Produkty, Rozwiązania i usługi dla przedsiębiorstw

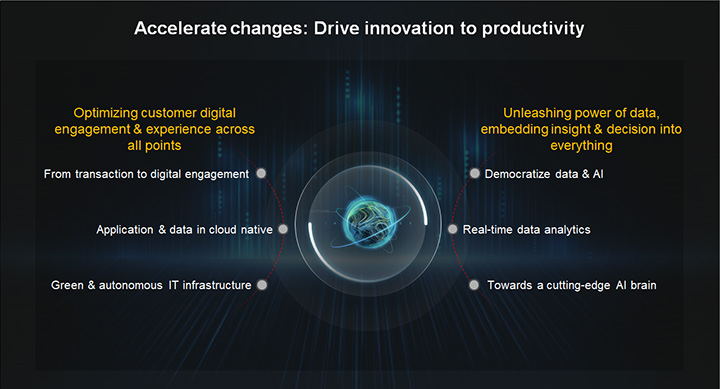

The global economy is now faced with a new norm. The finance sector is seeing new changes. How do we accelerate the application of new technologies and innovatively improve productivity? You will understand if you study the trend, be wise if you follow the trend, and be a winner if you adapt to the trend. Huawei strives to accelerate technology application in six fields, including shifting from transaction to digital engagement, developing cloud-native applications and data, evolving infrastructure to MEGA, industrializing data and AI application, enhancing real-time data analysis, and moving towards a cutting-edge AI brain. In this way, we help financial customers accelerate changes, innovatively improve productivity, make productivity visible, and speed up evolution towards the future.

To optimize customer interaction and experience, Huawei works with partners to quickly build super app platforms with public cloud SaaS, driving the development of more flexible and agile digital products. With new customer acquisition, service, and interaction modes, Huawei helps financial institutions greatly reduce customer acquisition costs, accelerating business transformation from transaction to digital engagement. The comprehensive mobility and intelligence of financial services accelerate the modernization of core applications and data, bringing cloud-native development into reality. Huawei uses highly reliable infrastructure, cloud, GaussDB, and data migration to help Postal Savings Bank of China (PSBC) reform its core systems and serve 650 million retail users in a cloud-native way.

Data and AI are becoming increasingly inclusive, encompassing all service scenarios and processes. Huawei is committed to building a leading data intelligence solution to help China Merchants Bank (CMB) develop the cloud-native data platform. This intelligent platform will upgrade CMB's decision-making and business operations in three ways: a better platform, improved efficiency, and by covering more scenarios. Accelerated real-time analysis supports everyone's use of data, unleashes the power of data, and enables faster business growth. Huawei continuously improves the NLP (Natural Language Processing), CV (Computer Vision), graph, and knowledge computing models which involve hundreds of billions of parameters. With more computing power, a one-stop AI platform, and optimized big data models, Huawei accelerates the construction of a powerful AI brain, integrates AI into user experience and products, and extends innovations from single services to the entire business process and more, allowing inclusive innovation.

These modernized cloud-native applications continuously optimize user connections and touch points. Meanwhile, through the collaborative innovation of storage, computing, network, and cloud technologies, Huawei accelerates the evolution of infrastructure to MEGA (Multi-domain Collaboration, Experience, Green, and Autonomous). This helps financial institutions develop digital infrastructure with high performance, availability, security, O&M efficiency, and sustainability.

Digitalization is the future. Huawei Digital Finance embraces change and continuous innovation as it dives deep into the finance sector. It adapts to the scenarios at hand, joins hands with customers and partners, upgrades service capabilities, and delivers ever more innovative solutions to accelerate the application of new technologies and innovatively improve productivity for green, digital, and intelligent finance.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy, position, products, and technologies of Huawei Technologies Co., Ltd. If you need to learn more about the products and technologies of Huawei Technologies Co., Ltd., please visit our website at e.huawei.com or contact us.

How GenAI Sparks Growth and Innovation in Leading Banks

4 Zeros Resilience Underpins the Path to AI Banking

Boost Resilience, Reshaping Smarter Finance Together

Non-Stop Banking, Resilience Boosts Intelligence

Navigate Change, Shaping Smarter Finance Together

3 Ways Huawei Is Unleashing the Value of Digital for Finance