[Shanghai, China, April 25, 2019] The Huawei Global FSI Summit 2019 was held in Shanghai today, under the theme “Holistic Digital Transformation, Taking the Pulse of Smart Finance.” The summit has attracted more than 2,000 financial customers, partners, and industry experts from global organizations, such as Deloitte, Industrial and Commercial Bank of China, China Life Insurance, Sberbank, Erste Bank, Shenzhen Stock Exchange, Bradesco, Guotai Junan Securities, and Zhejiang Rural Credit. Centering on the new challenges facing the financial services industry in the digital economy era, Huawei and all the attendees shared their digital transformation initiatives and successful practices with the aim to help more financial institutions navigate the road of digital transformation to smart finance.

Ma Yue, Vice President of Huawei Enterprise BG and President of EBG Global Sales, said in his opening speech: “The financial services industry has entered the 4.0 era. Financial services are becoming everywhere, driving the financial institutions to build platforms and ecosystems to allow the creation of new business and service models. AI and data have become core driving forces that enable financial business innovation. Huawei’s AI + Data Solution helps customer reshape their closed ICT systems into open cloud platforms. This allows data to evolve to big data and fast data. We are helping customers build AI platforms and achieve Smart Finance."

Ma Yue, Vice President of Huawei Enterprise BG and President of EBG Global Sales

Tim Pagett, Asia FSI Leader of Deloitte, commented in a keynote speech: “Changing steps have shifted from linear to rapid pickup. Structured and unstructured data is expanding rapidly. It is crucial to obtain, visualize, and integrate big data to make major business decisions. At the same time, demographic changes and digital enterprises have reshaped the market environment. The trend is to provide customers with smooth digital experience. Therefore, technology, talent, and business culture will all become flexible and agile.”

Tim Pagett, Asia FSI Leader, Deloitte

Smart banking is becoming the commanding heights of global banking in the digital economy era. Zhang Yan, Deputy General Manager of Technology Dept, ICBC, said that ICBC focuses on promoting in-depth integration of banks and ecosystems, reshapes the new business architecture of “all-customers, omni-channels, and all-products” with a new ecosystem, and then promotes the transformation of the “host + open platform” dual-core IT architecture. This is to accelerate the smart, inclusive, and open transformation of financial services, and to build an open smart banking ecosystem that integrates finance with technology.

Zhang Yan, Deputy General Manager of Technology Dept, ICBC

“Innovation is deeply embedded in Erste’s DNA and is one of the core business drivers within Erste Bank. Erste has proven already in the area of trade financing and in retail banking that it is capable to build technology-enabled FinTech like solutions from scratch.” said Clemens Müller, Executive Assistant of the BOD, Erste Bank.

Clemens Müller, Executive Assistant of the BOD, Erste Bank

Smart finance is quietly changing people’s lives. Yang Gang, Deputy General Manager of Science and Technology Management Dept, Zhejiang Rural Credit, stated that Zhejiang Rural Credit integrates new digital resources into every link and life scenario of the rural financial service value chain to support the “last mile” of financial services.

Yang Gang, Deputy General Manager of Science and Technology Management Dept, Zhejiang Rural Credit

Lin Zhipeng, Deputy General Manager of Data Dept, China Life Insurance introduced “China Life’s Digital Platform Construction”. He said China Life built a first-class digital platform by leveraging cloud IT architecture and artificial intelligence technology. Based on this, China Life can build a digital business platform that integrates healthcare, elderly care, and financial services with the insurance core. In this way, it offers smart insurance services to support social and economic development and improve people’s lives.

Lin Zhipeng, Deputy General Manager of Data Dept, China Life Insurance

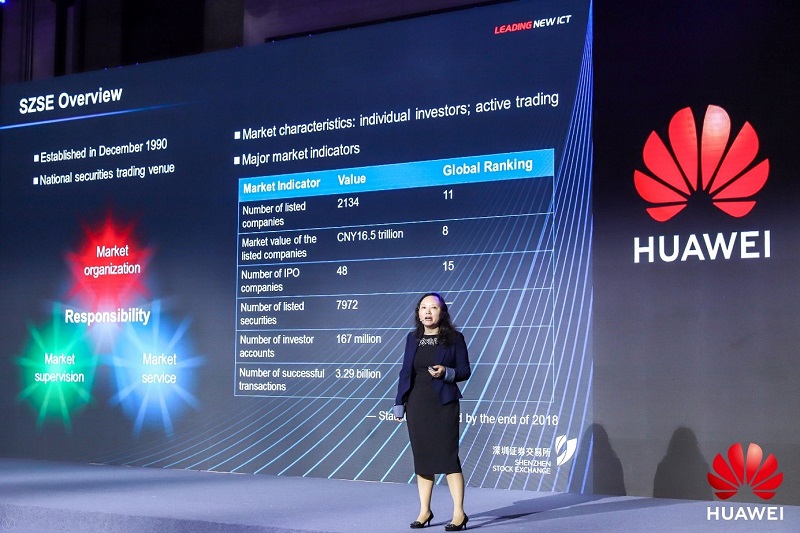

Yu Huali, Chief Engineer of Shenzhen Stock Exchange, said they have accelerated the transformation of the technical architecture by taking networking, digitalization, and intelligence as the core, in the open financial environment. Data and AI optimize risk control, improve service capabilities of trading platforms, and promote the healthy development of the securities trading market.

Yu Huali, Chief Engineer of Shenzhen Stock Exchange

Data becomes the core foundation of FinTech and digital transformation. Yu Feng, IT Director of Guotai Junan Securities, stated that they adopted the digital Guotai Junan strategy to promote data governance, improve customer experience, redesign operational processes, and upgrade business models. In addition, they have actively promoted the development of data ecosystems to help the securities industry achieve digital transformation.

Yu Feng, IT Director of Guotai Junan Securities

This afternoon, the Bank of Ningxia signed a strategic cooperation agreement with Huawei. The two parties will set up a joint team to work on data center planning and construction, cloud computing, big data, and informatization innovation. Together they aim to conduct groundbreaking innovations in big data, data governance, RISC-to-x86 migration, cloud infrastructure transformation, as well as mobile Internet financial products, new technology applications, and user experience design for the existing and future 5G network architecture. In addition, the two will study how to apply AI and biometrics to mobile Internet and financial services, and then share innovation achievements. Their cooperation will also cover enterprise operations management, talent development, and incentive system construction.

The Bank of Ningxia signed a strategic cooperation agreement with Huawei

Today the following forums were held: “Digital Transformation of Global Banks”, “Innovative Technology Enables Business Upgrades and O&M Transformation”, “Cloud + AI, Engines for Insurance Technological Innovation”, and “Digital Securities and Secure Finance”. Customers and system integrators both from China and abroad provided wonderful talks and interactive discussions. Partners in various financial domains, such as banking, insurance, and securities, have conducted in-depth communication with Huawei on digital transformation issues.

Huawei and its partners have built a smart exhibition hall of over 800 square meters. The Smart Experience, Smart Decision-making, Smart Architecture, and Fundamental Research areas demonstrate full-stack, intelligent financial solutions by offering scenario-specific service experience.

Smart Experience: Unattended counters, intelligent customer service, and VR banking show Huawei’s innovative applications in the IoT and intelligent security domains. This area shows how Huawei helps financial institutions contact with customers and deliver an ultimate services experience.

Smart Decision-making: Huawei’s smart, high-performance data analysis products and solutions, such as smart risk control, converged data warehouse, and AI Fabric, support efficient operations and decision-making of financial institutions.

Smart Architecture: The innovative architecture of “one cloud + three networks” demonstrates Huawei’s ability to help financial customers build open and scalable smart ICT architectures, and quickly launch services. Virtual banking, insurance cloudificaton, and blockchain-based credit investigation solutions show how HUAWEI CLOUD fulfills security, compliance, and trustworthiness requirements.

Fundamental Research: Demonstrates Huawei’s R&D strength in the AI, chip, IoT, and 5G fields, and allows visitors to experience 5G applications.

Smart Exhibition Hall

Adhering to the “Platform + AI + Ecosystem” strategy, Huawei Enterprise Business teams up with partners to provide ubiquitous connectivity and pervasive intelligence, and integrate new ICT through the digital platform to help government and enterprise customers achieve digital transformation. More than 700 cities around the world, and 211 of the Fortune Global 500 companies, including 48 of the top 100, have selected Huawei as their partner in digital transformation.

Huawei has continued to work with top financial institutions, research institutes, and independent software developers worldwide to accelerate the transformation of financial institutions. Huawei has served more than 1,000 financial institutions, including 20 of the world’s top 50 banks. Huawei Global FSI Summit 2019 is held in Shanghai from April 24 to 25. Started in 2013, it has developed into a global ICT event centering on the financial services industry. Industry experts have attended this event.