Produits, solutions et services pour les entreprises

Akıllı Telefonlar, Bilgisayar&Tabletler, Giyilebilirler ve Daha Fazlası

Over the last 20 years, the development of e-commerce in China has accelerated at a rapid pace, largely thanks to Internet giant Alibaba, which began life in 1998. Comparing 2015 to 2019, for example, annual e-commerce Gross Merchandise Value (GMV) doubled in China, reaching CNY32.7 trillion.

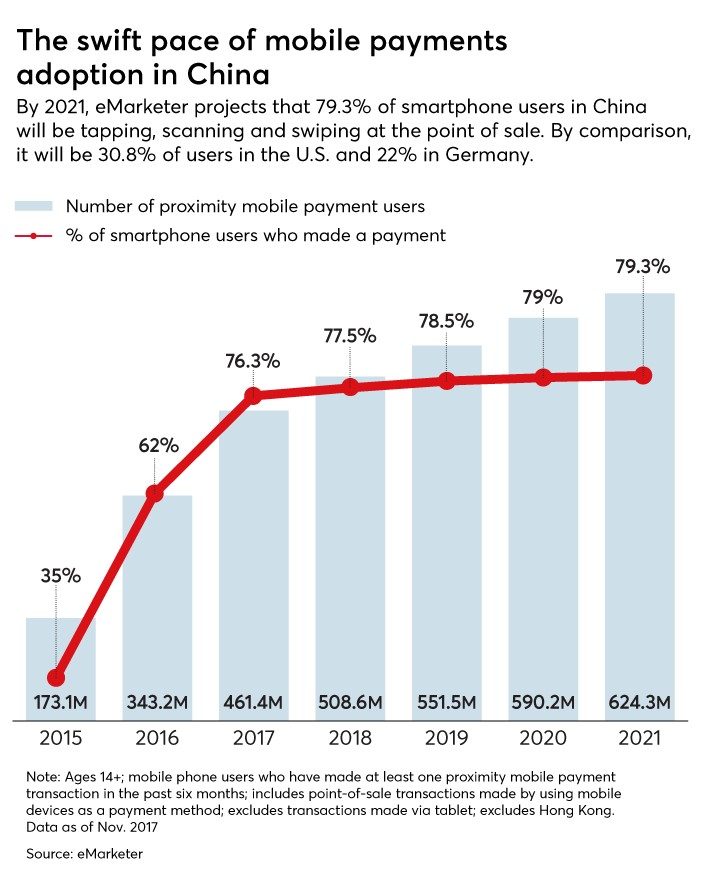

Unsurprisingly, mobile users are a key target group of China's booming e-commerce sector: as of June 2013, China ranked first in mobile commerce penetration globally. Indeed, smartphones have begun to replace computers for many Chinese consumers and, to meet the needs of this trend, many of the major Chinese online shopping stores have begun developing their own mobile apps.

As mobile users began to dominate the consumer market, demand grew for an efficient means to pay for goods — and mobile top-up became essential. In China, there are two e-commerce juggernauts, accounting for at least 90% of the mobile payment market: Alibaba's Alipay and Tencent's WeChat Pay. Alipay, a third party payment platform, was founded in 2004. A decade later, in the second quarter of 2014, it had become the biggest mobile payment service provider in the world.

Alipay's payment services are broad, including online secure transactions, payments, transfers, credit card repayments, and cellphone recharging. From purchasing clothes and groceries at local physical retail stores and supermarkets, to booking taxis or movie tickets — all of these services can be handled with Alipay. It also provides wealth management services such as Yu'e Bao — Alibaba's money market fund — where users invest their cash in a digital wallet and watch their money grow.

With the global spread of COVID-19 in 2020, the world faces unprecedented challenges. Social distancing has become the norm in many countries and contactless mobile payments are playing a more vital role than ever before. Indeed, a spokesperson for the World Health Organization (WHO) highlighted how contactless payments reduced the risk of transmission by cutting out the need to handle cash.

As such, then, the COVID-19 pandemic is having a major impact on the mobile payments industry, as consumers and businesses have been forced to drastically reorient their purchasing habits toward digital. It is a critical time, therefore, for banks to evaluate how the crisis is changing the digital world and identify what opportunities may arise. Banks must accept the widespread adoption of mobile payments if they are to compete with Financial Technology (FinTech) giants and keep their customer base growing and satisfied.

To succeed with this transformation, Based on my work at China Merchants Bank (CMB) and in interactions with other global financial institutions, I have found that the following areas will require the most focus and are critical to your success.

To stay relevant in the FinTech sector, banks must rapidly adopt a mobile first strategy for their digital transformation, in order to attract and retain customers. The primary goals of the transformation should be to improve the user experience, increase process efficiency, reduce operational costs, improve decision-making, and achieve business agility.

Based on my work at China Merchants Bank (CMB) and through interactions with other global financial institutions, I have found that the following areas will require the most focus and are critical to your digital transformation success.

In order to prevent the disruption of ongoing operations, you must protect and stabilize your legacy systems while also addressing the need to separate and expose the functions of those previously monolithic systems.

Many IT organizations still do not recognize that mobile banking is the future — almost all users prefer to deal with banks remotely over their phones. As a result, organizations treat mobility as, at best, a separate silo or channel, and at worst, an unwanted additional platform that receives little support. Moving to a mobile first strategy will allow you to transform your bank from product-centric to customer-centric.

Traditionally, banks thought only in terms of transactions — the customer comes to you to buy a product or service. However, it is now critical to understand the diverse drivers and needs that different customers may have according to their unique life schedule. Becoming focused on meeting those needs will increase customer satisfaction and open new opportunities for cross-selling. Banks should therefore map out customer journeys for one or two products and integrate the customer into a mobile banking platform.

Digital transformation is no easy task; it is an ongoing process that must continuously evolve. Choosing the right ecosystem partner is incredibly important and involves more decision-making than merely identifying a suitable technical service vendor.

As a global leader in digital transformation across a wide range of industries — including banking — Huawei has a global reach and insights to support your enterprise on its digital transformation journey.