This site uses cookies. By continuing to browse the site you are agreeing to our use of cookies. Read our privacy policy>

![]()

This site uses cookies. By continuing to browse the site you are agreeing to our use of cookies. Read our privacy policy>

![]()

Enterprise products, solutions & services

Mobile is transforming everything. Most of us are now turning to mobile devices for everyday services, from getting a ride to ordering groceries. Banking, of course, is no exception.

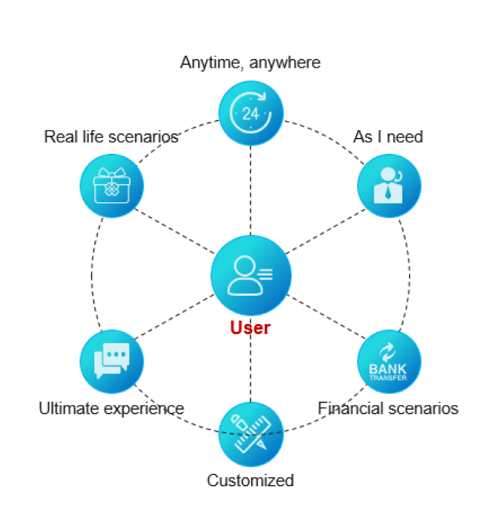

This transition to mobile has changed what people expect from their banking services. They want banking to be easily available whenever they need it no matter where they are. On top of basic digital banking, users want a customized experience tailored to their needs rather than a one-size-fits-all approach. They also expect a seamless user experience, not needing to spend lots of time figuring out how to get things done.

On top of customization and ubiquity, users want diversity. In the past, mobile banking apps mostly focused on basic transactions, service payments, and tracking account balances, but users now expect to do more on their banking apps. They want their payment systems to connect with other parts of their daily life, increasing convenience and improving user experience.

Figure 1. What do users expect from mobile banking?

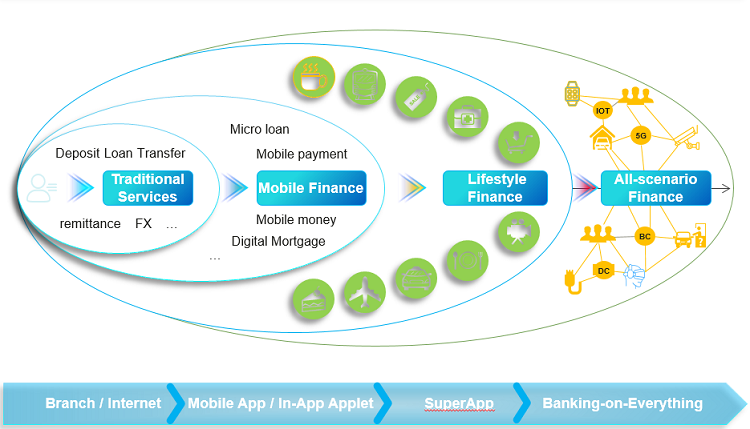

In response to these changes in user expectations, banks are moving away from traditional mobile banking applications to mobile applications which support lifestyle services. This is not a one-time switch that happens overnight. Rather, as shown in the figure below, it's an evolution that starts with traditional services, then shifts towards mobile finance, lifestyle finance, and eventually all-scenario finance.

Most larger banks have already developed robust mobile finance applications, offering mobile payments, mobile money, and digital mortgages, however banks are just starting to explore lifestyle finance, which is facilitated by SuperApps that integrate a wide range of different services and connect them to the bank. All-scenario finance will be the next step in banking, enabled by cutting-edge technologies like IoT and cloud. Finance will be seamlessly integrated with every aspect of daily life, assuring a whole new level of security and convenience.

Figure 2. The evolution of digital banking

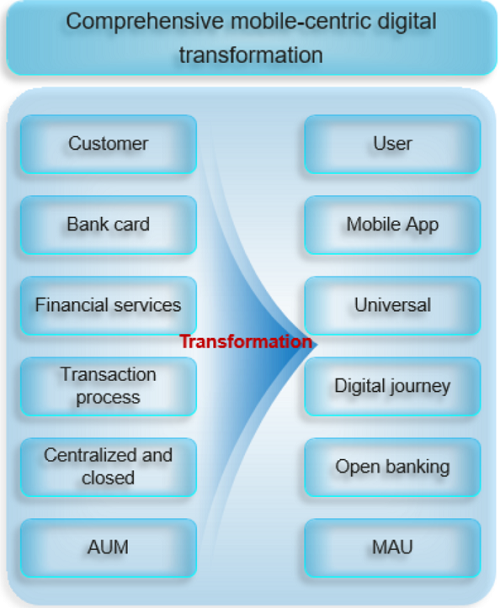

The first mobile apps developed by banks focused on customers and their basic daily banking transactions. Now, customers expect more, so banks are shifting towards platforms where you can plug in a wide range of new capabilities.

On these platforms, customers and non-customers become users and banks measure the success of these application by looking at the number of monthly active users (MAU) or engagement. Users rarely need physical bank cards anymore and instead pay with the mobile app. Instead of transactions, banks support entire user digital journeys. And most importantly, instead of just providing financial services, SuperApps are a lot more universal. They provide a wide range of services and products through partners, such as buying event tickets, order a taxi, purchasing insurance, shopping for travel products, and so on.

Figure 3. Transformation from traditional banking to banking on a SuperApp

Banks can't develop all these things on their own. Instead, they need to seamlessly integrate products and services from partners and other stakeholders, to then deliver this optimal universal experience to their users. The result is a customer-centric SuperApp.

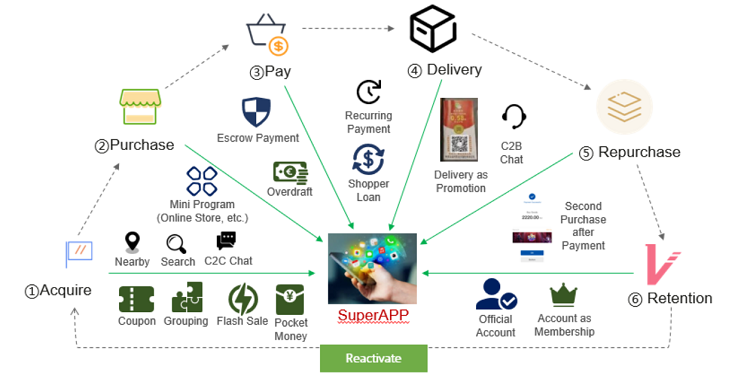

The big advantage of SuperApps is that banks don’t need to write all of the code for every service from scratch. Instead, they deploy a standard platform that can support a wide range of services and then provide open APIs for partners to plug in their offerings. These services allow banks to acquire users and incentivize engagement through purchases and payments. Upon delivery, users are encouraged to repurchase, which drives user retention and reactivation.

Figure 4. User experience cycle on a SuperApp

To offer such a suite of services, digitalization is crucial. In fact, digital transformation needs to be at the core of a bank's strategy; comprehensively digitalizing systems and processes to engage users through mobile apps. This type of change will ripple throughout the organization, not just customer-facing services.

The fact is, banks will need to go digital to stay competitive in the constantly evolving markets. They will need to become a platform that ties together a wide range of services, finding new ways to attract and retain users. This will expand into new types of services that will be supported by cloud and IoT, services we may not have come up with yet.

A few of Huawei's customers have launched SuperApps that have been very successful.

A leading bank in Singapore opened over 500 APIs to partners, onboarding more than 4000 partners to provide services through the bank. For example, users can order a ride with Grab, a local ride-hailing service and pay for it through the bank.

Another large bank in Southeast Asia adopted a digital wallet strategy, signing up lots of merchants, so users could pay for goods and services using the bank's digital wallet. This created a strong ecosystem, and the bank went from 1 million traditional banking customers to over 9 million users on their mobile app. Now, they can also monetize activities like gaming and e-commerce.

In addition, SuperApps represent an important tool for financial inclusion. Currently, there are 1.7 billion people who are still unbanked, for reasons like service costs, geography, lack of money or documentation and trust.

MPesa, our partner in Kenya, offers a wide range of services on its app, able to engage users who may not yet have a bank account. They start off with transferring money to others and paying merchants or bills. Then, they move onto small savings or micro loans. And eventually, they become used to transactions on the app, building trust toward financial institutions.

Another important feature of SuperApps is that they can support what we call mini apps or mini programs. This relatively new concept came from China's SuperApps like WeChat and Alipay, which integrate pretty much every aspect of daily life, from social media, to payments, to shopping, and more.

Normally, if you offer many different services on an app, you need some sort of admin capacity to support them. Mini apps eliminate the need for labor-intensive maintenance and investment in app development by the bannk. They are essentially small apps that exist within the ecosystem of a larger app and have a certain set of limited capabilities.

For example, a shopping center can create a platform where every merchant in the mall can launch an eCommerce mini program. Small businesses no longer need to develop their own apps, but instead use the preset low- or no-code platform to provide new services. This also doesn't affect any other systems in the shopping center's app, preventing issues in user experience and compatibility.

Banks can provide a similar set up on their SuperApps, allowing even small merchants and partners to participate in the SuperApp economy.

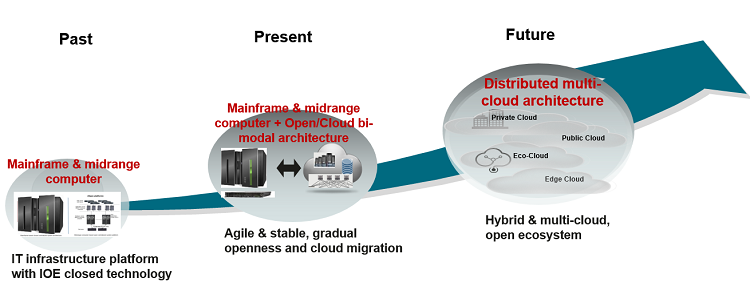

A big part of going digital is cloud migration. In the past, banks had their systems deployed entirely on-premises using mainframe computers. At the time, this was sufficient. But today, the wealth of services, transactions, and user expectations have pushed banks to migrate at least some of their services to the cloud, whether as an on-premise Private Cloud or using a Public Cloud. Increasingly, banks will adopt a mixed architecture, where they use on-premises mainframe and mid-range computers alongside a public or private cloud.

As they advance in their digital transformation journeys, banks will move towards a multi-cloud or hybrid cloud set up, using a combination of private and public clouds, their own data services, and SaaS applications. This enables more agility and openness, adds efficiency to many processes, and allows banks to aggregate and analyze data.

The next trend we are seeing is the move towards distributed multi-cloud architectures that also make use of edge clouds. This shift is driven by IoT technologies that are interconnecting things in all new ways. It's also a way to reduce transaction latency and secure data closer to the user. Right now, some of these edge clouds are simply a small computing box that runs virtual containers just like a data center would, but with processes happening close to the user. We expect that the use of such distributed architectures will evolve, enabling all-scenario finance.

Figure 5. Cloud migration for finance

One excellent example of this digitalization process is China Merchant's Bank (CMB), one of the largest commercial banks in China. The bank has gone from traditional banking, to mobile first, and now mobile only. Not only do they focus on driving up MAU and user engagement, but employees also communicate with customers directly through the bank's mobile app. It even provides services like video conferencing between staff and customers and robotic agents to provide more efficient customer care.

To get there, the bank has transitioned its core systems to an open cloud environment that uses both public and private clouds. This was a journey rather than an overnight process. CMB started with a mainframe system and then shifted to a bimodal approach that used a mainframe and a cloud for its mobile app and new services. Then, over time, it transitioned its mainframe to the open cloud using OpenStack, Kubernetes, and open containers.

This has resulted in an elastic and agile system that supports innovation, which is going to be one of the primary competitive edges for the bank in the future.

None of these technologies matter if banks don't forge strong partnerships or prioritize collaboration. As mentioned already, banks can't create SuperApps on their own, they need partners to increase engagement and interaction on their apps.

When it comes to all-scenario finance that is seamlessly integrated with our daily lives, IoT alone can't make it happen. We need different stakeholders, as well as policymakers, to be on board with this type of integration. Various industries, including finance, technology, retail, healthcare, mobility, and many more need to work together to create a robust ecosystem that delivers the ultimate user experience.

Above all, this ecosystem needs to have a sense of trust and security. This means deploying technologies that are secure-by-design and compliant with industry regulations. Only then can we expect to unleash the full potential of digitalization for the global finance industry.