This site uses cookies. By continuing to browse the site you are agreeing to our use of cookies. Read our privacy policy>

![]()

This site uses cookies. By continuing to browse the site you are agreeing to our use of cookies. Read our privacy policy>

![]()

Enterprise products, solutions & services

For many, the first time they had ever heard of the metaverse was when Mark Zuckerberg announced that Facebook was to become Meta in a flashy reveal. Besides this being excellent entertainment, most people still don’t understand the concept of the metaverse enough to be able to explain it to someone else. This lack of understanding has made it easy to disregard the metaverse and all of the opportunities that it could create.

In the world of business, it was only when the CEO of Microsoft, Satya Nadella, made the decision to buy Activision — the company that made Call of Duty — for US$75 billion that a lot of business people sat up and realized that the metaverse is not just about games. When someone like Nadella is willing to pay that much money for a metaverse-related business, it became clear that this is not just a hype. This is real business.

The metaverse was defined by The Financial Times as a collection of shared virtual worlds which are interoperable, in the sense that people can move between these worlds while taking their digital identity and assets with them. This is a world of business between what computer scientist Jaron Lanier called “economic avatars” — that is, virtual identities that can own property.

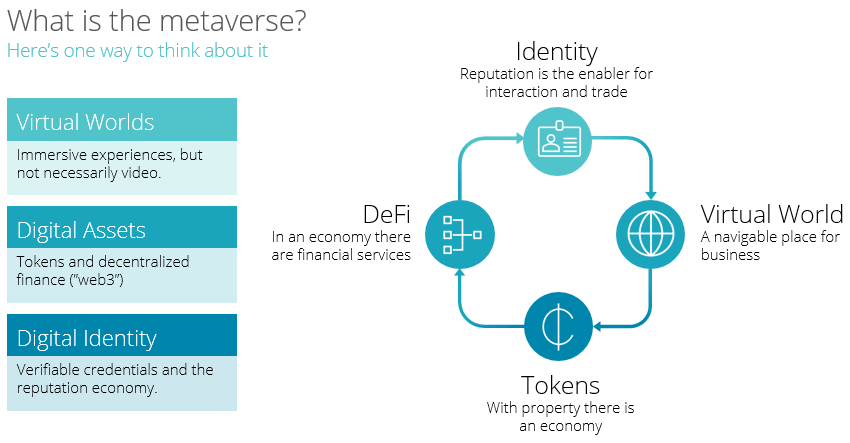

There are four key components to the metaverse. The virtual worlds, digital identities, tokens which make up the digital assets, and decentralized finance protocols (DeFi), which is the protocol on how to exchange tokens.

Virtual Worlds

Let’s start with virtual worlds, which is a navigable place for business. Virtual worlds can mean many things, they might be visual, audio, or tactile. If you’re a commodities trader and you’re in a virtual world where the shapes of the hills depend on the value of a certain commodity, that could be a very different virtual world from a place where I might be visualizing data.

Many years ago, when people used to buy and sell swords in World of Warcraft, I became very interested in how people in virtual worlds could be doing real business. When I asked Richard Bartle, who helped write the very first virtual world: The Multi-User Dungeon (The MUD), if he thought that there are real economies in these virtual worlds, his reply was no. In these worlds, like when people buy World of Warcraft gold, people are buying things that don’t exist from people that don’t own them. When you buy a magic sword, it’s not really yours. It’s still belongs to Blizzard Entertainment or Activision. The value of that sword can go from zero to infinity depending on somebody else’s programming.

Ultimately, that means that virtual worlds alone are not enough to be considered real economies. Simply having virtual worlds is not enough to do business. The important thing, however, is that they’re places where real economies could take place. We would need digital assets to trade, and that comes in the form of tokens.

Digital Assets and DeFi

Jay Clayton at the SEC 2020 said that it everything in the future will become tokenized. It’s tokens which are the key to unlocking new worlds of possibilities. They are what changes the virtual world from being a place where you don’t own things to a place where you do own things, because you can own the tokens. Tokens mean that the assets you buy are not just somebody else’s software anymore.

In the words of the Chief Innovation Officer of Ping An Group, Jonathan Larsen: "Tokens are more important than cryptocurrencies, ICOs, and even blockchain itself. When we have the right regulatory frameworks, we’re going to tokenize everything. Tokens are the key technology.”

Presently there are two kinds of tokens. There are fungible tokens, which is like real money, and there are non-fungible tokens, which are a kind of property. In that token economy, the ability to transact and move real property around in a virtual world means that there is a real economy. And because DeFi protocols allow us to exchange those different tokens, that means there’s a market. Once you have a market, you have financial services. That’s why the metaverse takes us into the world of financial services. The metaverse isn’t just a virtual world, the metaverse is a virtual world with real property, real money, and real transactions in it. Because of that, we can reasonably say that it could be the future of payments and property.

Digital Identity

The missing ingredient in all of this is digital identity. That’s the part of the equation that we haven’t quite gotten right yet. To have a well-regulated market that can function effectively, we need identity as well as money and property. We do not yet have the global, interoperable digital identity solutions that we need for this. We see elements of them coming together and decentralized identifiers and verifiable credentials, but we don’t have them in a consolidated framework. Digital identity is where I would hope people develop more strategies over the coming year.

There are many people who think that banks should be at the forefront of this. It’s actually slightly puzzling that banks haven’t begun tackling this. They have spent billions on Know Your Customer (KYC) and anti-money laundering, and yet they have not turned identity and reputation verification into a business in its own right.

Of course, there are other people that could do it — big tech for example — but we really need banks in that space because we need regulated institutions to manage identities and reputations. I should be able to use my Barclay’s identity from the UK to open a bank account with DBS in Singapore.

Now that we have virtual worlds, tokens, DeFi protocols, and digital identities, we have real markets. So, what kind of financial services can we see on top of that? The answer is all of them.

There are different ways of looking at financial services. They can be divided between the transfer functions and the support functions. Transfer functions in the form of savings and loans are already happening. There are already people who are lending money in these virtual worlds against digital assets. It’s over-collateralized and it needs more regulation, but nonetheless these things already happen.

We can also see the next steps taking place, the visualization, the support functions, the information functions, and most importantly, the risk functions.

Even now, there are at least three ways for companies to start working in the metaverse. For some companies, the metaverse is a just a place to advertise. Customers are there, so they feel that they should go there and make themselves known and to perhaps educate them.

Other companies wish to transact with customers in the metaverse. That doesn’t quite work at the moment because it would require customers to come out of the metaverse to complete the transaction with their credit cards. But we’re not far from being able to do business with stable coins in this environment, and we’ll actually be able to reverse business transactions there as well.

Finally, there are companies that want to take their business into the metaverse, which is when we start to underwrite in the metaverse. We start to consider the digital risks in that space, of which there are many. It will take time for companies to work out how to do that.

A simple model of the metaverse is to say that the virtual worlds, the digital assets, the protocols for trading those assets, and the digital identities that we need to make a regulated healthy market. It’s a very clear way of looking at the concept, and hopefully that helps you to start formulating your own strategies going forward.

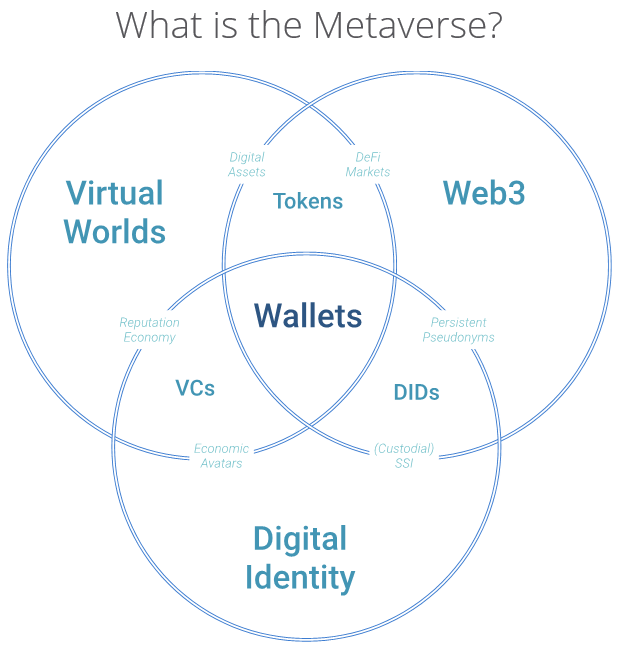

The places where all of the above come together, and what I suggest to be the strategic focus of organizations, is digital wallets. A digital wallet is a financial transaction application that securely stores your payment information. It allows you to pay using your device whether in person or online.

Wallets are the central organizing principle of virtual worlds. They’re the overlap between the customer, the service providers, the universe, and the metaverse. It can also be seen as the interface between the universe and the metaverse. How will customers actually interact with service providers in the metaverse? It will be through wallets. That’s the area for innovation — It all comes down to the wallet.

If you open up your wallet right now and look inside it, for most people, your wallet either contains no money or very little money. Most of the things that are in your wallet are more to do with identity, credentials, and reputation. Those all move into this space of wallets. That means, especially for banks, that having a business strategy when it comes to wallets is critical. Because even if banks are not going to part of the actual payment transaction in the metaverse, they can still play a role in providing the reputation element of the deal.

One of the difficult things there, is hiding the complexity from the customers, because the customers are not going to understand exactly how nonfungible tokens work and exactly how decentralized finance protocols work. They are never going to see DeFi protocols and digital identity standards. They will see either a super app with shared identity or smart wallets with shared authentication. We have to find a way to make the wallet interface easy and intuitive, but this can be done as big tech is already doing lots of wallets.

In summary, it’s actually quite easy to understand the metaverse. The three different areas of development are virtual worlds, Web3, and digital identity, which are all competitive spaces and where your organization should be acting. If you want to ensure a winning strategy in that space, it is vital to be looking at digital wallets.

The Economist released a piece telling people to not mock the metaverse and I completely agree. People spending money on pictures of chimpanzees with sunglasses on seems funny, and of course that doesn’t really mean much, but we can still learn from it. We can still learn about how those protocols work, how they come together, and we can experiment with them now so that we will be ready and have strategies in place to seize the opportunities that the metaverse presents.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy, position, products, and technologies of Huawei Technologies Co., Ltd. If you need to learn more about the products and technologies of Huawei Technologies Co., Ltd., please visit our website at e.huawei.com or contact us.