The Biggest Bank in East Africa Chooses Huawei

Este sitio utiliza cookies. Si continúa navegando en este sitio, acepta nuestro uso de cookies. Lea nuestra política de privacidad>

![]()

Productos, soluciones y servicios empresariales

If banking institutions are to maintain stable service growth and continue to be competitive, accommodating fast-growing Data Center Interconnect (DCI) bandwidth and building highly reliable and stable core production systems are both imperative. Constructing a high-bandwidth and low-latency active-active data center network makes this possible.

Well aware of this, and with one eye on the future, KCB Bank Kenya — the biggest bank in East Africa — chose Huawei to develop its network infrastructure. Huawei's all-optical data center networks provide secure, stable, and high-quality connections to accelerate digital transformation, simplify the customer journey, and improve digital operational efficiency.

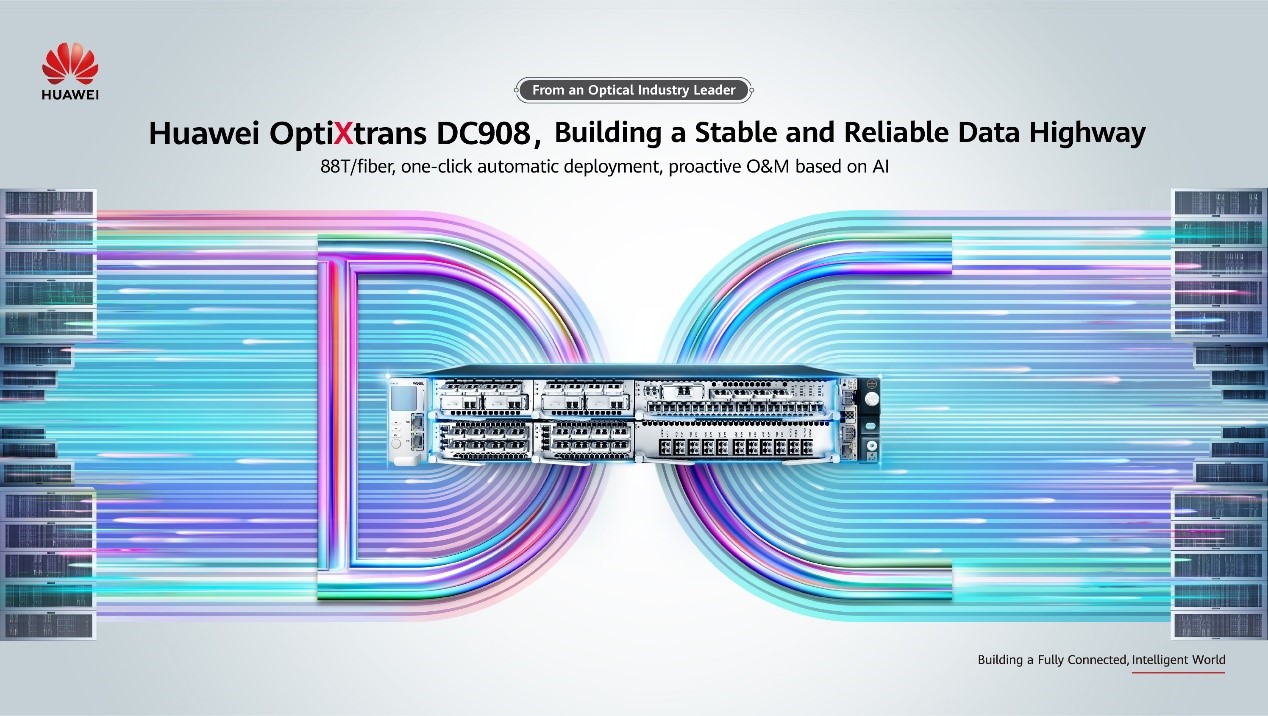

In order to achieve full digitalization and overcome related network challenges, KCB needed stronger interconnect performance across its entire network. Huawei's OptiXtrans DC908 is an all-optical DCI product that leads the industry, according to data analysts GlobalData. Offering outstanding performance, advanced architecture, and simplified Operations and Maintenance (O&M), the product is purposely designed to help enterprises handle the massive volumes of data center traffic that define the intelligent era.

Securing core financial data was essential for the bank. With 1 + 1 redundancy and built-in AES256 encryption, OptiXtrans DC908 is fit for purpose, ensuring both high reliability and security.

In addition, with a flexible rate of 100–800G and support for 88T per fiber, the bank does not need to worry about upgrading services for the next decade. OptiXtrans DC908 also supports innovative big data mining and intelligent payment, crucial for banking institutions in the digital era.

Finally, OptiXtrans DC908 supports simplified and intelligent O&M. 2U optical-electrical box-shaped devices can be directly deployed in IT equipment rooms, supporting one-click deployment in mere minutes — compared to days — while slashing the physical footprint.

And with embedded O&M features, such as network health prediction, co-cable detection, and fiber fault diagnosis, the bank can ensure precise and fast troubleshooting to maintain the stable and reliable running of financial services.

Huawei's DCI solution is designed to provide banks with more efficient and more stable performance, helping them successfully achieve digital transformation and inclusive financial service development.