Jason Cao, Huawei's CEO of Digital Finance BU, said, "In the digital world, all changes pose new challenges to resilience. We must redefine and consolidate resilience to better achieve non-stop banking." Finance is evolving towards always-on and ubiquitous services. In the future, financial institutions need to build a robust and resilient financial digital infrastructure that follows the 4 Zeros.

With the rapid growth of financial services, data centers, as an important infrastructure for financial institutions, also need digital and intelligent transformation to support stable, agile, secure, and intelligent development and innovation of financial services.

The development of AI fuels the continuous innovation of new services. It also poses new resilience requirements on the ICT infrastructure within data centers. The construction and operations of data centers face the following four challenges:

• Evolution: Traditional architecture hinders service agility and long-term evolution.

• Continuity: Massive data is associated with applications, requiring zero downtime.

• Reliability: High regulatory requirements, increased risk and accident uncertainty.

• Robustness: Hard fault demarcation cross-product, difficult to predict risks.

Huawei continuously focuses on the problems and requirements of financial institutions during financial ICT infrastructure construction and maintenance.

From the perspective of professional services, Huawei continuously considers how to use AI technologies to develop new solutions and capabilities to enhance the resilience and stable operations of data centers.

During the keynote Agile Resilience, Leading Digital Infrastructure Innovation at HiFS Frontier Forum 2024, Huawei released the Digital and Intelligent Services Solution for Financial Data Centers. Gao Qianying, Vice President of Enterprise Service Solution, emphasized, "The resilience of financial data centers needs to be considered from the perspective of planning, construction, and daily operations. This includes the overall architecture design that can support smooth evolution, data migration that does not affect service operations, secure and reliable disaster recovery (DR) management, risk prediction and detection, accurate fault location, and quick processing. The digital and intelligent services enhance the resilience of financial data centers and ensure robust service operations."

• Financial Target Network Planning: Resilient Architecture Enables Smooth Evolution

Huawei's financial target network planning service helps financial institutions plan future-oriented network infrastructure. It helps them design feasible evolution roadmaps, innovate financial services, and ensure that network infrastructure can adapt to the changing technology landscape.

Huawei's target network planning covers the full topology of typical financial networks, including data center networks, WAN, and campus or office networks. Referring to the best practices of networking in the financial industry and across industries, the service provides financial customers with a series of professional services, including status surveys, requirement assessments, network blueprint architecture planning, and knowledge transfer. Huawei uses the NetLive tool platform to support the target network planning service, evaluate the survivability of live networks, provide resilience visualization, and help financial institutions better understand and improve network infrastructure resilience.

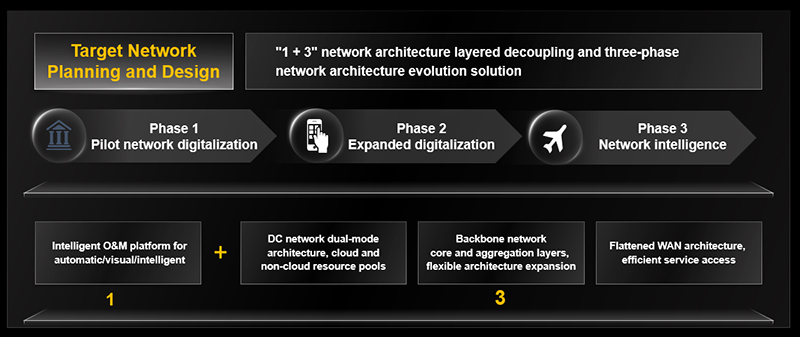

In the project of Bank S, Huawei deployed 1+3 network architecture planning and three-phase evolution solution.

Through this project, Huawei helped Bank S achieve:

• Leading architecture: Network as a service improved network utilization by 20%.

• Service support: Level-6 DR ensured network resilience; interconnection provided secure access to massive IoT services.

• Efficient management: Tools are used to automatically allocate and manage resources, implementing end-to-end service provisioning.

• All-in-one Migration Ensures Efficient Data Migration and Zero Service Interruption.

In different phases of financial service development and evolution, data migration is inevitable. It is often seen in the form of device replacement, service cloudification, and data center integration.

Huawei has set up 21 migration capability centers around the world and employed more than 300 migration technical experts, ensuring smooth migration to the new platform. In addition, Huawei has compiled migration experience from over 2000 cases into a 4-phase 17-step standardized migration process and integrated different migration tools into the CloudOps platform.

In the HDS storage replacement project of Bank S in South Africa, Huawei used the Migration Director to help the customer migrate data with zero downtime in complex scenarios involving more than 1000 hosts.

• One-Stop DR Service for All Scenarios from Storage-Level to Data Center-Level

Ensuring service continuity and effective disaster recovery mechanisms are critical for financial institutions. Any system breakdown can lead to significant financial loss, damaged customer trust, and regulatory compliance risks. Financial services are highly dependent on the stability and reliability of data centers. The Business Continuity Plan (BCP) is key to ensuring that financial services can run continuously under any conditions.

Huawei provides the one-stop DR management service based on the iDRP platform to help customers implement unified DR management at the data center level and ensure service continuity.

The iDRP platform supports intelligent warning within 1 minute, decision-making within 5 minutes, and agile switchover within 30 minutes.

• Intelligent warning within 1 minute: The DR technology can quickly detect and warn of emergency faults within 1 minute.

• Decision-making within 5 minutes: The association analysis algorithm is applied in real time to facilitate quick decision-making, enabling DR switchover within 5 minutes.

• Agile switchover within 30 minutes: The switchover process is automatically orchestrated based on the emergency recovery plan, completing one-click automatic switchover within 30 minutes.

Bank A's core banking service has been running for many years. Due to the complex logical relationships between core applications, outdated devices, and high incident risks, their existing data center system did not meet the DR management requirements for remote data switchback. Therefore, bank A did not dare to initiate DR switchovers easily, accumulating incident risks.

In the full process of consulting and planning, integration implementation, and DR drills, Huawei took the lead in building a complete geo-redundant DR solution for bank A. The solution quickly detects and makes decisions on data center-level DR events and implements agile switchover.

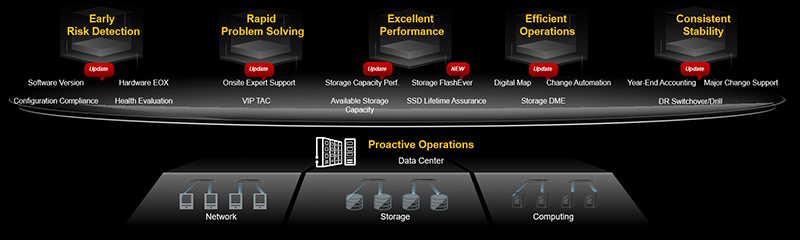

• Smart NOS O&M and Optimization Services Ensure Robustness Within Financial Data Centers

In the financial industry, the network stability of data centers is the basis for service stability and user experience. As noted in the IMF's Global Financial Stability Report of April 2024, against a backdrop of growing digitalization and rising geopolitical tensions, network risks faced by the global financial system are on the rise. Related policies and enterprise governance frameworks must keep pace with the situation.

Huawei Smart NOS focuses on the reliability and availability of ICT infrastructure. It analyzes and eliminates network risks in advance and provides dedicated TAC experts and troubleshooting mechanisms at the VIP level. In doing so, it can ensure that the SLA for problem resolution meets the requirements of the financial industry.

Based on best practices, Huawei uses an industry-leading intelligent analysis platform to evaluate and optimize the system architecture and improve the performance of networks and devices. In addition, new technologies are used to implement full-stack topology analysis, visualization, and cross-layer fault location from applications to infrastructures, improving O&M efficiency and ensuring stable system running.

Bank D found that the I/O performance of its data storage deteriorated after running for a long time. Problems occurred frequently with the accumulated potential risks, affecting the experience of upper-layer services. They sought a solution that could ensure the stable running of systems at a higher quality.

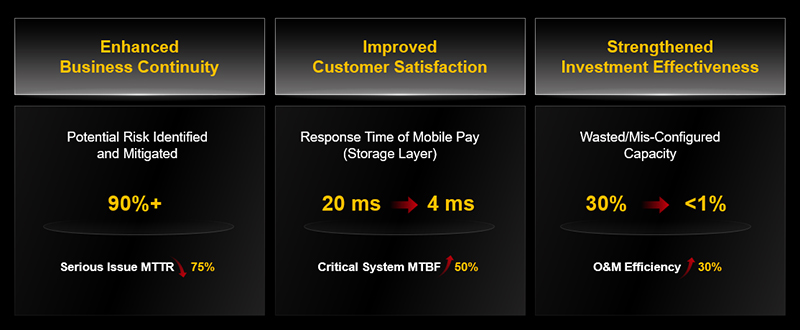

Huawei conducted in-depth health evaluation and performance optimization for bank D. Huawei identified and eliminated more than 90% of potential risks and improved O&M efficiency by about 30%. Thanks to the support of the VIP TAC frontline and remote expert team, the customer's MTTR of major issues was reduced by 75%.

• Development of Digital Financial Talent in the Intelligent Era

With the continuous evolution of financial data center architecture and technologies, data center personnel are facing unprecedented challenges. Such issues lie not only in mastering new technologies but also in understanding how they impact financial services. With highly skilled and constantly learning professional teams, financial data centers can effectively support the innovation and optimization of financial services.

Huawei continuously learns from best industry practices, gathers global wisdom, and provides systematic talent development services for the financial industry. Services include planning, cultivation, assessment, and operations, helping enterprises introduce advanced concepts and improve new skills.

Over the past three years, Huawei has trained 25,000 digital and intelligent talent for the financial industry and will continue to help more than 50,000 financial talent achieve digital and intelligent transformation over the next three years.

To ensure high-quality service delivery, quickly respond to local customer requirements, and promptly solve problems, Huawei has built service delivery platforms and resources around the world, including eight GTACs and TACs, three remote delivery centers, and more than 1,000 spare parts warehouses. In addition, Huawei has set up four financial service expert teams to provide high-quality digital and intelligent transformation services for financial institutions.

Conclusion: Huawei's digital and intelligent financial services help the financial industry jointly address the challenges faced by financial data centers. They provide full-cycle ICT support, helping institutions maintain competitiveness in the AI era. Through these innovative service solutions, institutions are better equipped to cope with the rapidly changing technical environment while ensuring service stability and security. With the continuous development of AI technologies, we can foresee that Huawei's service solutions will play an increasingly important role in promoting the digital and intelligent transformation of the financial industry.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy, position, products, and technologies of Huawei Technologies Co., Ltd. If you need to learn more about the products and technologies of Huawei Technologies Co., Ltd., please visit our product pages or contact us.