How Should Banks Respond to the Rapid Growth of Mobile Payments?

Enterprise products, solutions & services

Banks must quickly adopt a mobile-first strategy for their digital transformation, and devise strategies to compete with FinTech giants. Above all, they must focus on attaining and retaining customers.

The eCommerce industry has developed rapidly in China over the last two decades, with eCommerce Gross Merchandise Volume (GMV) reaching CNY32.7 trillion (approximately US$4.7 trillion) in 2019 — almost double the figure of 2015.

Such rapid growth has been facilitated by the rise of mobile payments. Mobile users have been an integral market for China’s booming eCommerce sector in the last decade, with many consumers now preferring to use smartphones instead of computers to shop online. Indeed, as early as June 2013, China ranked first globally in mobile commerce penetration.

Two payment apps account for at least 90 percent of China’s mobile payment market: Tencent’s WeChat Pay, and Alipay, a third-party payment platform established by Alibaba Group. Alipay’s payment services include online secure transactions, transfers, credit card repayments, and cellphone credit recharging. It also provides services for retail department stores, movie theaters, supermarket chains, and taxis. Early on — by the second quarter of 2014, to be precise — Alipay established itself as the biggest mobile payment service provider in the world.

As well as its payment services, Alipay also provides wealth management services such as Yu’e Bao — a money market fund launched in June 2013 by an affiliate of Alibaba that allows users to manage their savings, invest, and make payments.

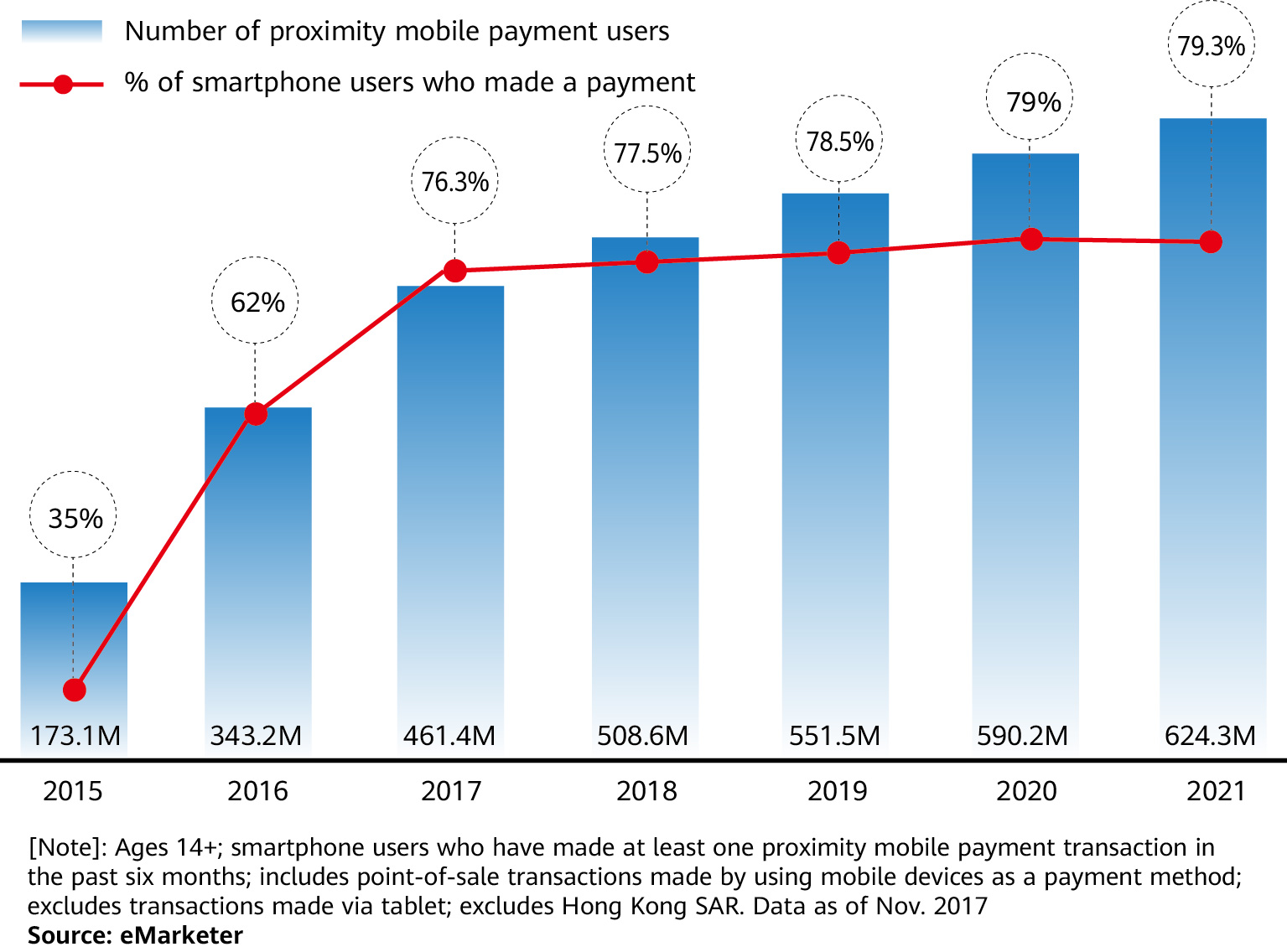

By 2021, eMarketer projects that 79.3 percent of smartphone users in China will be tapping, scanning, and swiping at the point of sale. By comparison, the figure in the US will be 30.8 percent, and just 22 percent in Germany.

As well as the greater range of mobile payment applications and functions available, COVID-19 is also affecting the way people spend, transfer, and manage their money. With the pandemic bringing unprecedented challenges to countries around the world, many governments have advised their citizens to minimize social interactions. In these circumstances, a World Health Organization (WHO) spokesperson recently recommended the use of contactless mobile payments whenever possible to minimize the risk of transmission involved in handling physical money.

Therefore, the pandemic is having a major impact on the mobile payments industry, as consumers and businesses have been forced to drastically change their purchasing habits, becoming more reliant on digital payments.

For banks, now is a critical time to reflect and to understand the threats and opportunities presented during this crisis. They must also adapt to the digital world dominated by mobile payments, and devise strategies to compete with FinTech giants. Above all, they must focus on attaining and retaining customers.

To succeed in these circumstances, banks must quickly adopt a mobile-first strategy for their digital transformation in order to attract and retain customers. The primary goals of the transformation should be to improve the user experience, increase process efficiency, reduce operational costs, improve decision-making, and achieve business agility.

The swift pace of mobile payments adoption in China

Based on my work at China Merchants Bank (CMB) and in interactions with other global financial institutions, I believe that there are several areas that are critical to success in this transformation — they will require the most focus.

• Stabilize Legacy Systems

To prevent disruption in ongoing operations, banks have to protect and stabilize their legacy systems while also addressing the need to separate and expose functions of these previously monolithic systems.

• Make Mobile-First the Focus for Customer Interactions

Many IT organizations don’t realize that mobile access is how all users will prefer to deal with banks in the future. As a result, they treat mobility as, at best, a separate silo or channel; at worst, they see it as an unwanted additional platform that they make little effort to support. Moving to a mobile-first strategy will allow banks to transform, moving from a product-centric to a customer-centric approach across the board.

• Change the Focus from Transactions to Customer Journey

Traditionally, banks think only in terms of transactions, with the customer simply coming to them to buy a product or service. In the future, however, it will be critical to understand customer behaviors. If banks become adept at meeting such needs, this will only increase the level of customer satisfaction, opening new opportunities for cross-selling. As a starting point, it’s advisable to map out customer journeys for one or two products and integrate them into a mobile banking platform.

• Find the Right Partners and Engage with Them

Digital Transformation isn’t easy. It takes years to achieve, given the technical difficulty involved, and because its objectives keep evolving. To navigate this complex journey, picking the right ecosystem partner is critical. And that entails much more than just choosing a technical service vendor. It’s essential to identify a partner that has broad and extensive digital transformation experience, an international perspective, and a global reach. Huawei, of course, is just such a partner.