This site uses cookies. By continuing to browse the site you are agreeing to our use of cookies. Read our privacy policy>

![]()

This site uses cookies. By continuing to browse the site you are agreeing to our use of cookies. Read our privacy policy>

![]()

Продукты, решения и услуги для предприятий

Смартфоны, ПК и планшеты, носимые устройства и многое другое

Huawei hosted a Digital Finance Session themed "Non-Stop Banking, Resilience Boosts Intelligence" at MWC Barcelona 2024. At this session, Jason Cao, Huawei's CEO of Digital Finance BU emphasized that resilience is the foundation for everything, and elaborated how to build the infrastructure resilience in the intelligent era.

In the past year, Huawei has made continuous progress in the global finance industry. We have taken a deep dive into 4 directions of "building resilient infrastructure, accelerating application modernization, enhancing data-driven decisions, and enabling business scenario innovation" and worked closely with our customers and partners to accelerate the digitalization and intelligence of finance.

To date, Huawei has served over 3,300 financial customers in more than 60 countries and regions, including 53 of the world's top 100 banks.

Today, I will focus on infrastructure resilience, because resilience is the foundation for everything.

In the digital world, digital financial services represented by real-time payments are booming. Technologies go for open architecture and cloud. Generative AI is growing rapidly in key areas such as financial engagement and software development.

All of these changes pose new challenges to resilience. We must redefine and consolidate resilience to better accelerate intelligence.

Future First, Resilience Must.

Mr. Brett King has presented Bank4.0. I suggest "Bank 4 Zeros" as a way to redefine resilience.

We must ensure zero downtime and high availability of financial services, deliver a zero-wait user experience, and achieve zero-touch operation while ensuring zero-trust service and data security.

"Bank 4 Zeros" are crucial for building comprehensive resilience in the digital era. They are paving the way for "Non-Stop Banking".

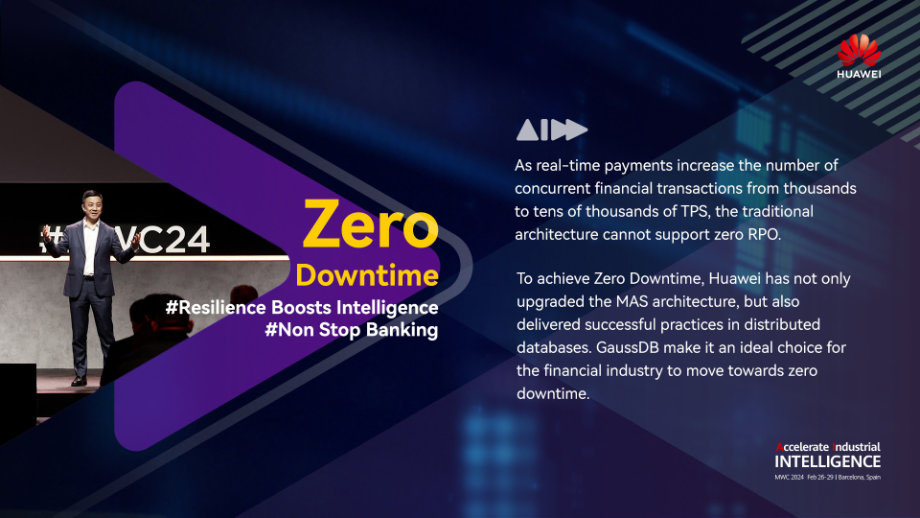

Real-time payments have increased the number of concurrent transactions from thousands to tens of thousands of TPS. The traditional architecture can no longer support zero RPO.

Huawei has provided a multi-active MAS architecture. This is very important for achieving the five nines (99.999) in SLAs.

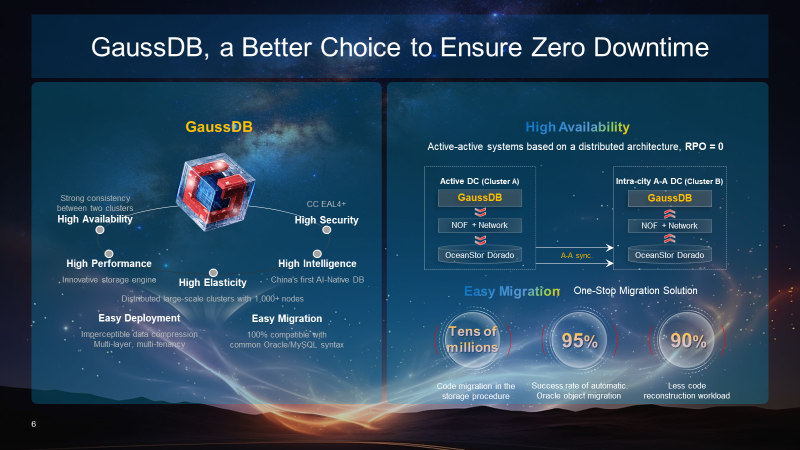

The MAS architecture has three key capabilities: a cell-based application platform, distributed databases, and highly available cloud-native infrastructure. Distributed databases, in particular, are the decisive factor for SLAs. Today I want to introduce you a new powerful database GaussDB.

In the transactional database field, there were not many choices in the past. Traditional databases could not well support the financial industry to move towards MAS.

To achieve Zero Downtime, Huawei has not only upgraded the MAS architecture, but also delivered successful practices in distributed databases. Moreover, Huawei has developed a next-generation distributed database called GaussDB, which was officially announced to global finance today. It boasts seven features including high availability, high security, high performance, high intelligence, high elasticity, easy deployment, and easy migration that make it an ideal choice for the financial industry to move towards zero downtime.

Postal Savings Bank of China has 650 million retail users who used to run in the traditional centralized core architecture which was not easy to support the new business development.

In 2020, PSBC built a new core with our MAS architecture and GaussDB, and developed 5000 "LEGO style" service components to achieve cell-based deployment.

Since the system went live in April 2022, GaussDB has supported over 2 billion peak daily transactions of PSBC, making it the world's largest cloud-native core development practice.

Storage is another core component for achieving high availability. Huawei storage is growing rapidly and has become one of the world's top 2 storage providers in 2023.How is it growing so fast? It is because of its industry-leading full-redundancy architecture and unified active-active SAN and NAS. Another key task for us is to exploit the advantages of multi-technology collaboration, which means making storage collaborate more efficiently with databases, containers, and network optical connectivity to further reduce the RTO.

Currently, Huawei's all-flash storage has supported more than 1000 PB data storage for global financial customers and enhanced zero downtime for them

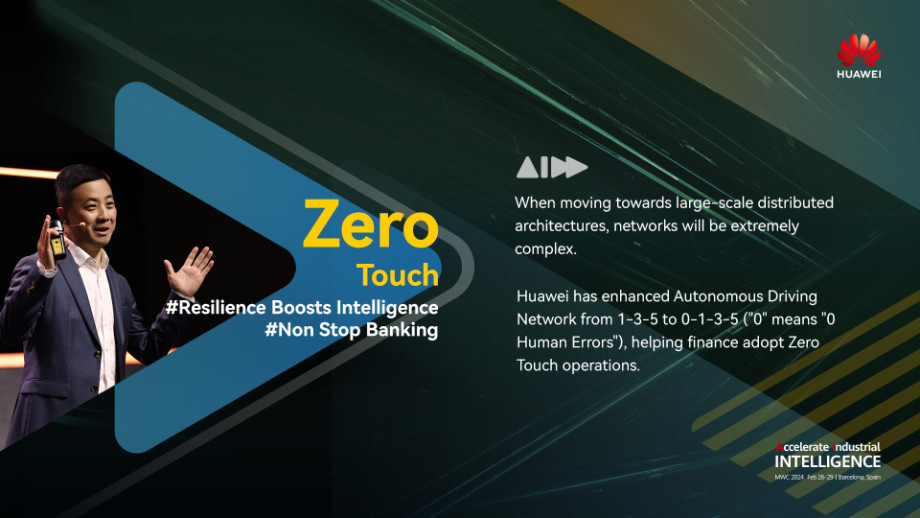

As we move to cloud and AI, networks and operation are becoming extremely complex, which is a big challenge for us.

Recently, an autonomous driving car powered by Huawei technologies, M9, has made a splash in China. It can dodge 100% obstacles automatically. It also prevents human errors in driving. Drivers can relax without holding the steering wheel all the time. We have applied the same concept to the network operation and management. Autonomy is the way to intelligent operation.

Huawei Autonomous Driving Network has been enhanced from 1-3-5 to 0-1-3-5 ("0" means "0 Human Errors"), helping finance adopt Zero Touch operations.

Digital Map is the most important capability, which was upgraded based on Cloud-Map Algorithms and Digital Twins. It leverages large AI models to visualize the correlation and changes of networks, traffic, and applications in real time. The result is a network digital twin simulation, which ensures zero change errors.

In Huawei and a top bank's joint innovation, Digital Map has achieved 88% faster troubleshooting, and one-click simulation of application changes. It also enables 100% network configuration change accuracy. And the touch time is reduced by 90%.

As digitalization expands, so do the vulnerabilities of every data point and network connection. They face constant threats and attacks from various sources. In 2023, the number of cyber attacks on global banks increased by 520%, and the average service recovery time of financial institutions after ransomware attacks was 16.3 days.

Virus attacks cannot be completely prevented. Attack and defense are in a race against time, so the speed is critical. Huawei keeps improving for fast attack detection, virus isolation, and data recovery.

We have provided the industry's first multi-layer anti-ransomware solution. It uses firewalls to detect and the storage air-gap to isolate the virus in seconds, preventing intrusions in a timely manner.

Huawei has built data security solutions for more than 40 top banks in 2023, protecting more than 100 PB of core production data.

Zero Wait is ultimate customer experience. For banks, real-time capabilities are critical to customer experience in the digital era.

For example, once after an employee receives salary, they immediately get a recommendation of wealth management. Similarly, once after an employee transfers money out, they immediately get a recommendation of micro loan.

How to use the transaction data in real time for the analysis and decision is all about the real-time data capability.

Today, I announce that Huawei Data Intelligence Solution is going global. This solution combines an all-serverless architecture with data lakehouse and data-AI convergence. It provides extremely strong real-time capability, especially for the data warehouse.

Two thirds of China's top 20 banks chose Huawei DWS to build leading data platforms. For example, in China a Top Bank which built the largest cloud data warehouse in Asia, it can store tens of millions data records in seconds, and query them in milliseconds.

And recently Thailand's top credit card issuer, chose Huawei DWS to speed up the transition from traditional marketing to real-time interactive marketing.

Huawei's Data Intelligence Solution makes every engagement real-time. It is an ideal choice for you to build a zero-wait experience.

That's the four zeros I'm sharing with you today. In an uncertain digital world, it's so important to reshape resilience, wherever you are, whether you're a big bank or a small bank.

Resilience boosts intelligence. In the digital world, all changes pose new challenges to resilience. We must redefine and consolidate resilience to better achieve non-stop banking: ensure zero downtime and high availability of financial services, deliver a zero-wait user experience, achieve zero-touch operation while ensuring zero-trust service and data security, and eventually accelerate the development of intelligence.

For sure, Future First, Resilience Must. Let's work together to achieve it.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy, position, products, and technologies of Huawei Technologies Co., Ltd. If you need to learn more about the products and technologies of Huawei Technologies Co., Ltd., please visit our website at e.huawei.com or contact us.

How GenAI Sparks Growth and Innovation in Leading Banks

4 Zeros Resilience Underpins the Path to AI Banking

Boost Resilience, Reshaping Smarter Finance Together

Navigate Change, Shaping Smarter Finance Together

Accelerate Change, Shaping Smarter Greener Finance Together

3 Ways Huawei Is Unleashing the Value of Digital for Finance