Promoting Inclusive Financial Services to Build a Fully Connected, Digital World

This site uses cookies. By continuing to browse the site you are agreeing to our use of cookies. Read our privacy policy>

![]()

Enterprise products, solutions & services

By applying mobile, data, open architecture, and security technologies, Huawei has developed integrated financial solutions (including mobile wallets, mobile payment, and micro and small business financing platforms) to fuel the growth of inclusive financial services and boost the digitization of banks.

As digital technologies, the Internet, and mobile communications become more integrated with the financial services industry, financial transaction modes and service models are evolving. Digital, mobile, and intelligent financial inclusion have become significant trends.

At the 2016 G20 Hangzhou Summit, the concept of Digital Financial Inclusion (DFI) was first proposed. According to the G20 Global Partnership for Financial Inclusion (GPFI), DFI refers broadly to the use of digital financial services to advance financial inclusion. The process involves the deployment of digital technologies to reach financially excluded and under-served populations, with a range of formal financial services explicitly suited to their needs and delivered responsibly, at a cost that’s affordable to customers as well as sustainable for providers.

Aligned with its vision for a fully connected, intelligent world, where digital services are available to everyone, Huawei aims to use connectivity technology to make inclusive financial services affordable and sustainable. Through various digital means, Huawei strives to provide equal, effective, comprehensive, and convenient financial products and services for all social groups, especially disadvantaged and low income households, as well as micro and small enterprises.

The idea of Financial Inclusion was first proposed by the United Nations in 2005 — the International Year of Microcredit — and it means, in effect, a financial system that can effectively, comprehensively, and conveniently serve all segments and groups of society.

DFI differs from traditional financial inclusion in three main ways:

Wider coverage: DFI relies on digital technologies such as the Internet and mobile communications to deliver reachable services within signal coverage, under the premise of wide coverage of basic communications facilities.

More accessible financial services: Big data technology enables banks and their regulators to better understand customers, manage risks, and lower the threshold for financial services. Micro and small enterprises, as well as low income households, have access to financial services such as credit and investment/financing, whereas previously they had difficulty reaching traditional financial services.

More closely related to people’s lives: Digital inclusive financial services are more scenario-specific. Digital technologies, especially mobile technologies, can be used to integrate financial services into work and general life, improving efficiency and boosting the economy. Financial enterprises can also build one-stop service platforms by providing digital financial services for users.

In low- and middle-income economies in Africa, the vast majority of economically disadvantaged people are often marginalized from modern financial life and become ‘invisible’ in the financial service system. They are unable to access savings, insurance, and credit services at an affordable cost. When formal financial services aren’t available, they turn to informal financial instruments, such as loans from local non-financial institutions and facilities from rural mutual aid associations. As a result, they have to pay high service and transaction fees, increasing the costs and risks of financial services.

In recent years, the popularization of mobile communications has provided necessary conditions for the rapid development of the digital economy, significantly boosting financial inclusion. Between 2005 and 2017, the number of mobile users in Africa increased from 87 million to 760 million, with an annual growth rate of 20 percent making it the fastest-growing market in the world. The mobile network coverage rate in African countries now ranges from 10 percent to 99 percent, with an average rate of 70 percent. Through mobile financial platforms such as mobile banking and mobile wallet, transactions are carried out at marginal cost. In other words, it is much easier to provide affordable financial services to the economically disadvantaged. In this context, enterprises will be more motivated to provide formal financial services to meet the needs of low-income groups.

In 2007, Safaricom, a telco with a market monopoly in Kenya, launched M-PESA, a mobile wallet for feature phones that enabled people to transfer money. In 2012, Safaricom started cooperating with Huawei to develop M-PESA’s capabilities using new mobile technologies.

M-PESA has grown quickly and become a leading mobile wallet service provider in Africa. The service covers seven countries — Congo, Egypt, Ghana, Kenya, Lesotho, Mozambique, and Tanzania — with 37 million active users and more than 400,000 service agents. These offline agents are often small retailers, post offices, and gas stations scattered in towns and villages, through which people can top up, transfer, pay, and even withdraw money, just like Automatic Teller Machines (ATMs).

With M-PESA continuing to grow, Safaricom also cooperates with 25 banks, including NCBA Bank Kenya and KCB Bank Kenya, to provide micro and small deposits and loans through the M-PESA mobile wallet. M-PESA cooperates with these banks on services such as Fuliza, which allows M-PESA customers to complete their M-PESA transactions when they have insufficient funds in their M-PESA account, and m-Sharia, a Sharia-compliant banking service.

Banks are important players in the financial inclusion field. For example, Equity Bank, which has nearly 200 branches and more than 30,000 agents in Kenya, is well-known for its agency banking mode. It is one of the leading enterprises providing financial services to Small- and Medium-sized Enterprises (SMEs) in Kenya.

Overseen by the central bank, third parties (such as shops) authorized by commercial banks can provide financial products to the public and become part of the retail network of commercial banks. These agents provide basic financial services through cellphones for people in remote rural areas where banks don’t have branches.

Integration of finance, the Internet, and technology has generated many new services, such as mobile payments, online finance, electronic bills, and virtual currencies. As well as being inclusive, financial services are becoming more virtualized and around-the-clock across industries and markets. However, this also has negative consequences: risks spread quickly and are difficult to identify. Traditional financial supervision approaches fail to effectively monitor, identify, control, and cope with these risks, creating a need for supervisory technology. Supervisory agencies use innovative technology to monitor, identify, and cope with risks, maintaining a balance between financial innovation and financial security. Meanwhile, as financial transactions become more frequent, a massive amount of data is generated every day, exceeding the capacity that manual analysis and processing can handle. In these circumstances, supervisory technology is also helpful in improving financial data analysis and processing capacity, reducing costs. In the context of strengthening financial supervision, new, more intricate financial supervision policies are rolled out frequently, and risk prevention and control responsibilities have shifted from regulators to financial institutions. Financial institutions and supervisory agencies need supervisory technology to improve their policy execution, prediction, and supervision capabilities. Meanwhile, the digital capabilities of financial regulators are improved in three ways.

Automatic extraction of data: For example, the central bank of Austria — OeNB — uses the Austrian Reporting Services (AuRep) system as an intermediate platform. After automatically obtaining fragmented raw data of commercial banks, the AuRep system converts the data based on standard rules, and pushes the converted data to the central bank. This greatly reduces the data reporting and compliance burden of the monitored objects and ensures the consistency and quality of data used by all departments of the central bank. The National Bank of Rwanda uses an Enterprise Data Warehouse (EDW) to periodically and automatically extract data from the IT systems of more than 600 regulated institutions, including commercial banks, insurance companies, microfinance institutions, and telcos.

Strengthened data verification and processing: To take an example, the Bank of Italy uses suspicious transaction reports (structured data) and news commentaries (unstructured data) to detect money laundering. Data visualization technology can also be used to transfer processed information to regulators in a way that’s visualized and easy-to-understand. Another example of this improved data processing can be seen at Dutch bank ABN AMRO, which converts data into logical forms such as traffic signal lights and dashboards. The Monetary Authority of Singapore also uses interactive dashboards and network diagrams to visualize data.

Cloud computing technology applied to data processing: To reduce data processing pressure and costs and increase the storage capacity of regulators, the Financial Conduct Authority of the UK, the National Banking and Securities Commission of Mexico, ABN AMRO, the Monetary Authority of Singapore, and the US Securities and Exchange Commission have all used cloud computing to process massive amounts of data.

To meet the data-processing capacity requirements of financial regulators, Huawei provides a converged data platform solution, which integrates structured and unstructured data management, Distributed Databases (DDBs), and converged data storage devices. It also integrates data virtualization and data enablement platforms, and provides end-to-end solutions covering front-end data access, storage, processing, analysis, and governance for customers in the Financial Services Industry (FSI). Using Huawei’s full-stack hardware, this solution helps industry customers optimize performance, from chips to platforms, helping customers build data analysis and processing platforms with improved performance.

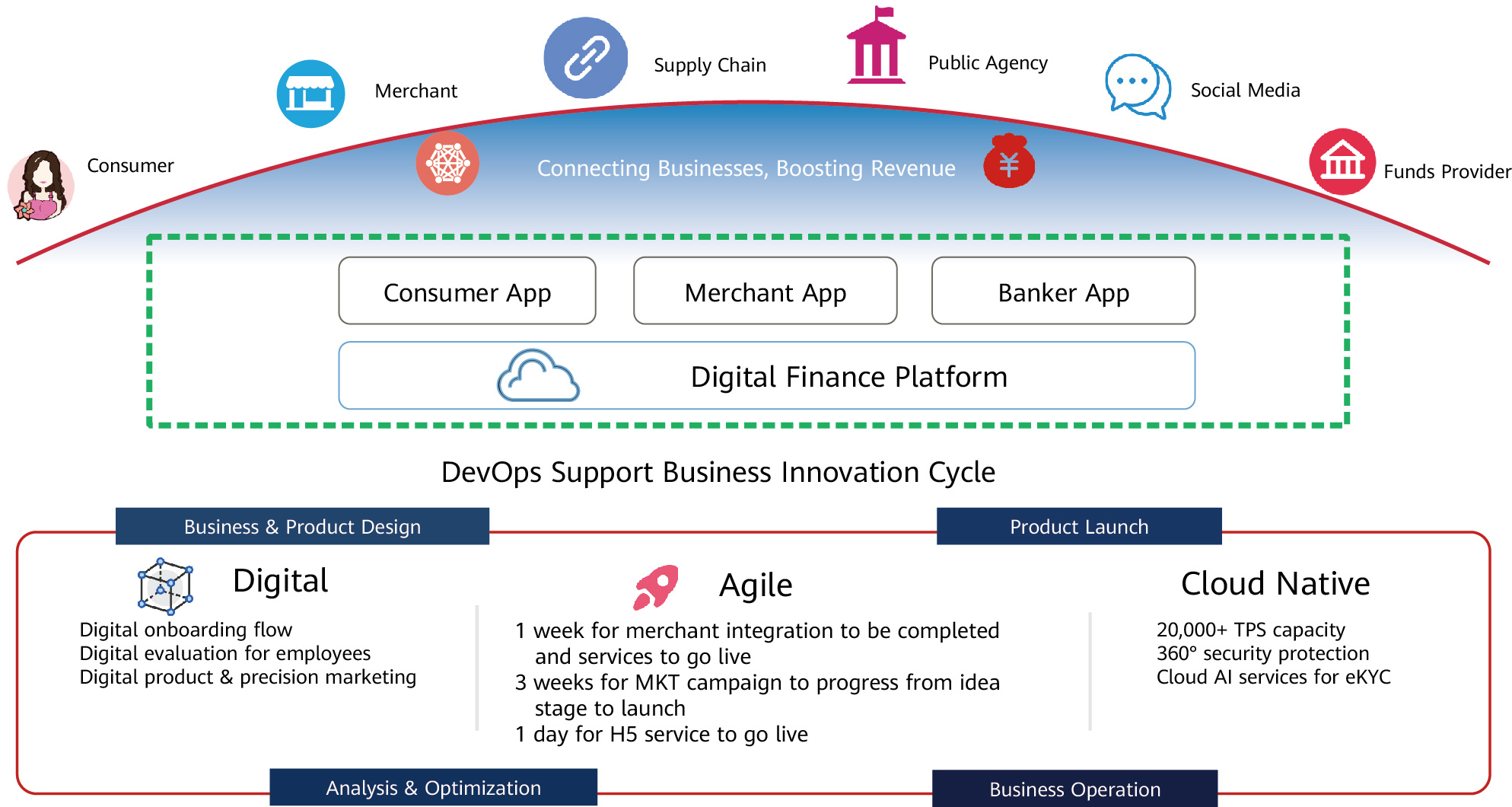

Figure 1: Huawei’s Mobile Money Solution

Credit and payment infrastructure is an element of every country’s financial infrastructure, and is critical to solving the problems that hinder inclusive financial development, such as information asymmetry and high transaction costs. The progress made by countries in promoting financial inclusion is largely reliant on the construction of financial infrastructure.

• Enhance Payment Infrastructure Construction

In many countries, central banks have led efforts to work with other stakeholders to establish reliable nationwide payment system infrastructure. Meanwhile, countries are focusing on the construction and maintenance of payment and settlement infrastructure in remote areas to ensure its stable operation. The construction and improvement of such infrastructure promotes the expansion of the physical networks of financial institutions, improves the diversity and efficiency of payment products, and boosts the digitalization of Government-to-Person (G2P) payments.

• Promoting the Digitization of G2P Payments

In recent years, several countries have implemented policies to benefit farmers, such as subsidies for agricultural workers, new rural pension subsidies, and new rural cooperative medical subsidies. Generally, these subsidies are widely distributed in small amounts. If they are distributed in cash, there are many procedures and the distribution costs are high. To resolve these problems, the Thai government, for example, directly grants subsidies to individuals through the mobile wallet platform of Krung Thai Bank (KTB), binding personal debit cards or Know Your Customer (KYC) information, leading to more people owning and using personal bank accounts. Residents receive subsidies using their bank cards, without needing to leave their villages. By using the bank’s KYC information, the government can ensure that the subsidy recipients are correctly identified and traceable, preventing impersonation and misappropriation of subsidies.

Evolution from mobile wallets to digital payments has become a popular way for governments to develop a cashless strategy. This evolution may further improve the experience of inclusive financial services and effectively explore the value of long-tail customers. For example, in Myanmar, Huawei’s mobile payment solution has helped KBZ Bank take a leading position in the mobile payment market within a single year. This solution uses Huawei’s core technologies and integrates the innovative spirit of FinTech companies.

• Promoting the Construction of the Digital Credit Investigation System

In recent years, the People’s Bank of China has promoted the construction of a credit investigation system to reduce information asymmetry between borrowers and lenders and provide responsible loans to enterprises and families. The Credit Reference Center of the People’s Bank of China collects data from more than 3,000 financial service providers, including banks, rural credit cooperatives, micro finance companies , insurance companies, and other non-bank financial institutions. It provides information based on the query requests of these organizations. By June 2019, the People’s Bank of China’s credit reporting system had collected information about 990 million people and 25.91 million enterprises and organizations. Average daily queries of individual and enterprise credit reports stood at 5.5 million and 300,000, respectively. The enterprise credit reporting system of the People’s Bank of China covers 13.7 million micro and small enterprises, accounting for 53 percent of all registered enterprises. Among them, 3.71 million micro and small enterprises have received credit support, with a loan balance of CNY33 trillion (approximately US$4.7 trillion).

The People’s Bank of China has also recognized the role that the private sector, particularly emerging financial technology companies, can play in improving China’s credit infrastructure. On February 22, 2018, it released a bulletin on its official website, stating that the personal credit investigation service of Baihang Credit had been approved. The shareholders of Baihang Credit include the National Internet Finance Association of China, which holds 36 percent of total shares, and eight Internet companies: Tencent Credit Information Co., Ltd.; Sesame Credit Management Co., Ltd.; Shenzhen Qianhai Credit Center Co., Ltd.; Pengyuan Credit Service Co., Ltd.; China Chengxin Credit Information Co., Ltd.; Zhongzhicheng Credit Information Co., Ltd.; Lakala Credit Management Co., Ltd.; and Beijing Huadao Credit Reporting Co., Ltd.

Meanwhile, access to more public information through the credit reporting system will facilitate financial inclusion. Government departments such as tax, business, and judicial sectors have a large amount of valuable data related to individuals and micro and small enterprises, but the information is often difficult to obtain. To address data-related issues, China needs to establish a complete legal framework for data and privacy protection, including the use of public information and alternative data.

To meet the requirements of financial infrastructure construction, Huawei provides an Artificial Intelligence (AI)-based credit assessment service solution. Based on the end-to-end service data of mobile wallet, mobile payment, and mobile financial products, Huawei helps financial institutions perform customer profiling and credit assessment.

China has a leading global position in promoting financial inclusion development because of its abundance of sophisticated financial technology, especially in payment infrastructure and credit infrastructure construction, which can serve as a good reference point for other developing countries. Chinese companies have also played an important role in FinTech development in Emerging Markets (EMs). Huawei plays a key role in telecom infrastructure construction in these EMs, eliminates the digital divide by building an inclusive connected network, and builds a solid foundation for financial inclusion based on connectivity.

Huawei has become the most important technology and solution provider for mobile financial services. By applying mobile, data, open architecture, and security technologies, Huawei has developed integrated financial solutions — including mobile wallets, mobile payment, and micro and small business financing platforms — to fuel the growth of inclusive financial services and boost the digitization of banks.

Huawei’s Mobile Money Solution has been used worldwide for 10 years, and it serves 206 million users, bringing huge benefits for banks and carriers. With growing cooperation between EMs, boosted by the China’s Belt and Road Initiative, Huawei aims to build on its DFI successes and cooperate more with financial institutions in fields such as supervisory technology and FinTech services.

Figure 2: Global Practices of Huawei’s Mobile Money Solution