Building an Intelligent Data Foundation for the Financial Industry

Produits, solutions et services pour les entreprises

Akıllı Telefonlar, Bilgisayar&Tabletler, Giyilebilirler ve Daha Fazlası

Based on a converged resource pool, Huawei provides financial customers with a simple, resilient, yet agile unified storage solution to build a solid, modern data foundation for financial services. With reliable products and outstanding services, Huawei’s storage products and solutions serve 45 of the world’s top 100 banks.

The biggest challenge the banking industry faces today is the growth of Internet finance. As intermediate traders, Internet financial services providers have taken many retail customers from traditional banks, and are also working to attract enterprise customers. In 2020, this process has been accelerated by the global outbreak of COVID-19, which has directly led to the exponential growth of contactless transactions, boosting the development of Internet finance. To tackle the challenges Internet finance brings and improve their ability to first retain and then gain customers, banks must make the most of their reputations for relative trustworthiness and reliability, and greatly improve the flexibility and convenience of their service rollouts at the same time.

To capitalize on the use of data, banks should deploy data storage architecture that best suits their size and their service development expectations. As the data foundation that supports the modernization of the banking industry, storage technology needs to meet three key requirements: cleanliness, toughness, and agility.

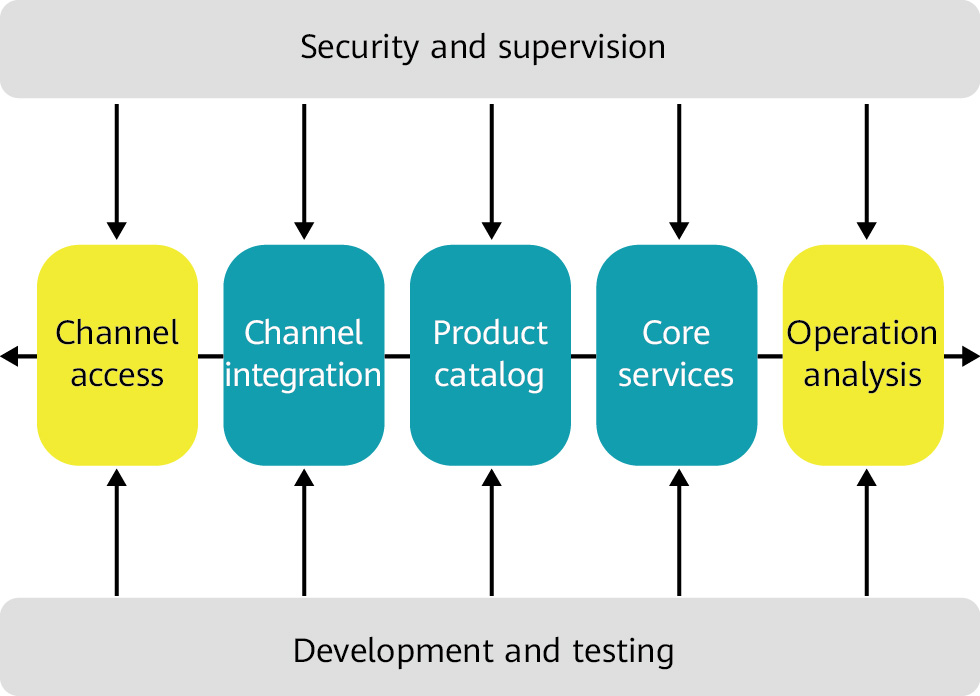

The banking service system essentially consists of seven modules: security and supervision, channel access, channel integration, product catalog, core services, operation analysis, and development and testing. Meanwhile, the main service processing flow is divided into five phases: channel access, channel integration, product catalog, core services, and operation analysis. Security supervision and development and testing cover every phase.

Figure 1: The seven modules of the banking service system

As key service modules, channel integration, the product catalog, and core services have high reliability requirements: Services must not be interrupted, and performance must be stable. Channel access, operation analysis, security supervision, and development and testing are common service modules that are susceptible to the impacts of regional political and economic environments, the actions of competitors, and service development. These modules demand elastic scaling, quick response, and agile services.

• Choosing the Right Storage Solutions for Key Service Modules

All banks have the same requirements for service stability in key service modules: always-online services. A reliability of 99.999 percent for single devices simply isn’t sufficient to meet their service stability requirements. All-flash — for stable performance — and 3-Data-Center (3DC) geo-redundancy, for multi-level Disaster Recovery (DR) protection, have become the basic configurations for mission-critical services. However, when selecting a specific solution, a bank should design the solution based on its own unique situation and environment. To give an example, one bank used a top vendor’s products to implement 3DC geo-redundancy ring networking. The two primary sites worked in dual-active mode and replicated the data to the third site to form a ring network. However, the country’s long-haul network was unstable, leading to numerous bit errors — and even fiber cuts at times. In networking modes such as this, the coupling between sites is too strong. Frequent switchovers caused by network instability mean that a large amount of data that is to be replicated accumulates in the memory of the main site. And when the memory is exhausted, faults occur. In regions where the long-haul network is unstable, it’s imperative to minimize the impact of the network’s performance on the solution and therefore reduce coupling between sites.

In this example, the vendor should have deployed a tightly coupled active-active solution at the primary site, and it should have formed loosely coupled asynchronous replication relationships between the main site and other sites.

As it is for production and DR, services must also always remain online during configuration change, data migration, upgrade, and device maintenance. Multiple factors, including human factors and the external environment, also need to be taken into account. More than 20 percent of faults in a Data Center (DC) are caused by human error. Conducting repeated checks and drills before change operations, along with the formulation of recovery plans in advance, is essential in mitigating this type of fault.

The electromechanical environment of a DC can also become faulty. It’s common for the fire sensor in a customer’s equipment room to report an alarm by mistake. As a result, the high-pressure airflow of inert gases from the fire extinguisher can create a howling noise at the air outlet, which causes resonance and massive damage to Hard Disk Drives (HDDs). Compared with HDDs, Solid State Drives (SSDs) have better environmental adaptability in terms of temperature, electricity, and vibration, significantly reducing the probability of faults.

• Choosing the Right Storage Solutions for Common Service Modules

When selecting storage solutions for common service modules, banks tend to focus on competition requirements. Many banks choose Software-Defined Storage (SDS) because it’s easy to obtain, expand, and manage. Meanwhile, Hyper-Converged Infrastructure (HCI) integrates computing, network, and storage resources, simplifying management and capacity expansion.

Customers have multiple options here, including open-source SDS software and general-purpose servers; commercial SDS software provided by vendors and general-purpose servers; commercial distributed storage (software and hardware) products; commercial HCI software and general-purpose servers; or commercial HCI integrated software/hardware products. As no product is perfect in every aspect, customers should choose the solutions that best satisfy their needs.

With their own data storage Operations and Maintenance (O&M) teams and plenty of development and testing personnel, large banks typically have strong Research and Development (R&D) capabilities and tend to choose open-source software and general-purpose servers. This is because the developers working at banks aren’t professional storage experts and they have limited methods for optimizing and monitoring the underlying layers, limiting their ability to deliver optimal performance for every scenario. Instead, banks rely on the maturity of open-source software to monitor and handle faults. For example, at an exhibition in Europe, a top bank’s R&D personnel asked Huawei staff how to optimize their system performance, complaining that many of their software apps can’t identify the disk slot and that it’s difficult to locate and replace faulty disks. Given such issues, banks should really focus on the development of new services and the improvement of service quality, and leave complicated tasks to vendors themselves.

HCI simplifies management and capacity expansion, and tightly couples various resources. During capacity expansion, computing or storage resources often become redundant. Determining the ratio of computing resources to storage resources in advance is therefore key to deploying HCI. Using HCI products integrated with applications is also feasible, and solution providers can more accurately calculate the optimal ratio of various resources.

Huawei is committed to providing the best storage products in the industry and customized solutions for banking services.

Figure 2: Huawei provides financial customers with a unified solution that is simple, tough, and agile

• High-End All-Flash Storage

For mission-critical services, Huawei’s OceanStor Dorado all-flash storage system is the only high-end storage system in the industry that can tolerate simultaneous failure of three SSDs.

At the controller layer, each engine supports four controllers. The system tolerates the failure of a single engine, and the collective failure of seven out of eight controllers across engines without causing service interruptions. For host links, the system supports single-link connection. Even if there is only one host link in the system, the controllers in the engine can still work properly and online upgrades can be implemented with no impact on host services. For SSDs, OceanStor Dorado supports RAID-TP (N + 3) protection, which can tolerate the failure of three SSDs at the same time. Here, data loss probability is 100 times lower than RAID 6 (N + 2) and 1,000 times lower than RAID 5 (N + 1) and RAID 1 (N + N).

• Distributed Storage

To enable common services, Huawei provides OceanStor Pacific distributed storage, which supports block, file, object, and Hadoop Distributed File System (HDFS). The solution also supports protocol interworking between files, objects, and HDFS, facilitating data sharing and concurrent development of multiple applications.

As well as supporting general-purpose x86 and ARM servers, OceanStor Pacific provides two types of hardware nodes for specific scenarios. For large-capacity scenarios, such as video and backup, OceanStor Pacific provides large-capacity nodes that support 120 disks in a compact 5U space — 20 percent higher than the next best-performing solution in the industry. It also provides ultra-high-performance nodes with a bandwidth of 144 Gbit/s for High-Performance Computing (HPC) and Artificial Intelligence (AI) training, 40 percent higher than the industry’s next best performing solution.

OceanStor Pacific also optimizes the container environment. It supports quick provisioning of massive containers, and 500 containers can be mounted per minute. The system also supports fast container migration. When a container is migrated to another server, path switchover and resource mapping can be completed within a second. And another benefit? Dedicated host clients are provided, improving performance by 30 percent.

• HCI

In the HCI field, Huawei provides the FusionCube solution and works with Forms Syntron to create the Bank as a Service solution, offering microservice-based banking services, and forming an End-to-End (E2E) microservice system from applications and basic computing to network and storage resources. The solution simplifies management, improves resource usage, and minimizes the Time To Market (TTM) of new services and reduces capacity expansion time.

• Unified Lifecycle Management

Huawei’s OceanStor Data Management Engine (DME) software manages the lifecycle of data and devices in a cohesive, unified way: Administrators can automatically plan and configure resources in a single view. With a built-in automation engine and predictive algorithms, management and troubleshooting efficiency is improved three-fold.

Based on OceanStor DME and storage products, Huawei provides a unified intelligent converged resource pool solution, to pool products, divide resources into different Service Level Agreement (SLA) layers, and allocate resources in a unified manner, following service requirements.

The OceanStor DME allows administrators to orchestrate and control data and data copies in multiple environments such as production, DR, and development and testing. Automatic, policy-based, or manual global snapshot, clone, and replication can be achieved in one view. The data of multiple versions is centrally managed, supporting Development and Operations (DevOps)-based agile production and development.

Based on the converged resource pool, Huawei combines the OceanStor DME, OceanStor Dorado, and OceanStor Pacific to provide financial customers with a unified solution that is simple, tough, and agile, building a solid data foundation for modern financial services. With reliable products and outstanding services, Huawei’s storage products and solutions serve 45 of the world’s top 100 banks.

In the next decade, the world will transform from a digital society to a smart society. As one of the foundations for socioeconomic development, finance will evolve from digital to smart finance. Huawei storage will continue to evolve toward cleanliness, toughness, and agility — maximizing the value and efficiency of each bit of data. In the intelligent era, Huawei will always strive to deliver the best products and solutions possible, to empower customers in the finance sector.