CMB: Retail Banking with AI and Distributed Databases

Produits, solutions et services pour les entreprises

Akıllı Telefonlar, Bilgisayar&Tabletler, Giyilebilirler ve Daha Fazlası

Established in Shenzhen in 1987, China Merchants Bank (CMB) is a leading developer in China’s digital banking sector. CMB has been promoting the strategic transformation of ‘lightweight banks’ in recent years by clearly defining the role of Fintech banks with the aim of transforming itself into a technology-driven bank.

CMB is focused on retail businesses. It seized the opportunity in the era of ‘retail banking 1.0’ characterized by bank card services and the ‘retail banking 2.0’ era characterized by hierarchical wealth management. Today, we believe that CMB is leading the industry into the ‘retail banking 3.0’ era.

To make ‘retail banking 3.0’ a reality, CMB needs to do the following three things: First, make the CMB Apps the main platform for banking operations and services. Currently, we have two Apps — the CMB App and the CMB Life App — with over 120 million total users, of which more than 60 million are Monthly Active Users (MAUs). Second, CMB needs to build a service system that covers all products, channels, and customers. And finally, the bank must continue to provide an unparalleled customer experience.

For marketing, service operations, and risk control, advanced banks adopt a data-driven approach. CMB has 137 branches and 1,693 sub-branches covering more than 130 cities in China and is serving over 100 million customers. Our digital banking business-operation system provides strong background support.

Recent years have seen breakthroughs in deep neural network algorithms that are creating explosive development opportunities for Artificial Intelligence (AI). The financial industry has created a number of significant applications by leveraging AI; for example, the use of facial recognition for identity verification in financial service scenarios, or to optimize customer experiences based on past activities. Natural Language Processing (NLP) enables dialogue between humans and machines and is currently in wide use for intelligent customer service assistants that greatly reduce operating costs.

In addition, machine learning plays an important role in financial risk control. New technologies are changing the IT infrastructure of banks. Three technologies are of particular note; they are: cloud computing, big data, and AI.

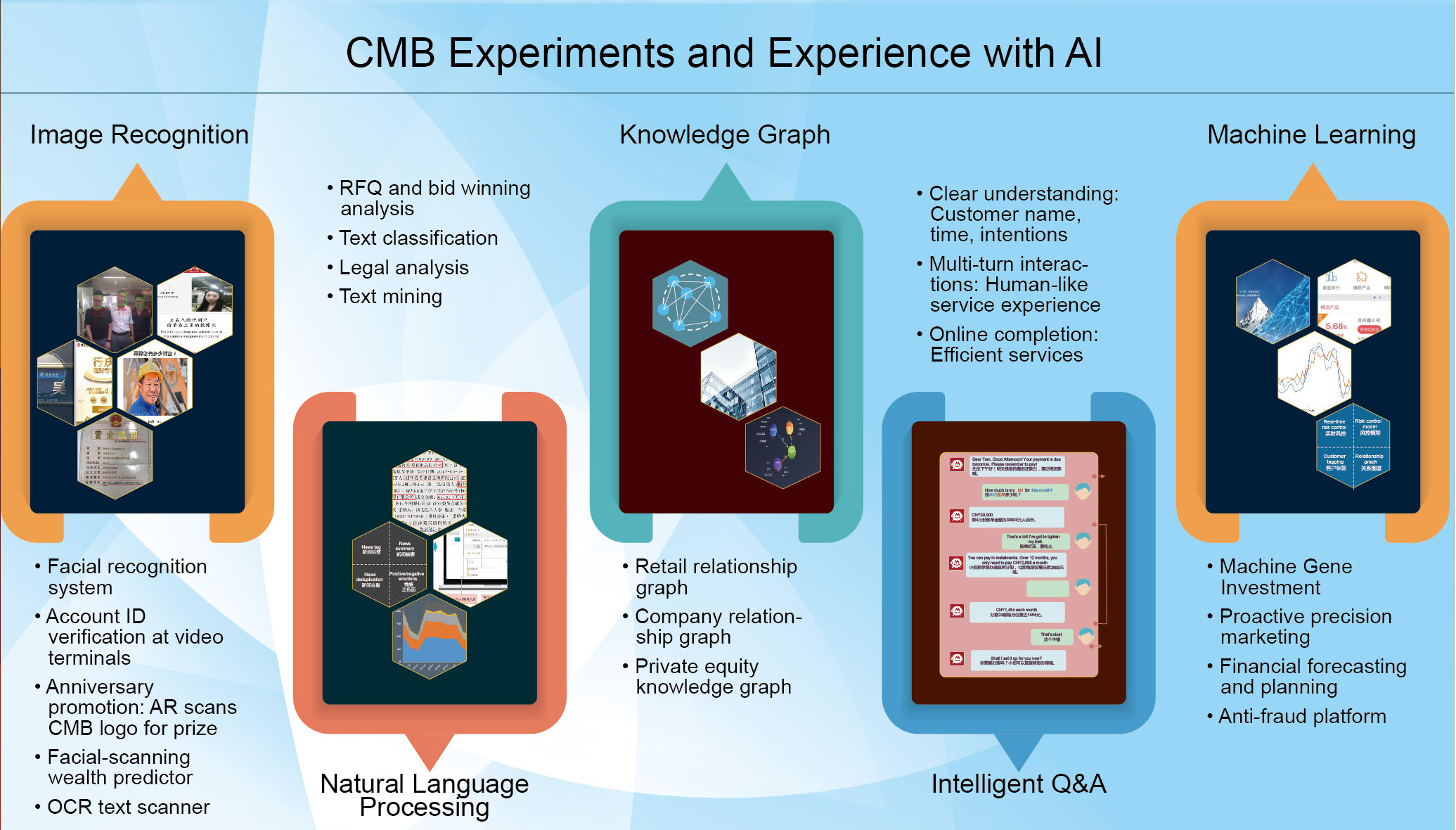

CMB has conducted proactive exploration and practice in AI.

• Image Recognition: In October 2015, CMB began to use facial recognition technology to verify account holders’ identities during ATM withdrawals, which was the banking industry’s first use of this technology in China.

• Natural Language Processing: Among the massive quantities of data generated by the Internet, is highly valuable, but unstructured, information. NLP allows users to realize the business value of this data. CMB analyzes the bid invitation and winning announcements of enterprises and governmental agencies on the network, and then parses the enterprises, projects, and amounts of the winning bids. This marks a starting point for discovering business opportunities in corporate banking services. Similarly, by analyzing court judgments published on the network, CMB can determine the plaintiff, defendant, cause, and judgment in each case, and use the information to warn individual and enterprise customers as appropriate.

• Knowledge Graph: CMB is building enterprise graphs to depict complex relationships. Currently, the retail and enterprise relationship graphs map the data from 120 million individual nodes and 50 million enterprise customer nodes.

• Intelligent Q&A: This is a combination of NLP and knowledge graph technologies. CMB has implemented access to intelligent Q&A systems in over 600 scenarios.

• Machine Learning: In the financial industry, machine learning most frequently manifests as intelligent investment advising and marketing risk control. In 2016, CMB developed the first intelligent investment product in the Chinese finance industry — ‘Machine Gene Investment,’ which generates over USD 1.7 billion (CNY 12 billion) of business and serves nearly 200,000 customers. In addition to being the first of its kind, Machine Gene Investment is the largest intelligent investment product in the industry. Each retail transaction is checked by an anti-fraud platform. This platform, deployed with complex rules and models, is capable of processing transactions in 50 milliseconds, on average, to achieve real-time and intelligent fraud prevention. CMB has also explored the use of machine learning in financial forecasting and planning. For example, predicting the business volume of individual branches and cash demand for each ATM location.

AI and big data technologies are revolutionizing every aspect of the banking system and banking operations, services, and management practices. The system is transforming from a traditional business model to a new, data-driven, and ‘lightweight’ banking model. CMB is dedicated to facilitating this transformation.

In keeping with this data-driven development trend, massive amounts of data need to be processed efficiently. Therefore, a scalable and high-performance database becomes the cornerstone of a bank’s IT infrastructure.

CMB has six requirements for an advanced database:

• High scalability for massive data processing

•High performance, real-time processing for financial big data scenarios

• High availability to ensure the entire banking information system’s business continuity

• Cloud-based for on-demand allocation of separate computing and storage resources via a multi-tenant system based on isolated applications on a large cluster

• Easy Operations and Maintenance (O&M) of large databases

• Easy development that allows developers to avoid database and table partitioning at the application layer.

Huawei is a Research and Development (R&D) leader in the database field and is able to build a variety of advanced database products. CMB, as a database-dependent customer, has requirements and scenarios for its businesses as well as extensive experience in database development and O&M. In November 2017, the two enterprises built a joint innovation lab to develop a world-leading distributed database product, GaussDB, with four goals:

• High-performance enterprise-level kernel: The single-node transaction processing capability must reach the million-per-minute level to enable distributed transaction ingestion, and meet the finance industry’s data processing requirement.

• Distributed high-scalability: Linear scalability with a ratio greater than 0.8 is required. Clusters need to implement online scale-out without interrupting services.

• Distributed high-availability: In a single data center, if the Recovery Point Objective (RPO) is zero, the Recovery Time Objective (RTO) can be reduced to seconds. In addition, multiple data centers, copies, and the all-active function must be supported to achieve automatic fault diagnosis, isolation, and switchover.

• Distributed cloudification: CMB needs to implement computing and storage separation and support multiple tenants.

Currently, CMB has achieved the first and third goals of this database project — high-performance enterprise-level kernel and distributed high-availability. We have also deployed the GaussDB on two important business systems and have started to use it in production environments. In the future, CMB will focus on the following three aspects of the overall database architecture:

• Developing distributed databases and facilitating the transformation of the overall database architecture to better support business development at the database level.

• Simplifying mainstream database types and database technology stacks for easy development and O&M.

• Expanding the use of AI and machine learning technologies to build highly automated and intelligent database O&M systems that can support low-cost and large-scale O&M.