Prodotti, soluzioni e servizi per le aziende

Users expect more, faster, and better banking services. This goes for everything and credit card services are no exception. Banks that design the best apps for their credit card users and create the optimal user journeys will win against their competition. For this, they'll need technology.

Here, we sum up five ways banks can use new technologies to create best-in-class user experiences for credit card holders.

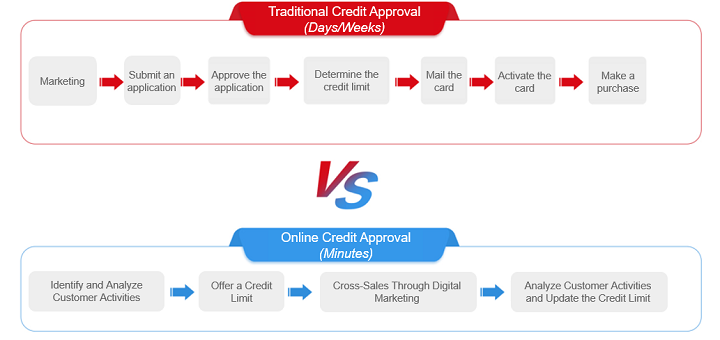

In the past, approving a credit card could be a cumbersome process. It would take anywhere between a few days to several weeks. A sales person would approach the customer, sign a contract, and enter the customer's information in the bank's system. The bank would then check the customer's credit history and approve a certain credit limit. Finally, the bank would send the card to the customer, who would then activate it by phone or making a purchase.

In contrast, online credit approval is much faster and more convenient. Internet companies acquire customers through digital marketing. With the customer's permission, they identify and analyze customer behavior and proactively offer a credit limit. Once the customer gets a credit card, which can be physical or digital, the bank dynamically adjusts the credit limit based on the customer's spending patterns. They also cross-sell other financial products through digital marketing.

Big data algorithms and AI play a key role in this approach. With the customer's permission, these technologies help banks identify, analyze, and use data on customer behavior and transactions in real time. This dramatically accelerates lending processes while also improving customer experience and risk control.

AI and Big Data in Practice

China Merchants Bank uses the Huawei FusionInsight Real-Time Decision Engine to automate its credit approval process. A process that used to take about a week is now nearly instant. Customers immediately receive a virtual credit card, improving their banking experience.

The engine also supports a real-time intelligent anti-fraud system. This has halved the number of high-risk cases, saved CNY100 million in losses, and increased the processing capacity ten-fold. The service continuity has reached 99.99%.

Another example is the Credit Card Center of China Minsheng Bank, which has partnered with Huawei to build a Big Data Joint Innovation Lab. The lab uses machine learning and AI technologies to unleash the value of data and facilitate innovation. Its main goals include improving customer experience, increasing marketing conversion rates, enhancing risk management, and reducing management costs.

China Minsheng Bank now uses a graph database, which takes just five minutes to obtain eight types of inter-related data about 17 million customers. The lab can intelligently identify and analyze customer feedback and respond by delivering over 400 million intelligent services per year. With Huawei's help, the bank has also built a one-stop model development and training platform. Data teams use the platform to iterate algorithms 30% faster.

In 2021, Asian Banker recognized the partnership as the "Best AI Innovation Lab in China" .

China is a global leader in digital payments. The country's and global shift towards digital payments started in the early 2000. Over two decades later, in 2021, 90% of all payments in China were made via mobile apps, according to China UnionPay.

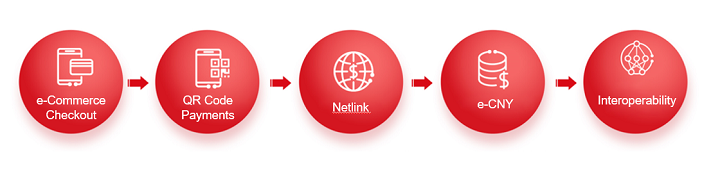

2004 – 2010: Alibaba's Alipay launched a checkout function on the Internet e-commerce platform. Users could link their bank card to an Internet account to pay for online transactions, enabling the rise of e-commerce.

2011 – 2016: WeChat launched its digital wallet, enabling payment through a social media platform. Customers could now pay by scanning a QR code with their smartphone. They could also link their bank account and easily transfer money to others or to their WeChat wallets.

In a bid to popularize digital payments, WeChat Pay launched the "red packet" function, so users could send traditional money envelopes to friends and family through WeChat. The function went viral during the Spring Festival in 2014.

WeChat Pay and Alipay were funded through financing. They used this money to encourage users and merchants to switch to digital payments by providing coupons and discounts. Both quickly became digital payment giants and established complete payment ecosystems. This process disintermediated banks, because they were not involved in the payment processes nor did they have access to user payment data. As such, they could not prevent money laundering and credit card fraud, leading to higher risks in transactions.

2017 – 2019: To better regulate digital transactions, China established Netlink. The organization began to centrally manage online payments performed by non-banking institutions. This meant that WeChat Pay and Alipay had to share the payment data of bank card users with the card issuers, helping banks mitigate fraud risks. That said, WeChat Pay and Alipay remained independent and do not share data with each other.

2020 – 2022: The People's Bank of China announced China's digital fiat currency — the e-CNY, and started trials in many cities across China. Commercial banks also began to innovate. Plus, WeChat Pay and Alipay began to exchange their users' payment data. With the popularity of interest-free installment services, the business model for credit cards continued to evolve.

In the future, we expect that the interoperability within the digital payment system will continue to evolve. Regular credit cards will be further interconnected with UnionPay, Alipay, WeChat Pay, and e-CNY, which will enable personalization through big data analytics. The entire digital payment market will move to a multi-platform architecture involving both banks and Internet companies. This will have a snowball effect on innovation, magnifying the value-add of digital payment ecosystems.

As we already discussed, digital wallets are increasingly popular. Many customers no longer need to carry a physical credit card, instead using a digital card on their mobile wallet. Now, banks have a new space for customer acquisition, activation, and retention — mobile apps. To create a seamless experience for their customers, banks are deploying super apps, which consolidate a range of services in a single app.

Financial services: This includes managing cards, accounts, and credit limits, searching transactions, as well as access to online stores, insurance products, coupons, and installment payments. Banks need robust digital operations to acquire customers through these scenarios.

Partner services: Customers get discounts when they use the app to order food online, pay for meals at restaurants, or take a taxi, increasing the app traffic. For this, the app needs to be interconnected with partner systems through open APIs. This can be challenging and often requires the help of independent software vendors.

Interconnection with third-party platforms: Banks connect with Internet platforms such as WeChat Pay, Alipay, Amazon, and others, so customers can use their credit cards for consumption and payment. For example, customers will receive random discounts for each payment. This is a key way for banks to activate credit card customers and access a wealth of customer behavior data. Banks can also cross-sell their own products to enhance customer loyalty. All this requires a strong software interconnection and data exchange capabilities.

e-CNY as a payment option: Banks encourage customers to use the e-CNY wallet through incentives like cash advances and an interest-free period for credit cards. Afterwards, users repay the bank in installments or merchants pay using the Buy Now Pay Later (BNPL) model.

Super apps connect customers to scenarios while also enabling internal employees and external partners. Banks that develop excellent super apps will surely have a competitive edge. In terms of technology, they will need mobile micro-services, an agile mini app framework, and low code development and operation platform to succeed. Meanwhile, talent and integration will be key challenges for banks.

Banks need both online and offline operations to adapt to the rapidly changing market environment while also satisfying the wide range of customer needs. Banking products can be rather homogenous, so online-offline personalization is key to staying competitive.

As banks started to digitalize, they would channel their investments into underlying technologies, credit scoring, and transaction volumes. Internal operations focused on monthly settlements, bills, and repayments, prioritizing accuracy. Today, cloud computing can expand on these services. It provides nearly infinite computing and storage capacity while mobile networks connect billions of terminal devices. Also, products and services can be tailored to the specific requirements of each customer.

For example, customers can search, classify, and analyze bills in real time. Each customer can have their own interest-free period depending on behavior and spending patterns. They can also customize repayment ratios and amounts. Soon, we will see digital currency like the e-CNY added as an option for credit cards.

For all of this to happen, banks need to transform their internal operations. Processes need to be faster and more automated. Banks also need to prioritize services for app users, who can then be converted into revenue-generating customers.

Another important area is risk mitigation and management. The key is to strike a balance between risk management and customer convenience. Internet companies that can mine value from a wealth of user behavior data in compliance with laws and regulations have an easier time effectively managing risks and providing a better customer experience.

What technologies will banks need? Most importantly, they will require a robust big data platform to collect, organize, analyze, and operationalize data in real time. This will enable both risk management and customer acquisition.

Over half of all complaints received by banks have to do with their credit card services. On top of that, customers sometimes face monetary losses due to credit card fraud, generating severe reputational risks for banks. To retain customers, banks are focusing on providing an improved user experience.

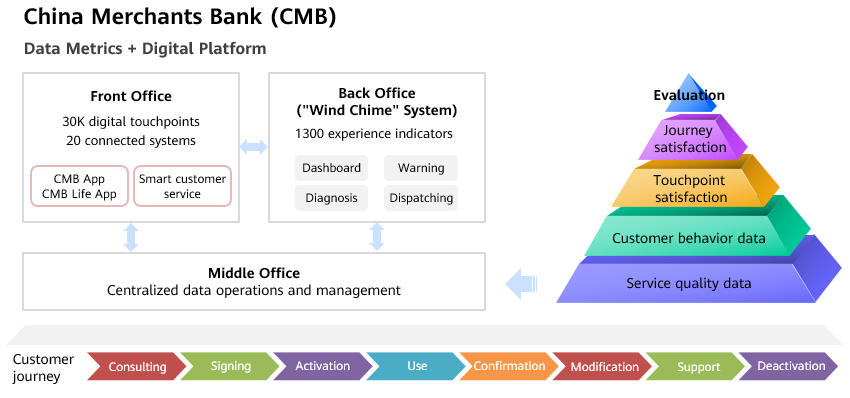

For example, China Merchants Bank (CMB) has created a "wind chime" system to analyze customer experience data in real time. The bank has deployed more than 30,000 touchpoints along the customer journey, modernized over 20 systems, and established more than 1300 customer experience indicators to detect and respond to customer feedback in real time. This allows the bank to continuously improve customer satisfaction.

Another example is Ping An Bank that uses the Lingxi intelligent service system to predict customers' service requirements in real time. This innovative credit card service model has significantly improved customer experience. With it, the bank's net promoter score (NPS) has increased from 32% in 2019 to 40% in 2020.

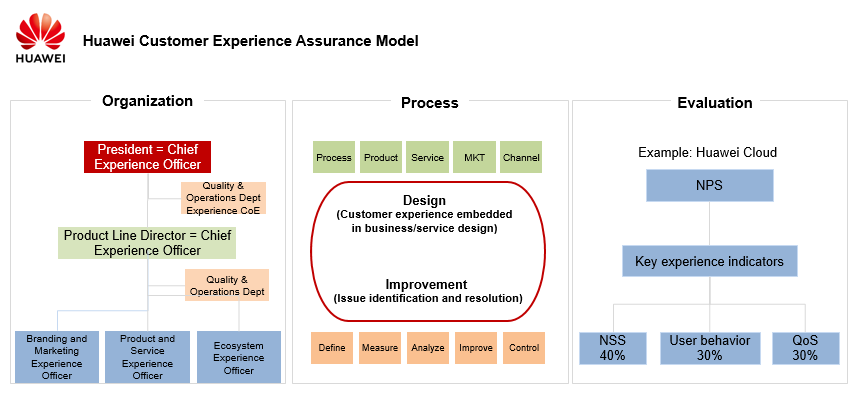

When working with finance customers, Huawei understands the importance of user experience thanks to our extensive experience in consumer business. Ren Zhengfei, Huawei's founder, considers quality, experience, and brand as the crucial aspects of successful customer management.

We transfer that knowledge into everything that we do, working with our finance clients with their end users in mind. We build customer-centricity into every step of our design, sale, and improvement processes. Everyone, from business departments to top leadership, is responsible for customer satisfaction. On top of that, we have comprehensive evaluation methodologies to monitor and improve service quality.

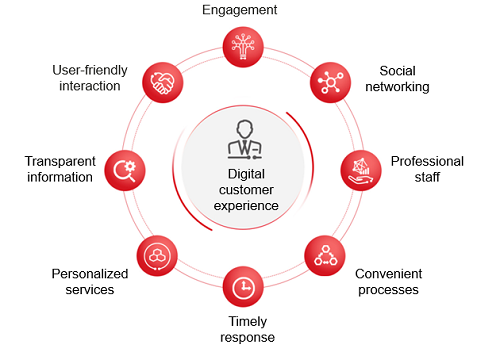

Applying what we have learnt through our years of experience working with the finance industry, we believe there are eight key aspects that define the success of digital customer experience.

Let's recap how technologies are changing how we bank and use our credit cards.

• Credit approval is more agile and efficient over the Internet, using big data for dynamic, accurate credit limits and adjustment.

• Multiple digital payment platforms interoperate and share data with each other. This data drives innovation in the credit card business.

• Banking is shifting to super apps. These one-stop platforms are opening more APIs and adding fiat currency options.

• Banks are transforming their internal operations. They use digital platforms to automate processes, promote business model innovation, and balance risk management and customer convenience. They are also turning to apps to digitalize operations, explore new scenarios, and leverage data marketing to activate customers.

• Finally, banks are using digital tools to manage and continuously improve the digital customer experience.

At Huawei, we believe that cutting-edge technologies will enable banks to better serve their customers. However, technology is just the foundation. Truly delivering the ultimate experience requires banks, and us, to understand the customers and provide scenario-specific services that respond to their unique needs. We hope to work alongside banks as they go through their digital transformation journey and bring all-new experiences to end users.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy, position, products, and technologies of Huawei Technologies Co., Ltd. If you need to learn more about the products and technologies of Huawei Technologies Co., Ltd., please visit our website at e.huawei.com or contact us.