Produkty, Rozwiązania i usługi dla przedsiębiorstw

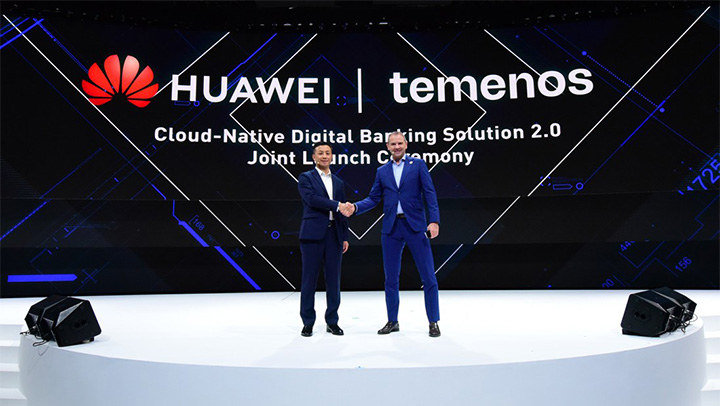

[Singapore, July 20, 2022] During Huawei Intelligent Finance Summit 2022 — Huawei, launched the Digital Banking 2.0 solution leveraging Temenos open platform, and discussed with customers and top partners in the financial industry about how to build a cloud-native architecture to achieve business agility and industry innovation.

Facing fierce competition with Internet giants, banks are transforming from providers of traditional financial services to those of new digital financial services based on the industry ecosystem. New technologies — such as cloud-native, open API, and big data — as well as the new economic environment have been driving digital banking to be open, intelligent with seamless integration capability.

Banks have to go digital to meet the various new requirements in new scenarios, and digital banking is an inevitable choice. Indeed, global digital banks have undergone explosive growth in recent years. According to the statistics of Simon-Kucher's new bank database, 153 digital banks emerged in 2020 and 2021, and this number will continue to rise in the future.

During the summit, Huawei released the Digital Banking 2.0 Solution leveraging Temenos open platform. This new Digital Banking solution is an upgraded solution and uses Temenos open platform for composable banking to provide cloud-native, core banking functionality and data capabilities. The solution supports the quick launch of digital banks and helps larger banks accelerate their modernization in the cloud. This greatly improves the rollout efficiency and customer satisfaction.

Digital Banking 2.0 Solution enables fast service integration and rollout based on a cloud-native architecture, providing core banking functions for banks. The solution has the following key capabilities:

1. Pre-integrated: The solution certified with Temenos and other partners in the industry offers a complete and comprehensive function stack of digital banking for customers in different business scenarios, such as retail, corporate and Islamic banking, etc.

2. Agile: The solution provides composable banking services that allow new services to be developed and iterated through simple assembly. At the same time, the cloud-native system is highly scalable and cost-effective, requiring less initial investment.

3. Open: The platform provides open APIs for third-party invoking and integration. It enriches the ecosystem and supports more business scenarios. All of this results in improved system operational efficiency and user satisfaction.

Neo Gong, Senior Solution Director of the Huawei Enterprise BG Digital Finance, introduced, “Digital Banking 2.0 can be delivered in the SaaS or cloud foundation model. This solution helps customers improve their efficiency of business operations and cost management, so that they can focus more on service innovation and ecosystem development. Based on the collaboration with Temenos, a leading open platform for composable banking, this solution provides rich core banking functionality for banks.”

Through building an agile,elastic,secure and reliable cloud foundation,and integration with partners to build scenario-based financial solutions,Huawei is committed to further promote the development and innovation of financial services, shaping smarter, greener finance together.