraints. It also involves drawing a target blueprint and architecture (such as geo-redundancy) based on plans for the next 5–10 years, and defining KPIs and implementation steps level by level (application-service-resource).

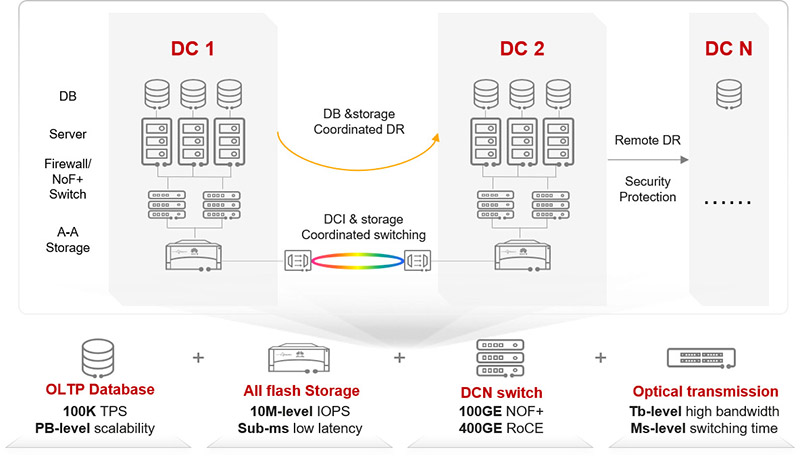

• Build a unified disaster recovery (DR) management platform and improve automatic O&M capabilities. Implement information collection and resource management based on multi-protocol interfaces. Improve core capabilities such as disaster rehearsal & warning, impact evaluation, decision-making assistance, and agile switchover. Support the automation and visualized management of quick fault location, decision-making, and switchover.

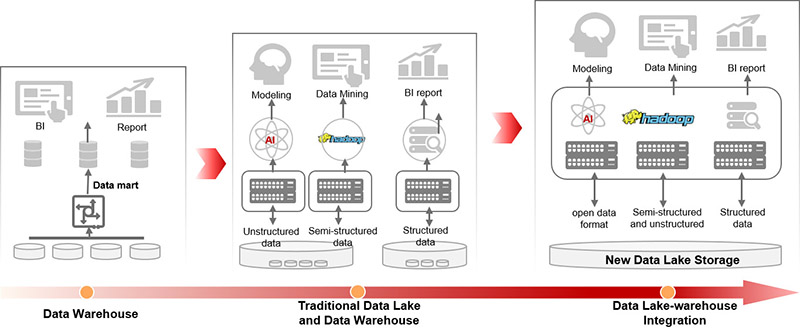

• Build a big data platform with a data lakehouse. Big data applications have been used to take historical information statistics and predict future trends. These are now evolving to assist precise and intelligent decision-making. The data lakehouse will significantly improve the analysis efficiency of the big data platform. The application of foundation models requires the efficient collection and preprocessing of huge amounts of raw data, high-performance training data loading and model data storage, and timely and accurate industry inference knowledge base storage. To achieve this, we need to develop a data platform with high reliability, high performance, balanced traffic, and data sharing, as well as full-stack storage, computing, and network facilities.

• Build a container-based cloud-native application platform. This platform should support more efficient resource provision. More importantly, it needs to house new cloud-native microservice applications to implement modular construction and agile rollout of applications.

• Accelerate the application of all-flash storage to reduce the total cost of ownership (TCO) of massive data and build green data centers to adapt to coordinated innovation of financial applications and data infrastructure, fully unlocking data potential.

• Build a unified storage pool. Future service development requires an architecture with data-AI integration and training-inference integration. To this end, we need to develop new data paradigms to promote new data formats, access protocols, and in-memory computing, and use a unified data storage pool to manage raw data, analysis data, and training data.

• Build a data center network (DCN) with high availability (HA) and DR for data center connections based on high-performance network devices and intelligent management platforms. This DCN needs to provide three capabilities: zero-interruption fast switchover, zero-incident network change, and zero-worry fault demarcation.

• The service bearer network must support end-to-end IPsec and SRv6 capabilities. Provide slice deployment based on user IDs to ensure fast service access and end-to-end secure encryption. Provide consistent security assurance for branches and the headquarters through intelligent protection featuring cloud-network-edge-device integration, keeping financial branches secure.

• At the network management layer, using the conventional O&M method, we can only view the tunnel layer but cannot visualize or locate quality problems of a specific application on the network management platform. To solve this problem, the platform needs to support application-level service visualization and optimization, automatically locate and optimize congestion or fault points based on applications, accurately restore customer service experiences and help O&M engineers quickly locate faults node by node.

• For AI, big data, distributed databases, and cloud-native applications, establish a joint design team for new applications and digital infrastructure. Promote new database architecture with decoupled storage and compute, storage-optical connection coordination, and cloud-network synergy. Utilize all assets ranging from applications to hardware to achieve win-win partnership.

Huawei constantly optimizes the cloud-pipe-edge-device ICT product portfolio to build more secure and resilient digital infrastructure for the finance industry. For example, Huawei has:

• Proposed the Multi-Site High Availability Service (MAS) architecture based on the collaborative DR of GaussDB and Dorado, providing an architecture reference for finance geo-redundancy.

• Provided the multilayer ransomware protection (MRP) solution featuring storage-network collaboration for data centers, implementing fast virus detection, data isolation, and service recovery. More than 100 banks around the world have adopted MRP that protects core data assets of over 100 PB and provides a five times faster recovery speed than the industry average.

• Launched secure SD-WAN and SASE, which can accurately identify abnormal behavior on terminals, build secure ubiquitous connections, and support seamless service switchover at financial branches.

• Released the network digital map solution. This solution enables panoramic visualization of services, supporting self-healing with fault detection within 1 minute, root cause locating within 3 minutes, and fault recovery within 5 minutes based on comprehensive system monitoring and control.

Huawei has developed and rolled out diverse products and solutions like these to help improve the resilience of financial systems.

Huawei will continue developing more competitive products and solutions to better support our financial customers in implementing digital and intelligent transformation. To date, Huawei has served over 3600 financial customers in more than 60 countries and regions, including 53 of the world's top 100 banks. We have established comprehensive strategic partnerships with more than 80 large banks, insurers, and security companies around the world, and become a trusted strategic partner for the digital transformation of financial institutions.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy, position, products, and technologies of Huawei Technologies Co., Ltd. If you need to learn more about the products and technologies of Huawei Technologies Co., Ltd., please visit our website at e.huawei.com or contact us.