Enterprise products, solutions & services

With Financial Technology (FinTech) growing rapidly as a sector, digital banking — any banking services delivered through digital channels, whether provided by traditional banks or independent virtual banks — is on the rise.

In light of this, since 2013, many countries, including China, have issued policies that aim to attract industry and innovation leaders to digital banking. China's 14th Five-Year Plan, Hong Kong's FinTech 2025 Strategy, and the European Union (EU)'s FinTech Action Plan all support the development of digital banking and cloud computing, propelling digital banking to new heights.

Traditional banks are quickly following suit, looking to transform their services — and for good reason. Deloitte's Digital Banking Maturity 2020 report highlights that digital champions outperform peers on the basis of cost/income (–4.0 percentage points) and Return On Equity (ROE) (+1.9 percentage points). Simply put, data drives capable traditional banks — such as China Merchants Bank (CMB) and Singapore's DBS Bank — to accelerate their transformation.

Of course, only through advanced cloud computing technologies and revolutionary infrastructural changes can digital banking truly gain competitiveness. In particular, cloud-native features provide powerful tools for banks to upgrade and innovate their services.

The Cloud Native Computing Foundation (CNCF) defines the use of cloud-native technology to help build and run scalable applications in new cloud environments. Adopting a cloud-native approach gives rise to loosely coupled systems that are resilient, manageable, and observable.

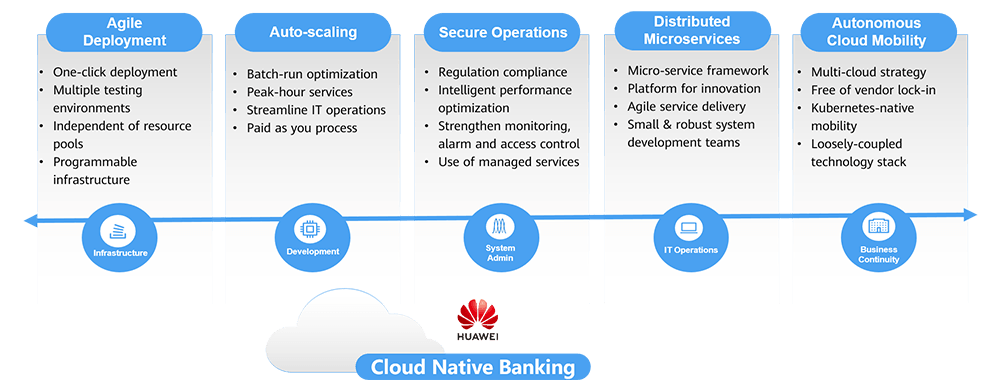

For digital banking, cloud native offers five key features.

1) Agile Deployment: With a wide range of business contexts requiring different testing environment conditions, such as varied batches or parameters, it typically takes at least one to two weeks to build a new environment — from budget approval to resource purchase, reinstallation, and recompilation, through to final deployment. However, thanks to container technology, the cloud-native environment achieves one-click deployment using Infrastructure as Code (IaC) and deployment files. Deploying a complete system set under this process usually takes less than 30 minutes, with resources also able to be reclaimed very quickly.

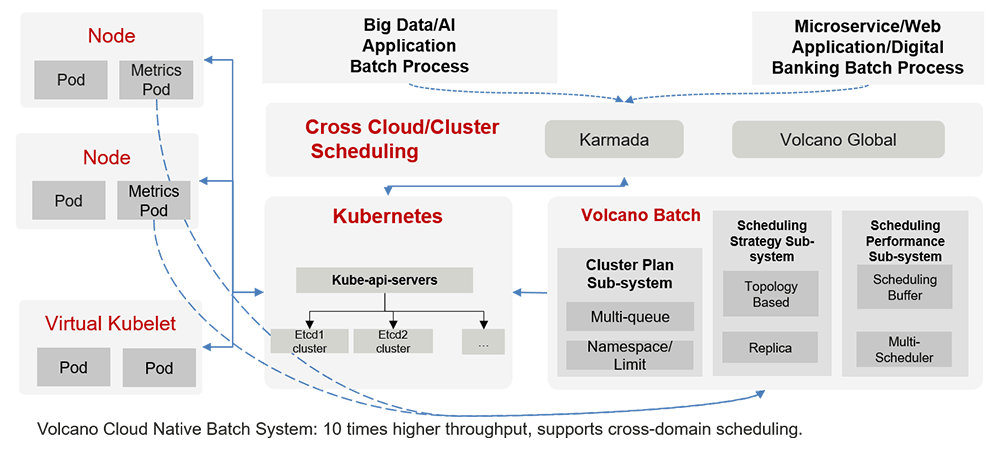

2) Auto-scaling: At night, banking systems process and copy huge amounts of files for core banking services; making time management critical. Normally, this is handled through Operations and Maintenance (O&M) processes that rely on manual controls, monitoring, and alarms. However, when batch processing is performed in a cloud-native environment, the system can automatically scale up or down depending on actual needs, such as the information sequence, Central Processing Unit (CPU) usage, or latency. And this is completely independent of the fixed resource pool, ensuring that the batch is processed in time, while the system remains stable during peak hours.

Figure: Digital banking with the Huawei Volcano cloud-native batch processing infrastructure for auto-scaling

3) Secure Operations: Regulatory banking frameworks have strict requirements on business continuity. For Information Technology (IT) systems, this means high availability. Similar to non-cloud infrastructure, cloud-native digital banking requires multi-site architecture that involves inter-site connection and switchover. However, cloud native is not constrained by infrastructure resources. It can also use the application monitoring, policy design, and management capabilities of a cloud platform to run and switchover applications. In addition, to enhance security, the cloud also provides Security Information and Event Management (SIEM) and third-party Cloud Access Security Broker (CASB) software.

4) Distributed Microservices: Agile development is key for service agility. In a cloud-native environment, microservice architecture — which addresses the coupling issues that Service-Oriented Architecture (SOA) faces — is core for applications and essential to simplifying development. This means that different teams can develop programs and keep them separated for concurrent maintenance, while interconnecting services using a standard service mesh, such as the open source Istio. Each developer only needs to focus on their own microservice development instead of wasting time on complex interconnection and verification. In addition, microservice design is stateless and the application framework is distributed, allowing operations and applications to also be distributed.

Plus, microservice design is stateless and the application framework is distributed, so operations and applications can be distributed as well.

5) Autonomous Cloud Mobility: When deploying key applications on a cloud, banks usually need to choose from one or more cloud providers. This is the basic principle of a multi-cloud strategy, where applications need to be migrated between clouds — named, fittingly enough, cloud-to-cloud migration. Cloud-native deployment relies on the adaptability of deployment files to the cloud and the openness of the cloud platform itself. For cloud platforms using closed technologies, application deployment is relatively complex, carrying portability and migration risks. For highly open cloud platforms, deployment generally complies with open architecture standards and principles to achieve application portability.

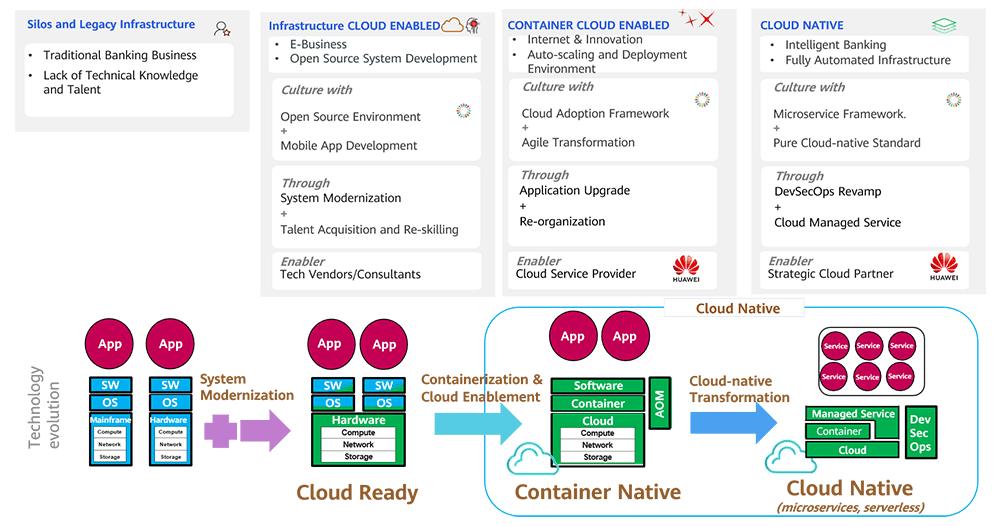

To successfully reach a cloud-native level, traditional banks need to constantly evolve in terms of technology and management. Achieving such a level is no easy feat. For example, some banks only establish a few agile development teams that fail to deliver a final product. Others rely on consulting firms, but when contracts end, the banks are left struggling to implement long-term requirements and lack certain cloud-native features. In Huawei's experience — and see the figure below — cloud-native infrastructure requires not only the relevant service and technical capabilities, but also a cultural transformation with the help of enablers.

Cloud native provides significant momentum for digital banking. It represents a new wave of digital transformation for the finance industry and supports a complete solution for digital banking innovation and iteration, with high transaction volumes and low Internet costs. It also accommodates the complex coupling of IT O&M, based on cloud-native features, such as agility, low costs, fault tolerance, high availability, high performance, and loose coupling.

Cloud-native financial applications will continue to grow. In fact, they are the prerequisite for financial institutions to capitalize on the value of cloud computing. As such, banks should carefully evaluate their current IT architecture and begin looking at their evolution toward cloud native.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy, position, products, and technologies of Huawei Technologies Co., Ltd. If you need to learn more about the products and technologies of Huawei Technologies Co., Ltd., please visit our website at e.huawei.com or contact us.