Produits, solutions et services pour les entreprises

Akıllı Telefonlar, Bilgisayar&Tabletler, Giyilebilirler ve Daha Fazlası

The traditional financial services industry is facing severe challenges. The development of Internet finance and mobile Internet has greatly changed financial services in the fields of payment, loan, investment, wealth management, customer engagement, and customer services. By incorporating Internet services, FinTech companies provide extensive financial services, enabling disintermediation or turning traditional financial enterprises into channels.

Against this backdrop, financial enterprises need to seek solutions to address these challenges and regain their leadership in the finance field, especially in retail. At the same time, the concept of bank 4.0 makes open banking a popular trend. In fact, open banking becomes a practice model for the next-generation banking business transformation and innovation. The current financial innovation does not simply add new technologies to traditional financial services. Instead, it represents in-depth business transformation with the support of new technologies.

In the future, banks will be everywhere and financial services will be seamlessly integrated into people’s lives.

Open finance brings both opportunities and challenges to traditional financial enterprises.

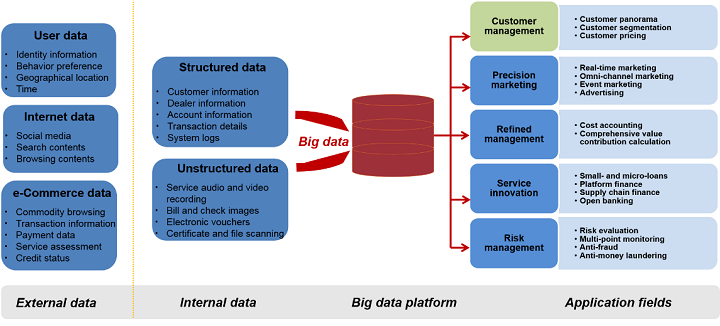

How can they achieve openness? How can they build a new business system under the framework of open finance to attract customers and reap profits? The answer is to make good use of data. Financial enterprises have always been the important producers, owners, and users of data, which is determined by their business characteristics. Among them, banks rely most on data utilization. Data analysis and decision-making models are of particular significance to banks. In the new round of financial business transformation, data empowers innovation and transformation. Financial enterprises should fully explore the value of data and establish business systems to monetize it.

In the future, a financial enterprise’s ability to use data will become the key to its digital transformation.

In fact, data analysis and Artificial Intelligence (AI) technologies have been widely used in front, middle, and back offices. For example, in front offices, customer data analysis and AI interaction improve customer services and experiences. In middle offices, data analysis and AI detect fraud and prevent risks. In back offices, data is comprehensively analyzed and presented to help banks improve management and make informed decisions.

Now, data enables business-model innovation and open financial service development. For instance, combining external and internal customer data produces more accurate credit ratings, which can be used to issue small loans and improve revenue and customer experiences while lowering risks and operating costs.

The following figure shows financial big data application scenarios:

Figure 1: Financial big data application scenarios

Financial enterprises' data utilization consists of the following phases:

Figure 2: Phases of financial big data applications; from big data to AI

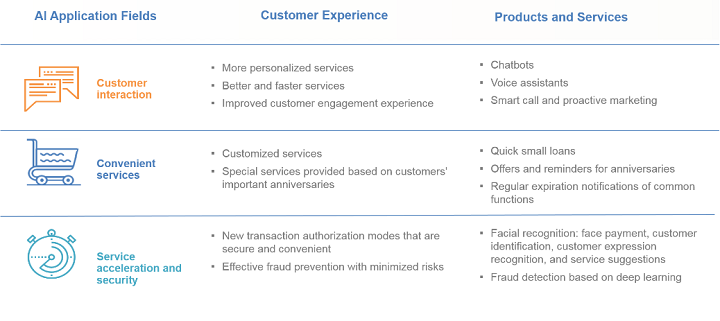

AI uses computers to mimic human thinking processes and intelligent behavior (such as learning, reasoning, thinking, and planning). AI explores computer intelligence principles, and how to make computers similar to human brains to support applications at higher levels. AI is driven by a large amount of data and embodies an in-depth application technology based on big data technologies. Applying AI to the financial services industry is a hot spot now. In the near future, AI will be used in customer services, risk management, and product innovation.

Figure 3: Application of AI in banks

Huawei has long been committed to the research of big data platforms, distributed databases, and AI. Huawei has established eight research centers worldwide and employs thousands of related R&D personnel. Huawei’s top experts have developed hundreds of patented technologies in these three fields.

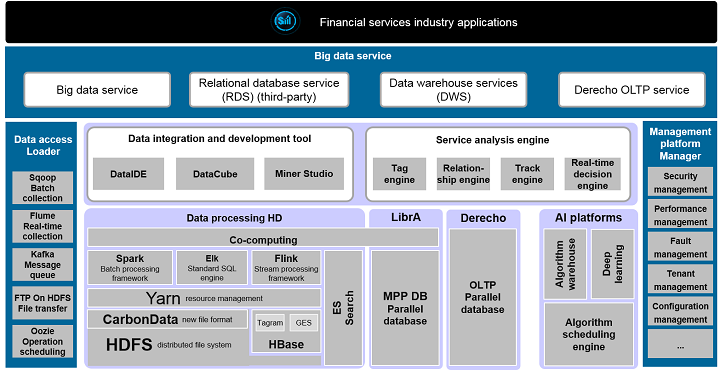

In the big data and AI fields, Huawei provides financial customers with end-to-end solutions, including a big data infrastructure platform (network, server, and cloud platform), a data processing platform, a parallel computing platform, an implementation analysis platform, a management platform, and an application development platform. Additionally, adhering to the “Platform + Ecosystem” strategy, Huawei also develops big data and AI applications by collaborating with ecosystem partners.

Huawei’s big data and AI platforms have been adopted by dozens of banks worldwide, covering replacement of traditional data warehouses, real-time analysis and application of big data, and AI applications. Huawei’s big data platform and ecosystem solutions regarding customer insights, proactive marketing, risk management, and innovative services allow full data mining and application, helping customers continuously create business value and maintain a competitive edge.

Figure 4: Huawei FusionInsight big data and AI platform

Huawei’s big data and AI platform offers the following features: