Produits, solutions et services pour les entreprises

Akıllı Telefonlar, Bilgisayar&Tabletler, Giyilebilirler ve Daha Fazlası

Recently, at a fintech event in Saudi Arabia, the topic of cloud and AI's relationship caught my attention; particularly, the phrase "no cloud, no AI". It gave me pause for thought. In fact, this statement only scratches the surface. Without cloud, we would not be able to further push the envelope. We would not have the connectivity or the resources to utilize big data to its fullest. We need the openness and flexibility that cloud can offer if we are to continue evolving our services. That is why I say: no cloud, no innovation.

Reaching for the Clouds: A Hybrid Solution

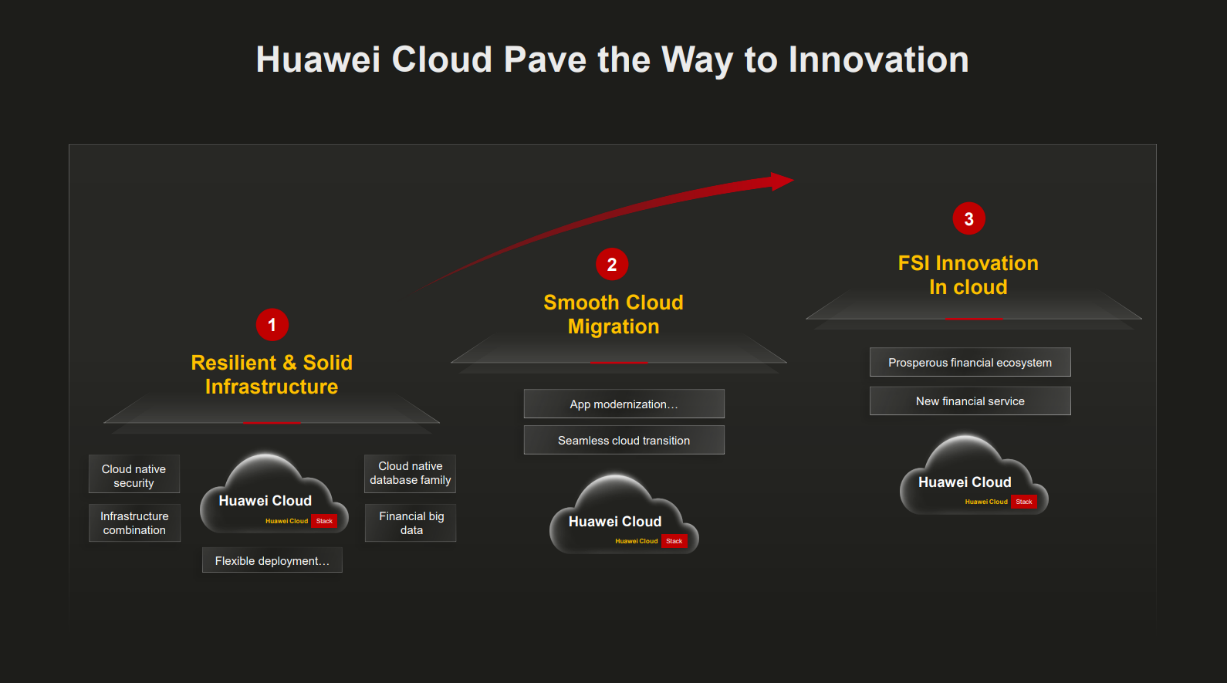

This begs the question — how do we move to cloud? Investing in a mainframe to support a private cloud would inevitably be an astronomical expense. And to put all of one's eggs in the public cloud basket is not an option for some, on account of regulations, data protection and issues to do with latency. From Huawei’s perspective, there are three main things to consider:

The first is your infrastructure. You need a resilient, sturdy infrastructure with failsafe after failsafe. Huawei provides a highly unique solution for this in the form of a hybrid cloud, one that employs public and private servers. More on this momentarily.

The second is the process of migration. A secure, seamless and step-by-step cloud transition is essential to keep digital banking services up and running without a hitch.

Last but not least, you must consider what you stand to gain. After going to all the effort of migrating infrastructure to the cloud, how are you going to enjoy it? By this stage, you will have a prosperous financial ecosystem and new financial services in the palms of your hands. Planning ahead and considering your next stages of innovation becomes essential.

So, where should you start? Huawei Cloud covers a great deal of ground so that you don't have to. Beyond public and private cloud structures, there is our Cloud Pond solution. This acts as an extension to your current data center with an on-premises connection to our public cloud.

For those with concerns surrounding connectivity, we have the Huawei Cloud Stack. This is an on-site dedicated cloud over which you have full control. But that's not the be-all and end-all; the technology is from the same stack as the public cloud, and your account with us can work on both.

This opens up all kinds of options.

Picking and Choosing the Best Cloud Structure

The value of active-active structures to maintain a robust system has become increasingly evident. I think the concept of active-active shows us something deeper than its surface effectiveness: Not only should the infrastructure be split, but so should your team.

The setup is simple: One pair of active-active data centers that support each other, and then one separate data center that is synced as a backup. Each should have their own team, so if a natural disaster strikes one area, they can rely on the team from the other location to have their backs. This is a failsafe within a failsafe, which for banks, should be a top priority.

We can also play around with what sites we put where. Regulation plays a huge part in this: For countries where regulatory bodies are cautious to change, building two private clouds and having recovery on the public cloud is a solid option. For others who favor cloud in digital policy, putting two sites on the public cloud becomes viable, with one private. Further still, some digital banks who are charging into the market want to skip DC construction, and would prefer to have all three sites on a public cloud. The key is: What is the main focus of your IT team? The choice is yours.

Migration Season

Having settled on your infrastructure, now you must migrate your applications. There is a methodology to this.

Part of creating a strategy involves considering what you already have and using a classification system to organize it all. This informs how we approach migration, and ensures we go step by step. There are three classes, simply named A, B and C, to help us sort what gets migrated first to last.

Class C refers to auxiliary systems like human resources, management, and supply chains. These are stable and can stand alone, making them the best candidates to move first and to public clouds.

Class B are important systems that rely more on flexibility, like your data analytics and Internet applications. They can go next.

Class A consists of your critical systems that require a stable foundation and high accuracy, like payment and settlement, trading, and core banking services. These are best migrated last, and to on-premises infrastructure.

Huawei does what we call a lift and shift. With our migration center, we can help you move data without an agent. And with DRS, UGO, and our extensive set of tools, those prioritizing open source solutions will find options to easily migrate from legacy to new databases.

A Whole New World

With the power of a modernized cloud system at your fingertips, your innovation plan now comes into play. For many, improving concurrency to support transactions is at the top of their list. Traditional financial services rely on centralized banking, but with digital banking, services span time zones and regions. Similarly, customer expectations have shifted priority from accuracy to speed. They want transactions to be instant. Mobile banking as brought us to a place of interaction rather than transaction, and to support such monumental change, Huawei provides a variety of resilient database solutions. Our own in-house solution is GaussDB, and again, RDS and UGO are ideal for open source database migrations.

It would be remiss not to mention security amongst all this talk of change. Cybercrime, fraud and the art of risk control have all become more sophisticated in tandem. With big data, we can perform risk control in real time, with precise responses formulating in milliseconds. With the graphic engine, we can conduct post-event analysis to identify the relationship between participants in the event and see what kind of risk we’re dealing with. With behavior models for users, we can much easier see the red flags and protect people's assets from scammers and fraud.

With big data, banks can shift from internal improvements to external; that is, from streamlining operations to bettering their services for every customer or account holder. Customer needs and behaviors are changing. Now we can stay ahead of the beat.

This by no means is a journey any financial institution walks alone. Huawei does not provide every cloud service imaginable — we have tirelessly developed a partner ecosystem we can rely on to flesh out solutions exactly as we need. We believe that we can serve our customers not only with our physical technologies, but with our ecosystem solutions. We hope this will include you.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy, position, products, and technologies of Huawei Technologies Co., Ltd. If you need to learn more about the products and technologies of Huawei Technologies Co., Ltd., please visit our product pages or contact us.