Huawei’s all-flash storage system offers a cost-effective architectural design that configures short-term and long-term capacity for CSS Insurance to economically protect its original investment.

Insurance is a traditional industry that has been heavily influenced by new technologies such as the Internet, cloud computing, Big Data, and mobile computing. International Data Corporation, IDC, recently predicted that over 50 percent of the world’s large enterprises, including many insurance companies, will have formulated their digital transformation strategies and built industry platforms by 2018. One such example is CSS Insurance, based in Lucerne, Switzerland, with business that extends across the country. CSS has weathered a century of changes, challenges, and has grown rapidly throughout, regardless of the external economic environment. This article will explore the technological factors that have contributed to the success and continued growth of CSS Insurance.

Agility First

Founded in 1899, CSS Insurance is one of the leading health insurance companies in Switzerland. It has more than the 120 branches across the country and serves 1.73 million individuals and 18,850 companies.

For an enterprise like CSS Insurance, digital transformation is a macro target. Service speed and agility are micro indicators that have always been among its core values. By improving its speed and agility, an enterprise can strengthen its core competitiveness; and these two goals are at the heart of CSS Insurance’s IT transformation strategy. The company’s priorities are to ensure fast response for mission-critical services and zero waiting time while implementing horizontal and vertical elastic expansion to match performance and capacity with business growth.

As CSS Insurance’s business has continued to develop, with more customers purchasing and renewing their insurance plans, the growing customer base has put an increasing strain on the IT system. The data center has had to handle a large number of insurance service requests each day, including queries, creation of insurance policies, and claims settlements.

This has, in turn, placed tremendous pressure on CSS Insurance’s IT staff, including Michael Tschuck, the head of the company’s data center. As the service loads continued to increase, it took a longer time for the databases to respond to requests during peak hours. Some customers became annoyed with these slow responses.

Beginning in the second half of 2012, Mr. Tschuck and his technical Operations and Maintenance (O&M) team tried to resolve the problem. First, they conducted an in-depth survey. The team discovered that the slow system responses were mainly caused by Input/output Operations Per Second (IOPS) performance bottlenecks in the all-flash array which handles mission-critical services. The array could only process up to 150,000 IOPS, which could no longer meet the access requirements during peak system hours.

According to the calculations by the IT department, based on CSS Insurance’s rate of business development, a flash memory system was required that could handle over 300,000 IOPS to provide high-speed storage services for its core service system. This would allow CSS Insurance to meet the service requirements of the next three to five years.

The All-Flash Application Bottleneck

Once the team understood the source of the problem, CSS Insurance’s IT department began to design a solution. The finance and insurance industries have always been at the forefront of the transition to an information economy. Companies like CSS Insurance have been pioneers in exploring and implementing many new concepts and technologies, particularly data centralization. Insurance companies need central storage for their service data such as customer profiles, insurance, premiums, and claims. This helps improve their operational efficiency, reduce business risks, ensure service quality, and lower IT costs.

However, data centralization is a double-edged sword. While it improves management efficiency and unifies support, new technical challenges are presented for data center construction such as disaster recovery, information security, and response speed. As of 2012, Michael Tschuck had been working at CSS Insurance for many years. He had witnessed the earlier transformation of the company’s IT system, including the centralization of data, the procurement and usage of CSS Insurance’s first all-flash array, and the resulting improvements to its service system performance.

Mr. Tschuck recalls that CSS Insurance built two production data centers in Lucerne to support its nationwide insurance services and centralized its data quite early, which dramatically improved its efficiency. Response speed is a major concern for the CIOs of insurance companies like CSS Insurance because of its direct impact on operational efficiency and customer satisfaction.

In 2009, CSS Insurance became the first company in the industry to deploy an all-SSD storage system to provide high-speed storage services for its core business systems. This first set of all-flash arrays solved CSS Insurance’s most immediate problem by significantly improving the agility of the IT system, but it did not resolve the more long-term obstacles. As the number of customers and insurance products grew over time, the amount of data requiring high-speed storage increased in parallel.

Unfortunately, CSS Insurance’s existing SSD storage system was designed with a maximum capacity of 5 TB. After several expansions, the system’s capacity had already reached its limit and could not support cascading additional enclosures. Even system processing of 150,000 IOPS could barely meet the company’s needs. Ultimately, CSS Insurance had no choice but to purchase a new SSD storage system.

Balancing Performance, Capacity, and Costs

Decreasing prices have made all-flash arrays more competitive and driven their adoption by enterprise customers. All-flash products are efficient, secure, and reliable, and it is inevitable that they will replace traditional disk arrays, especially for mission-critical services that require high performance and large capacity. Gartner has predicted that the revenue from all-flash arrays will exceed that of disk storage in 2017, and IDC has reported that the finance industry is the largest user of all-flash products. If all-flash products can be used in financial institutions, such as banks, insurance companies, and securities, and all-flash is proven to be efficient, secure, and reliable, then these products can be widely used in the future.

Accordingly, once the decision had been made to upgrade CSS Insurance’s existing hardware, Michael Tschuck and his team set out to find a suitable all-flash replacement.

The first question was whether to keep the original equipment for future use or replace it. After a discussion with the integrator, Infoniqa, CSS Insurance determined that they had to purchase a new set of all-flash arrays to replace the existing one. Infoniqa performed a detailed analysis of mainstream products and recommended all-flash arrays from two different suppliers before beginning their tests.

Michael Tschuck participated in the product selection process. He said: “The product from one of the suppliers failed the pressure test. When its IOPS exceeded 300,000, there was an obvious increase in its access delay.” This vendor’s product was accordingly rejected. Although the other supplier’s device passed the performance pressure test, the result was not satisfying. If CSS Insurance chose the latter product, given its forecast capacity demands, CSS would have to buy more devices to meet capacity requirements, which would result in additional costs.

After these setbacks in product selection, Mr. Tschuck had Infoniqa broaden its scope and look at other vendors. Of these choices, it was Huawei’s OceanStor Dorado all-flash storage system that showed the greatest promise.

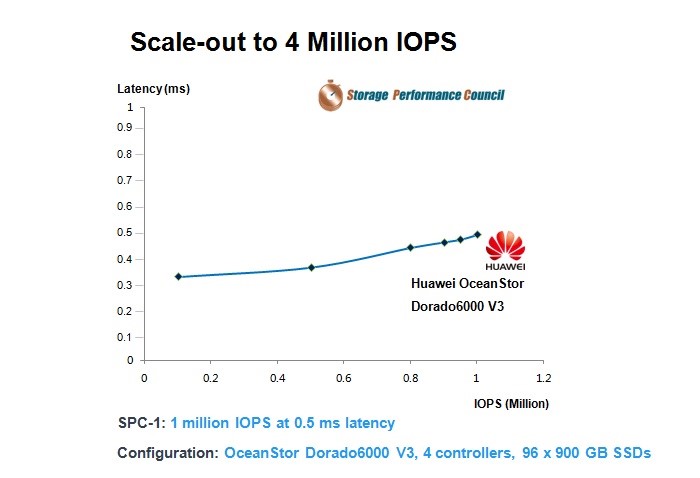

SPC-1 performance test results of Huawei OceanStor Dorado all-flash storage

SPC-1 performance test results of Huawei OceanStor Dorado all-flash storage

Huawei’s OceanStor Dorado provides more than 600,000 IOPS, and also has an average latency of less than 1 ms. Additionally, Dorado can be scaled up to 40 TB through expansion subracks. These indicators could meet the requirements of CSS Insurance, so Infoniqa strongly recommended Huawei OceanStor Dorado as an option to CSS. Michael Tschuck was encouraged by the OceanStor Dorado’s specifications, but he was concerned about its stability. However, after nearly two months of pressure and function tests, Huawei’s all-flash array proved to be extremely stable, to have the largest capacity of any comparable product, and to be flexibly scalable.

Upon seeing all the test results, CSS Insurance decided to deploy seven sets of Huawei’s Dorado products and fully reconstruct the CSS storage system by replacing all of the original all-flash arrays with Huawei devices in both production data centers. In addition, another all-flash device was used for function tests for launching new services.

Huawei’s OceanStor Dorado helped CSS Insurance break the performance bottleneck that had been hindering services for several years. Huawei devices provide IOPS performance that increases linearly with business growth as well as faster, more stable response time, which relieved the pressure on CSS Insurance’s data centers, continuously improves their operational efficiency, and increases customer satisfaction. Huawei’s all-flash storage system offers a cost-effective architectural design that configures short-term and long-term capacity for CSS Insurance to economically protect its original investment.

From CSS Insurance’s first use of all-flash arrays in 2009 to this more recent upgrade, their storage systems have also reflected the developments in all-flash storage, which seeks ultimate performance while still striking a balance with performance, capacity, availability, reliability, and costs. All-flash storage has already become the best performance choice for mission-critical business, but the key is to find the right product and a trustworthy supplier. In the end, this is why CSS Insurance chose Huawei.

(0scores)

Like the story? Give your score.

0/500

0comments

You have scored successfully.

You have submitted successfully.

Evaluation failed.

Submission failed.

Please write your comment first.